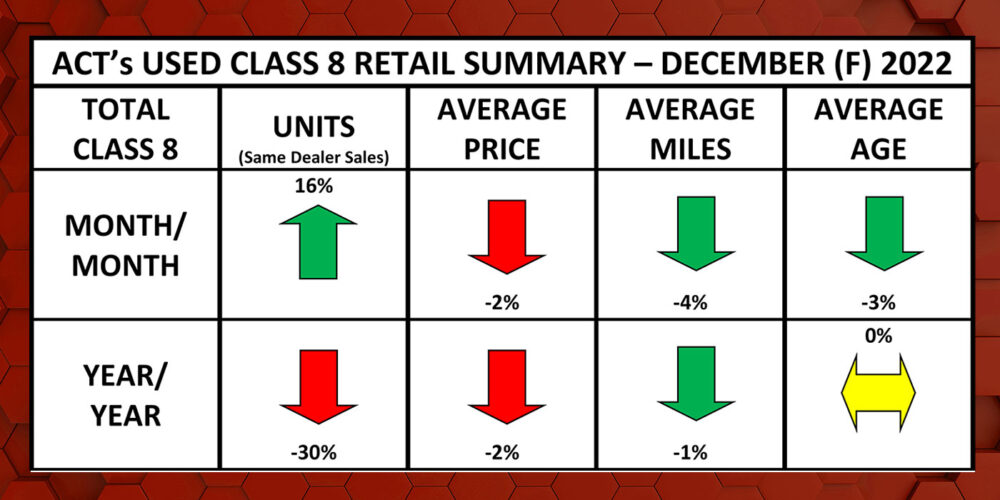

According to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research, used Class 8 retail volumes (same dealer sales) increased 16% m/m in December. Average mileage was down 4% m/m, with average price and age down 2% and 3%, respectively. Longer term, average price and miles were lower, with age flat y/y.

“Activity typically sees a moderate increase in December, so the increase was directionally consistent with expectations,” said Steve Tam, vice president, ACT Research. “We ascribe the relative strength to the elevated new truck sales in November and December, which helped to sate pent-up demand in the inventory-starved used truck market. While the economy and freight markets are slowing, effectively cooling used truck demand, there are many used truck buyers who have been forced to hold onto their trucks beyond their expiration dates.

“Used Class 8 retail truck sales for December were still meaningfully weaker for longer-term comparisons, falling 30% y/y and 35% for all of 2022 compared to full year 2021,” he added. “We estimate the total Class 8 used truck market sales for 2022 were 245,000 units, down from 265,000 (-7.5%) in 2021.”