FTR reports preliminary trailer orders decline in July from final June numbers

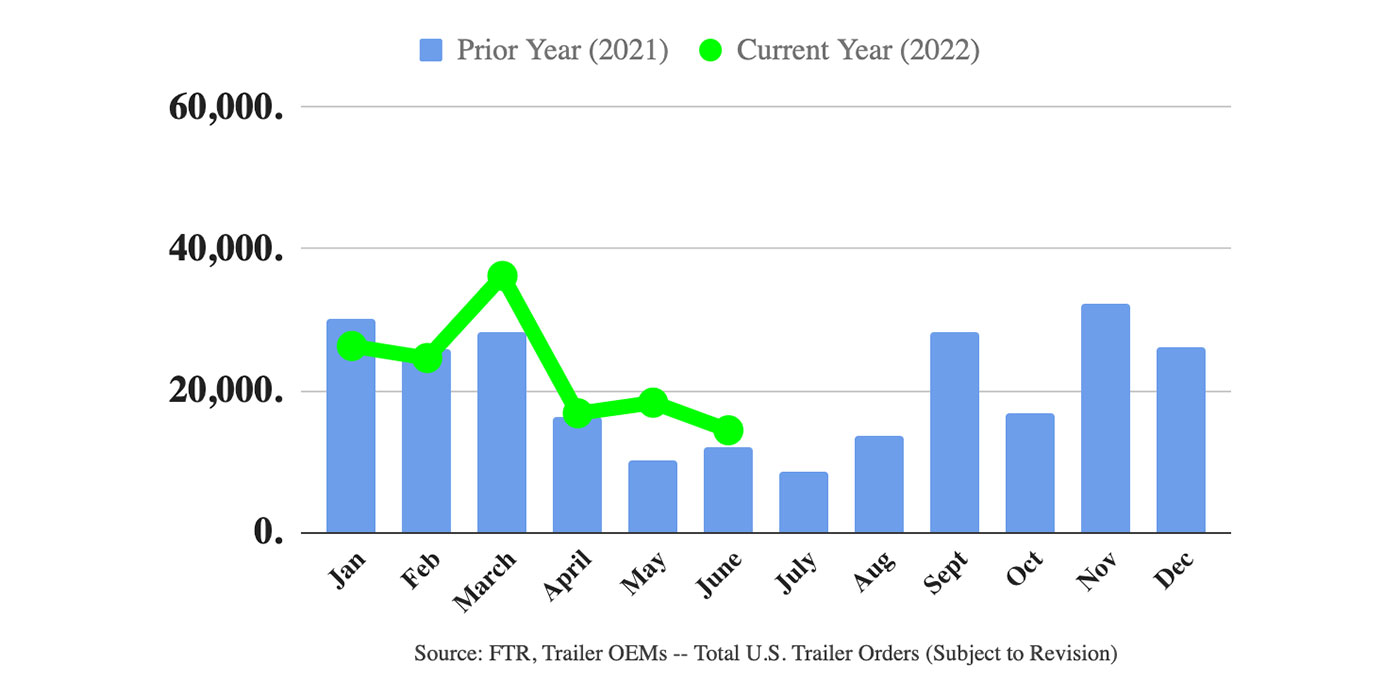

FTR reports preliminary trailer orders fell back in July 28% from the final trailer orders reported for June to a total of 17,000 units. July 2022 trailer order activity was +101$ y/y with orders now totaling 275,000 units for the past twelve month. “Amidst these uncertainties and production challenges, OEMs have continued to strategically manage

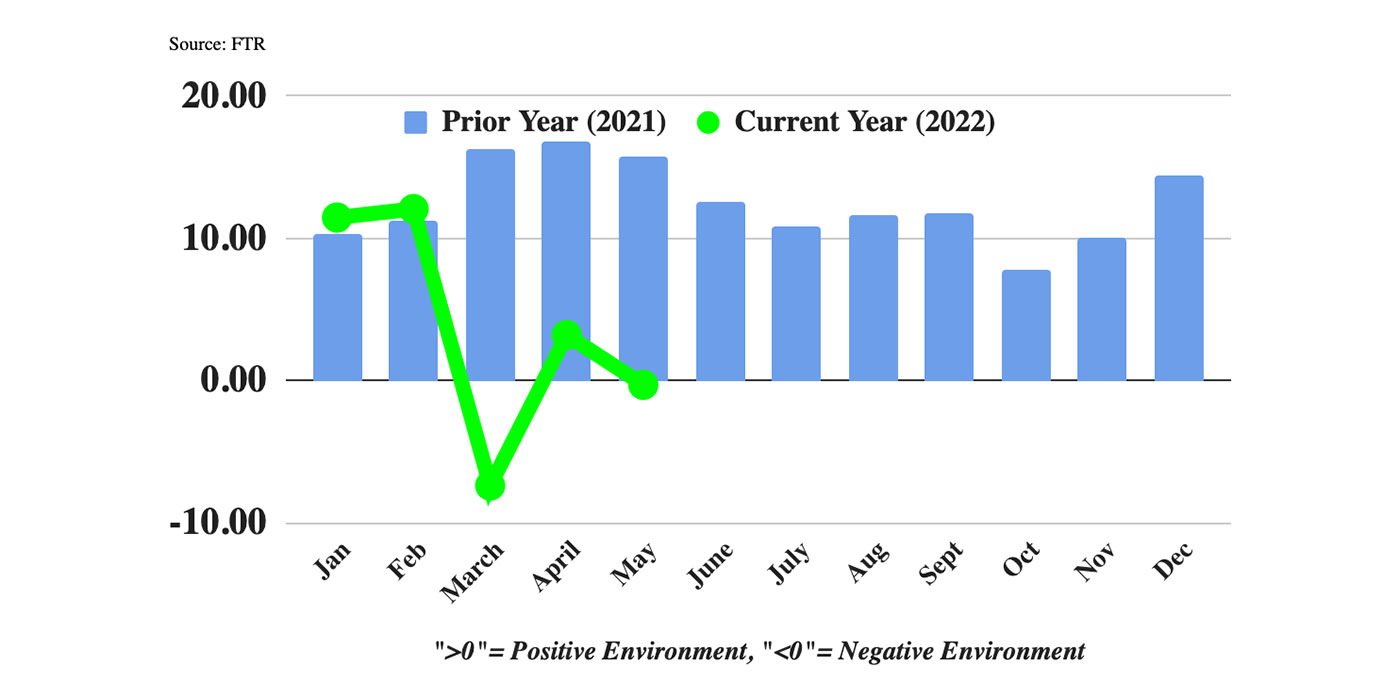

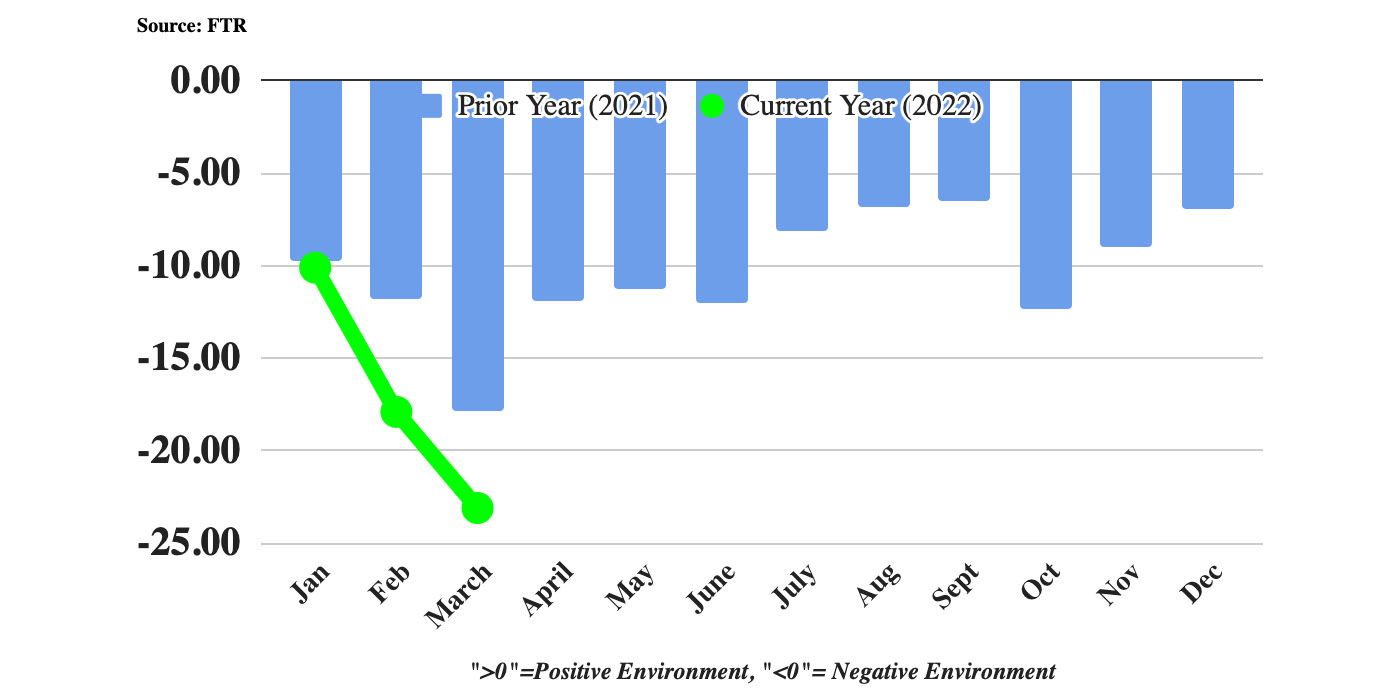

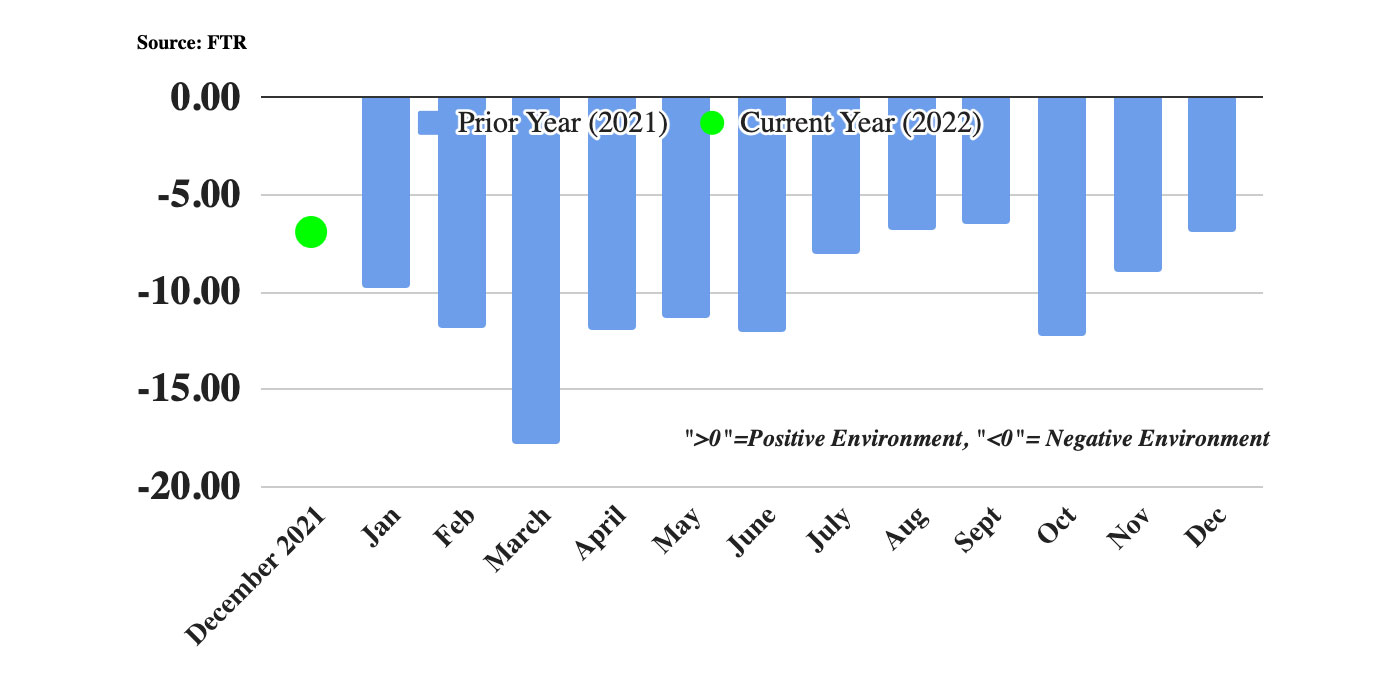

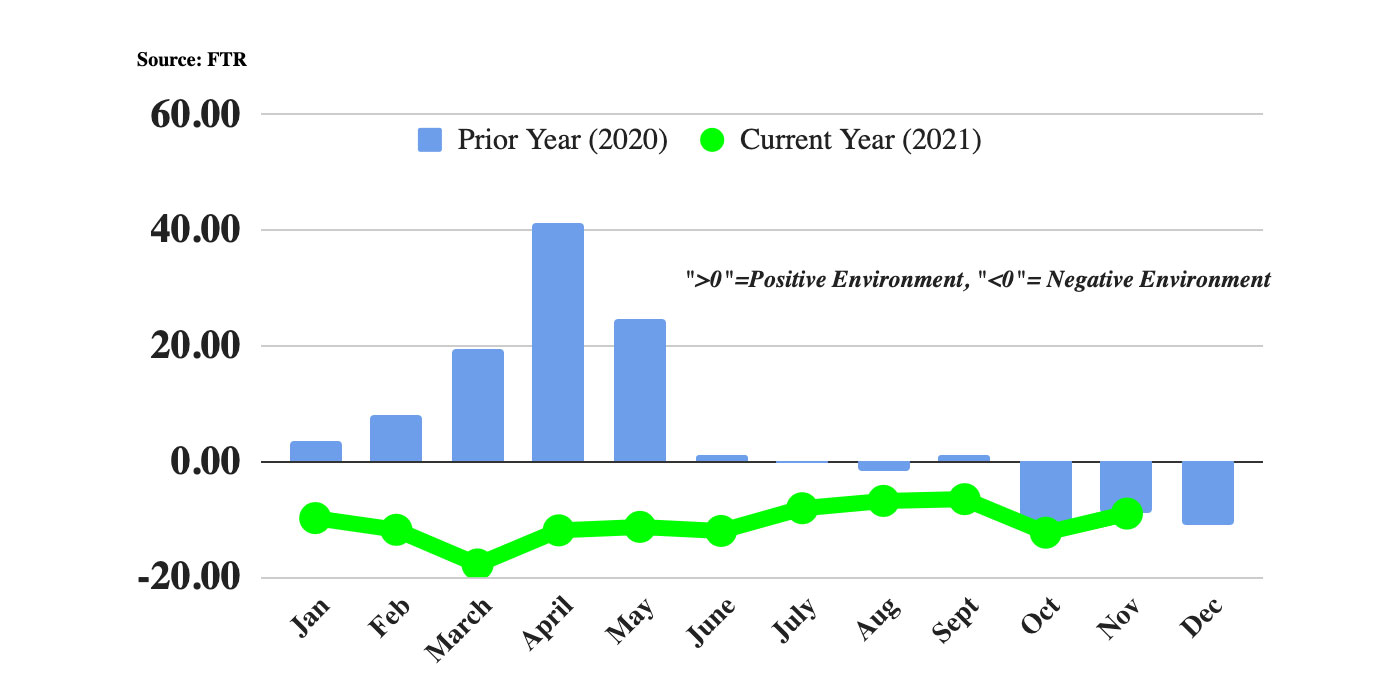

FTR’s Shippers Conditions Index drops to -6.2 reading

FTR’s Shippers Conditions Index (SCI) fell back in May to a -6.2 reading. After relatively stable diesel prices in April, large increases in May coupled with tighter capacity utilization led to tougher market conditions despite some rate relief. The outlook for the SCI is for little change as utilization and rates are expected to remain mildly

FTR’s Trucking Conditions Index fell due mostly to diesel price gains

FTR’s Trucking Conditions Index (TCI) for May fell back into negative territory with a -0.3 reading from 3.21 in April. Sharp increases in diesel prices during May offset slightly improved freight market conditions for carriers. Freight demand, capacity utilization, and freight rates were slightly stronger in May but together were unable to diminish the negative

FTR reports preliminary trailer orders continued to backtrack in June

FTR reports preliminary trailer orders fell back in June to 14,400 units. Orders were down 23% m/m but up 20% y/y. Trailer orders for the past twelve months have totaled 265,000 units. The order number for June met expectations, as OEMs have filled most of the available build slots and are not yet booking orders

FTR’s Shippers Conditions Index rebounds in April to best reading since September 2020

FTR’s Shippers Conditions Index (SCI) rebounded in April to a reading of -1.7 after shippers experienced the toughest conditions on record in March. The April SCI is the best since September 2022. Shippers found some relief in April from more stable diesel prices coupled with less challenging capacity utilization and freight rates resulting in much

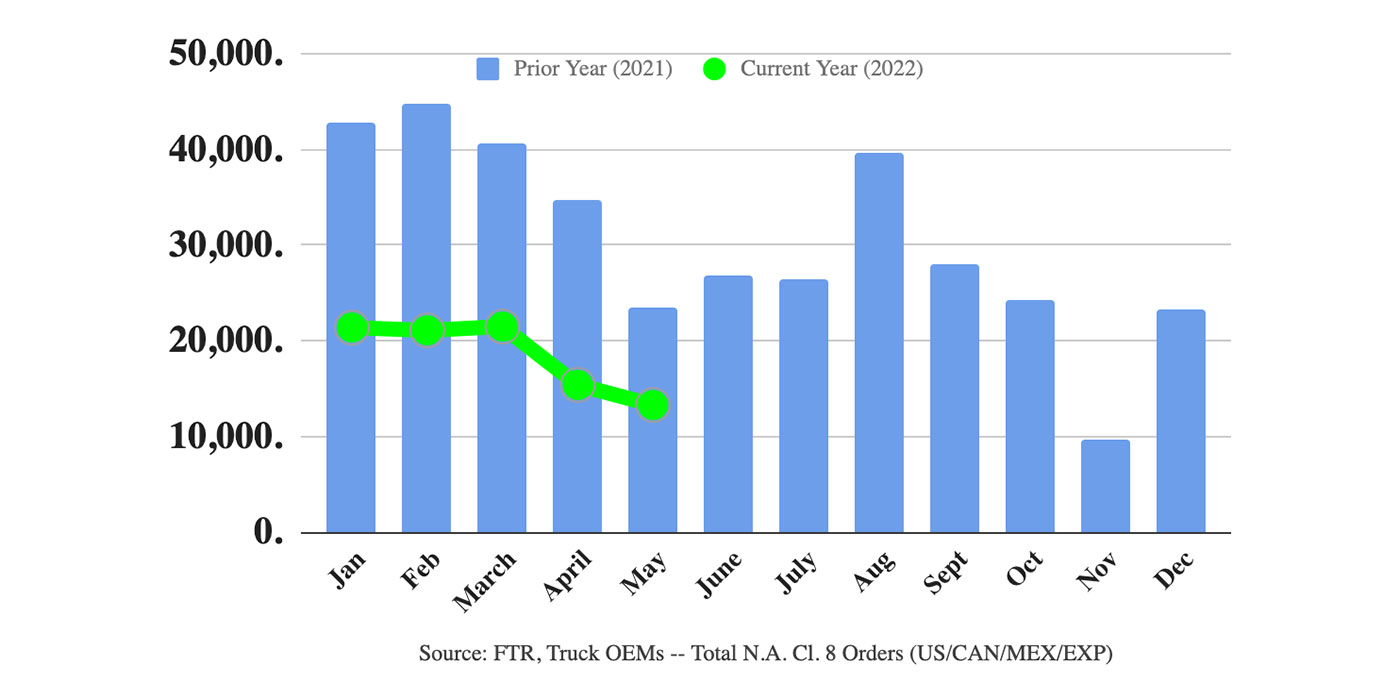

Prelim N. A. Class 8 net orders show modest gain in June

FTR reports preliminary North American Class 8 net orders for June rose modestly m/m to 15,000 units. Orders continue to be subdued, as 2023 build slots remain restricted due to limited visibility into future conditions surrounding material costs and lead times. June activity was up 13% from May and down 36% y/y. Class 8 orders

Preliminary Class 8 truck orders dip to lowest total since 2021

FTR reports preliminary North American Class 8 net orders dipped in May to the lowest total since November 2021 at 13,300 units. May order activity was down 13% m/m and down 43% y/y. Class 8 orders have totaled 270,000 units over the last twelve months. OEMs are quickly running out of build slots for 2022 and

FTR’s Shippers Conditions Index fell sharply ahead of a projected further deterioration

FTR’s Shippers Conditions Index (SCI) fell sharply again in February to -17.9 after dropping to -10.1 in January. The February reading narrowly beats March 2021 as the toughest month to date for shippers. The record won’t last long as March is expected to be much lower still as some rate relief will not nearly offset

FTR’s Shippers Conditions Index continued to improve

FTR’s Shippers Conditions Index (SCI) for December improved from the November -9.0 reading to -6.9 primarily due to a drop in fuel prices during the month. Even though lower fuel costs helped shippers in December, they will be a significant near-term negative as diesel prices surged in January. Fuel costs aside, the outlook is for

FTR reports preliminary Class 8 orders stayed steady

FTR reports preliminary North American Class 8 net orders stayed steady in January at 21,400 units. The January total was down 8% m/m and 50% y/y. Class 8 orders have totaled 343,000 units over the last twelve months. January orders continued to track in a restricted range with the total for the month equaling the

FTR’s Shippers Conditions Index improved in November

FTR’s Shippers Conditions Index for November improved to a -9.0 reading from October’s -12.4. October’s reading had been the lowest reading since the all-time low was reached in March of 2021. Stable diesel prices in November led to better market conditions for shippers, but other factors still made for the toughest conditions since June aside

FTR reports preliminary trailer orders retreated in January to 26,500 units

FTR reports preliminary trailer orders for December retreated to 26,500 units, down 18% m/m and -42% y/y. Trailer orders for 2021 totaled 249,000 units. OEMs continue to manage backlogs carefully, as the supply chain disruptions persist. Order volume was very close to the average of the previous three months. Liquid tank trailer orders were sturdy.