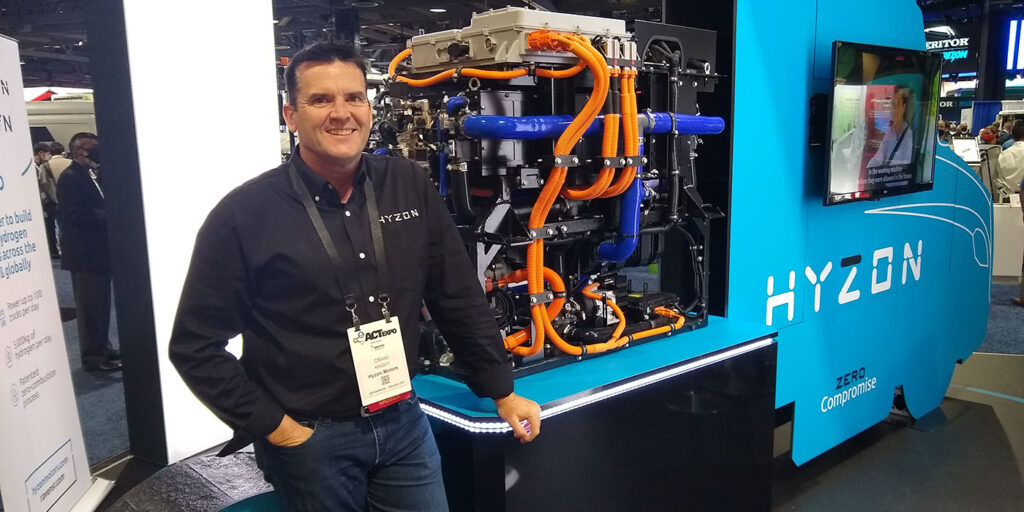

Hyzon Motors trucks never stopped moving. The hydrogen fuel cell manufacturer had several Freightliner Cascadia trucks rolling around the Long Beach Convention center during ACT Expo held in late August, and the line for rides was long as attendees kicked the tires on the new powertrain technology. While a hydrogen truck moving under its own power answers the first question of how viable hydrogen technology is for long-haul heavy-duty applications, there are plenty more once the basics are seen.

I had the chance to sit down with Craig Knight, Hyzon Motors chief executive officer, to learn more about the technology and how a newcomer like Hyzon Motors plans to approach the industry.

Fleet Equipment (FE): Let’s start with the basics: What’s Hyzon’s company history?

Knight: Hyzon Motors is a new name, frankly. We set up this new business in early 2020, and it was started by hydrogen veterans, including myself. We started the parent company, Horizon Fuel Cell, in 2003 in Singapore and set out to commercialize fuel cell technology, thinking that it would only be five to six years before we found useful applications in the market. Instead, we ended up scrapping for survival for many years, developing technology for portable power systems, backup systems, and all kinds of stationary generator set-type replacements. We learned to innovate and became very deep in the technologies around not only fuel cell designs, but in all the materials.

About two-and-a-half to three years ago, we started looking at the opportunity to globalize the fuel cell experience that was being gained mostly in China to supply fuel cell powertrains for trucks and buses.

We found that the big OEMs were not that proactive or aggressive about putting this kind of technology into their vehicles. They weaken their value proposition because the diesel engine is where it’s at for commercial vehicles. We chose to become a master vehicle integrator and go downstream into this mobility application. So years and years of technology development, but a new name in Hyzon and a new activity in the master vehicle integrator role, basically.

FE: So what’s your business model? How are you going to market?

Knight: We supply the full vehicle. We work with the customers to solve the hydrogen supply challenges. What we’re aiming to do is really push aggressively towards the tipping point, which comes about when the economics are compelling. When a zero-emission truck operates with a cost structure very similar to a diesel truck, there’s really no reason not to go there.

FE: As a fuel cell manufacturer, how are you supplying the full vehicle?

Knight: We take care of the sourcing of the chassis and of the upfitting of the chassis [with the fuel cell] and the commissioning of the vehicle. We use a Freightliner chassis in North America. They’re good vehicles and platforms; they have all the safety features. So we don’t have to invest in that stuff. We consider that non-core. What we consider core is making power from hydrogen molecules and getting that power to the wheels: the electrical propulsion and how we make the power from the stored hydrogen. That’s our core competence; that’s where we focus.

FE: So if I’m a fleet, I’m buying the truck directly from you?

Knight: For the moment, we’re concentrating on doing our own completely integrated fuel cell solutions by using those well-accepted platforms.

FE: How does support after the sale work?

Knight: We work with aftersales partners to make sure that the vehicle can be serviced, because that’s the most important thing after the customer has it. We’re working with Velocity in Southern California, and they have experience with battery electrical already. We’re preparing a training program around fuel cell electric vehicles. We’re engaging in that process of familiarization amongst the team at Velocity for the purpose of not just supporting, but even promoting these vehicles too.

FE: Speaking of the electric driveline, what are you using on your sourced chassis?

Knight: The trucks that are driving around ACT Expo use Dana. We have other vehicles that have ZF drivelines. We’ll work with the equipment that makes the most sense in the supply chain. We’re working on increasing the Hyzon content in the vehicles from the hydrogen system and fuel source system to be a bigger part of that electric propulsion system over time. We’ve announced a development in e-axle technology. It’s an obvious direction that we need to go in where we increase Hyzon content in the vehicle.

FE: What’s the range of the Hyzon trucks outside?

Knight: The typical range is 350 to 400 miles. We’re trying to make sure that the specs perform for most high daily uptime, high daily utilization, back-to-base type operations with no modification of the driver behavior or the fleet operator’s management of the fleet.

The idea is that they come to work, and they do everything they used to do. The only difference is at the end of the shift, they fill up at the blue pump, not the black pump. That’s literally what we want them to change. We don’t want them to change how they load the containers or the load. We don’t want them to change any of that.

FE: Where are your manufacturing and integration locations?

Knight: We’re setting up fuel cell membrane, plate and stack production in Chicago. Then we’re setting up a complete integrated system In Rochester—building hydrogen subsystems in Rochester—and then we send build kits to the assembly factories that attach the kits to the chassis. One of those is a Hyzon majority-owned joint venture in Europe and another assembly partner is Fontaine Modification, which has a lot of facilities around the U.S. with capacity to build 50,000 to 60,000 a year. Using Fontaine in North America gives a scale without building a big plant. We’re not building the truck from the ground up. We don’t believe in recreating the starting point for this transition. We believe in optimizing going forward and improving technology going forward. We don’t believe you need to build the truck from the ground up as a starting point to transition fleet operators from diesel to hydrogen.

FE: As you enter the North American trucking market, how do you see hydrogen fuel cell adoption developing as a viable solution?

Knight: The frank question is around hydrogen infrastructure–that’s the big hurdle to adapt to fuel cell trucks. We’re working with Raven to build up to 250 waste-to-green hydrogen hubs. This is a company that’s been making synthetic fuels from municipal waste, solid waste. They’ve perfected the process of isolating the hydrogen from gas to produce an automotive grade hydrogen that we can use for trucks. The first site is in Richmond Bay, and there’s a second site, which has not yet been announced, that will also be in the Bay Area. There’ll be more locations, closer to L.A. and Long Beach, in the not too distant future.

FE: So wait, you’re taking trash and making hydrogen fuel? That’s wild.

Knight: This type of technology enables us to make hydrogen from an unwanted fuel supply. Essentially, it’s a hydrogen reserve that no one wants. You get paid to take it. Then you convert it to hydrogen. Pretty good economics. Then, when you sell the fuel, you get a low carbon fuel standard (LCFS) credit.

The great thing is though we can electrify heavy trucks without impacting the grid.

FE: Right, there’s been a lot of talk at the show about the impact trucks will have on the grid.

Knight: We electrify heavy trucks on the pile of garbage. We don’t touch the grid. With hydrogen, people forget about the chemistry. They talk about physics and electrical efficiency, but they forget about chemistry. Hydrogen is in everything. It’s in the grass, it’s in the leaves on the trees. It’s in the piles of municipal waste. You just need to access it.