In a race to stop the spread of COVID-19, millions of Americans across the country were ordered to stay home, except for essential activities. While all states have reopened in some capacity, the date they went into lockdown and the time they spent under that lockdown varies dramatically.

To see how these varying restrictions impacted commercial transportation in the United States, Samsara says it has leveraged data from the nearly 130 million trips our 15,000 customers—operating across diverse industries including transportation and logistics, food production, local government, and more—have taken since the start of 2020. The company analyzed transportation trends and safety incidents before, during, and after lockdowns across the United States.

Below are some of the highlights from the study, but the full study can be found by clicking here.

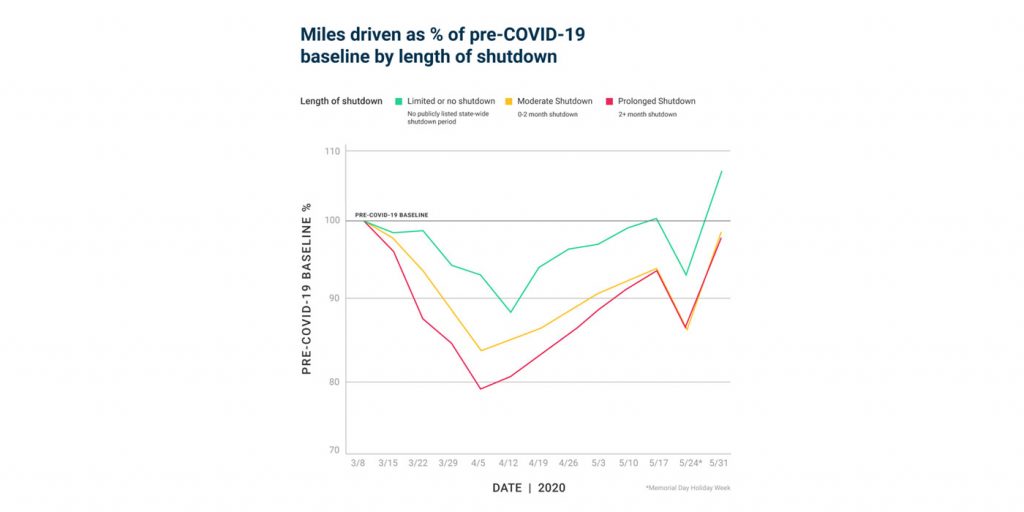

Commercial driving activity has returned to normal, or higher than normal, levels

On average, U.S. states have returned to be within 95% of pre-COVID-19 commercial driving activity—which Samsara defined as miles driven and the number of operating vehicles on the road. But this is not without some variation.

States that experienced limited to no lockdown restrictions are seeing a faster return to average commercial driving activity pre-pandemic. Not only have these states already seen a return to more than 100% of pre-COVID-19 commercial driving activity, but they also saw more modest declines during shutdown periods, Samsara says. In the week immediately following Memorial Day, commercial driving activity in these states increased by 7% from pre-COVID-19 baseline levels. While this may partly be due to lost activity during the holiday week, overall miles driven and vehicle activity trends continue to show increases above the pre-COVID-19 baseline.

Industry impact varies widely—education most impacted, long haul and construction remain stable

Long haul transportation experienced a quick recovery from COVID-19. Food and beverage and wholesale trade transportation have also essentially reached pre-COVID-19 commercial driving activity.

This is in sharp contrast to other industries like passenger transit and education. With some schools still unsure of whether classes will be held in the fall and travel or leisure activities on hold for the foreseeable future, these two industries have experienced a sustained impact from the pandemic, Samsara says. Passenger transit activity has stabilized at around 35% of pre-COVID-19 levels and educational services activity remains below 10%. Other industries, like oil and gas, have not yet recovered from COVID-19’s implications, operating at 60% of pre-COVID-19 commercial activity.

The construction industry, on the other hand, is starting to clock in more miles, operating at 5% above pre-COVID-19 levels in recent weeks.

With emptier roads, harsh braking and acceleration decreased by 40%

Passenger traffic has decreased significantly since April, making U.S. roadways emptier than they were pre-COVID-19, Samsara finds. Data from customers who use our AI dash cams, which use advanced artificial intelligence to detect risky driving behavior like harsh braking and accelerations, shows that COVID-19 has had an impact on the frequency of these behaviors—even when adjusted for decreased mileage.

In fact, there has been a decline in harsh braking and acceleration across all states, culminating at 40% below the pre-COVID-19 baseline, Samsara says. The trend has become even more pronounced as commercial fleets are beginning to resume pre-COVID-19 levels of activity with significantly fewer passenger vehicles on the road, leading to fewer harsh braking and harsh acceleration events per 1,000 miles driven. States with comprehensive restrictions still in place are seeing even sharper declines in these behaviors.

Empty roads led to something else—a 20% increase in severe speeding

In early April, severe speeding rose 20% above the pre-COVID-19 baseline, indicating that while there may be a decline in some risky driving behavior (like harsh braking and accelerations), there are certain driving behaviors that are making roads more dangerous too.

Large cities—especially those with strict shelter-in-place guidelines—have seen empty roads like never before and experienced an even larger increase in severe speeding. A sample of five cities (Atlanta, NYC, Chicago, Houston, and San Francisco) reveals speeding jumped 40% in early April, compared to the 20% increase nationwide. However, speeding started to decrease in May, as states began to lift shelter-in-place orders and more vehicles returned to the roads.