Samsara recently looked at commercial transportation data from three industries that closely reflect consumer mobility—food and beverage, wholesale and retail, and transportation and warehousing—to see which cities have experienced a decrease or increase in activity.

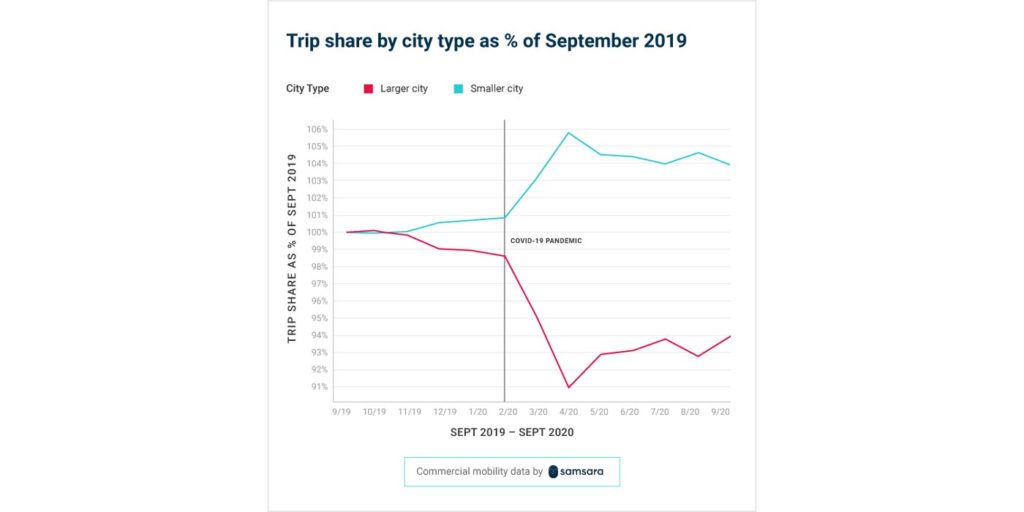

For this analysis, Samsara compared trip share per month from September 2019 to September 2020 for the top 200 cities in the U.S. by population and population density. Trip share is the ratio of trips that occurred in a given city compared to the total number of trips that occurred in all cities Samsara analyzed. Analyzing trip share allowed the company to normalize for any overall spikes or dips in total U.S. commercial transportation activity, and isolate each city’s specific trend.

Here is what the company found:

- Trip share has shifted from bigger to smaller cities over the last year. Even before the COVID-19 pandemic hit, overall trip share for America’s top 25 cities was declining. At the low point in April 2020, big cities saw a 9% decrease in trip share compared to September 2019, whereas small cities saw a 6% increase.

- Los Angeles, CA, Baltimore, MD, and San Diego, CA are among the cities with the most significant declines in trip share. For example, Baltimore saw a 43% decrease in trip share, comparing September 2020 to September 2019.

- Savannah, GA, Jacksonville, FL, and Greensboro, NC are among the cities with the most significant increases in trip share. For example, Savannah saw a nearly 200% increase in trip share, comparing September 2020 to September 2019.

- The COVID-19 pandemic has accelerated this trend for some cities. When COVID-19 first hit the U.S., some cities saw sudden changes in trip share. For example, San Francisco, CA saw a 37% decrease in trip share from February to April 2020, whereas Sacramento, CA saw a 20% increase over the same time period.

All in all, Samsara says its commercial transportation data supports other reports of an “urban exodus” that has been accelerated, for some cities, by COVID-19.

This trend has been widely noted in the real estate industry, with reports on housing market data and moving company and rental market data showing similar findings. In fact, a recent analysis from LinkedIn on migration trends found that “hints of de-urbanization can be found across the country.” Mirroring Samsara’s city-specific findings, LinkedIn reported that big cities—including New York, the San Francisco Bay Area, and Boston—are seeing the steepest declines in net arrivals, while smaller cities—including Jacksonville and Sacramento—are seeing the largest gains.

If this de-urbanization trend continues, Samsara says we may see effects beyond commercial transportation. It’s possible that the COVID-19 pandemic could spur a fundamental shift in our city landscape, which would likely trickle down to industries beyond commercial transportation, including hospitality, retail and more.

This data was compiled by Samsara’s Ali Akhtar. To view the full data analysis, click here.