Class 8 natural gas truck retail sales gained 11%

For the first five months of 2022, US and Canadian Class 8 natural gas truck retail sales rose 11% year-to-date against comparisons of the same time period in 2021, as published in the quarterly report (AFQ: Alternative Fuels Quarterly) recently released by ACT Research. “Sales of NG-powered vehicles as reported by the six major truck

Used Class 8 truck sales volumes, prices, miles, age increase

According to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research, used Class 8 retail volumes (same dealer sales) were 1% higher month-over-month. Longer term, volumes dropped 44% y/y and were 34% lower ytd. Average price and miles were down 6% and 1%, respectively, compared to

Five truck trend takeaways from July

I’ll be the first to admit that I’m not quite ready for the leaves to start falling. The first of August marks the beginning of the end. It’s soon time to turn off the A/C and crank up the heat. Before you know it, Christmas will be right around the corner! … maybe I’m getting

How Daimler Truck N.A. maps out a product strategy during a time of trucking transitions

The buzz of electrification in trucking continues to build as electric trucks roll into applications. While EV headlines continue to dominate (guilty as charged), diesel is still king of the road for the foreseeable future. Diesel development continues as the industry faces down another round of GHG emissions regulations in 2024, and diesel will play

ACT Research: U.S. used truck prices softening

Preliminary used Class 8 retail volumes (same dealer sales) rose 6% month-over-month, but were 39% lower compared to June of 2021, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. Other data released in ACT’s preliminary report included month-over-month comparisons for June 2022,

Ten questions before adding battery electric trucks to your fleet

So, you’ve done the research to determine the right battery electric trucks for your fleet, but equally as important is knowing your charging needs. That’s right, we’re talking about charging today, not about battery electric trucks at all! Because incorporating electric trucks into your fleet would be like taking delivery of 15,000 gallons of water

Morgan Truck Body, EAVX highlights zero-emission equipment

Morgan Truck Body featured two advanced-technology truck bodies at the first Zero-Emission Truck Showcase + Ride and Drive, June 8 at the Auto Club Speedway in Fontana, California, hosted by The California Air Resources Board (CARB) and organized by CALSTART. The event provided an opportunity for industry OEMs and fleet operators to discuss the state

U.S. used truck sales cycle at the ‘beginning of the end’

Preliminary used Class 8 retail volumes (same dealer sales) fell 10% month-over-month, and were 40% lower compared to May of 2021, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. “Unfortunately, long-awaited reports of loosening inventories come at exactly the wrong time in

Photo gallery: CARB, CALSTART showcase zero-emission trucks

CARB and CALSTART hosted their first Zero Emission Truck Showcase and Ride and Drive at the Auto Club Speedway in Fontana, Calif., earlier this month, showcasing 25 OEMs and fleet operators including Xos, GreenPower Motor Co., Ford, GM, Kenworth, Navistar, Nikola, Hyundai, Workhorse, BYD, Phoenix Motorcars, Orange EV, Lion Electric, AME, Lightning eMotors, Hyzon, Motiv

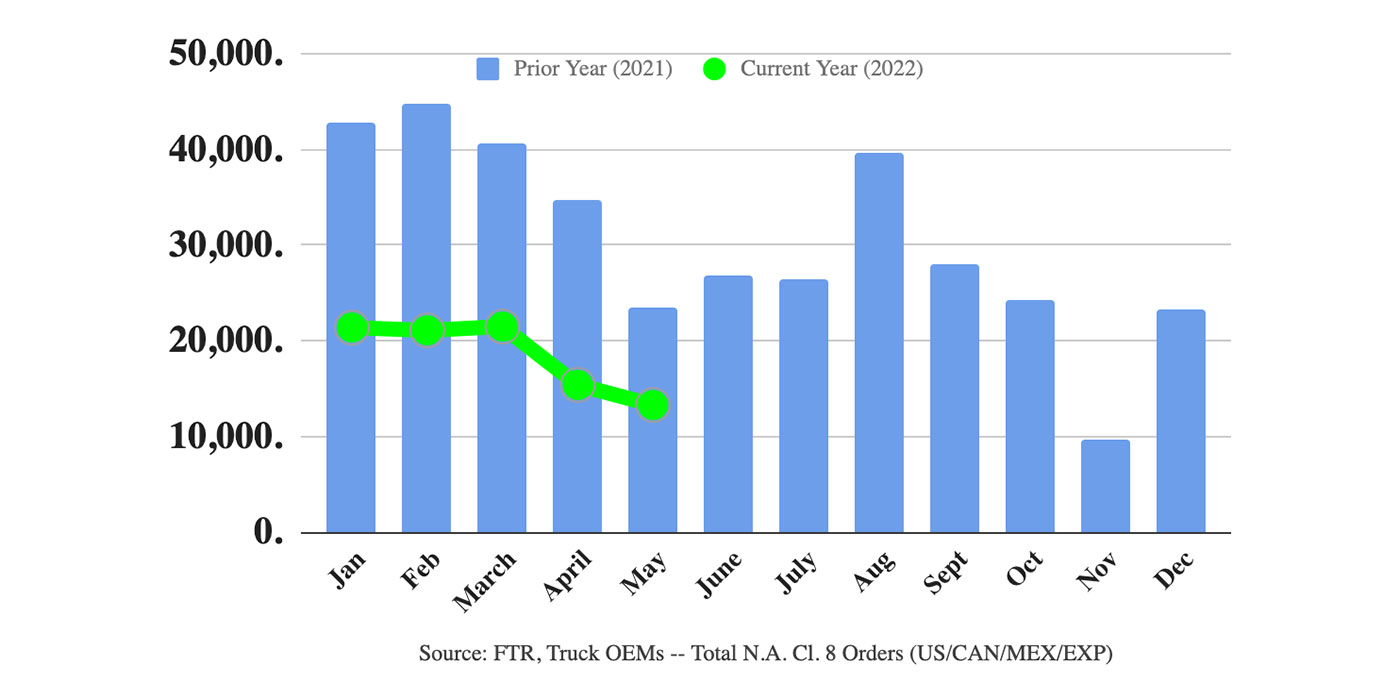

Preliminary Class 8 truck orders dip to lowest total since 2021

FTR reports preliminary North American Class 8 net orders dipped in May to the lowest total since November 2021 at 13,300 units. May order activity was down 13% m/m and down 43% y/y. Class 8 orders have totaled 270,000 units over the last twelve months. OEMs are quickly running out of build slots for 2022 and