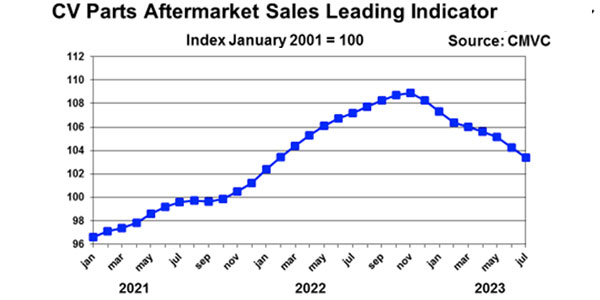

Commercial Motor Vehicle Consulting (CMVC) Parts Aftermarket Sales Leading Indicator (PLI) continued its downward slide in July signaling sluggish growth in parts aftermarket sales in the coming months. PLI has declined for eight consecutive months.

“The growth rate of CV parts aftermarket sales is slowing to sluggish growth rates in the coming months due to a combination of micro and macro factors,”said Chris Brady, president of CMVC. “Micro factor: the greater availability of new and used trucks has caused new and used truck operators to upgrade their fleets. Fleets are returning the average age of their truck fleets back to a norm from evaluated levels, causing the average age of a truck in the fleet to have more economic life resulting in slowing parts aftermarket sales.

“Macro factor: fleet capacity utilization is trending downward causing the rate at which the truck population depreciates to slow, resulting in slowing growth of parts aftermarket sales.

For example, the PLI says that the capacity is growing at faster growth rates than freight volumes in the for-hire trucking industry, so carriers with brokerage operations are directing loads to company-owned trucks from third-party carriers, which is reducing truck utilization for third-party carriers, including owner-operators and small fleets. Lower truck utilization, according to the PLI, is slowing the rate at which parts/components depreciate, weighing on parts aftermarket sales. Micro factors will stabilize in the coming months, but macro factors may continue to weigh on parts aftermarket sales in the coming months, CMVC says.