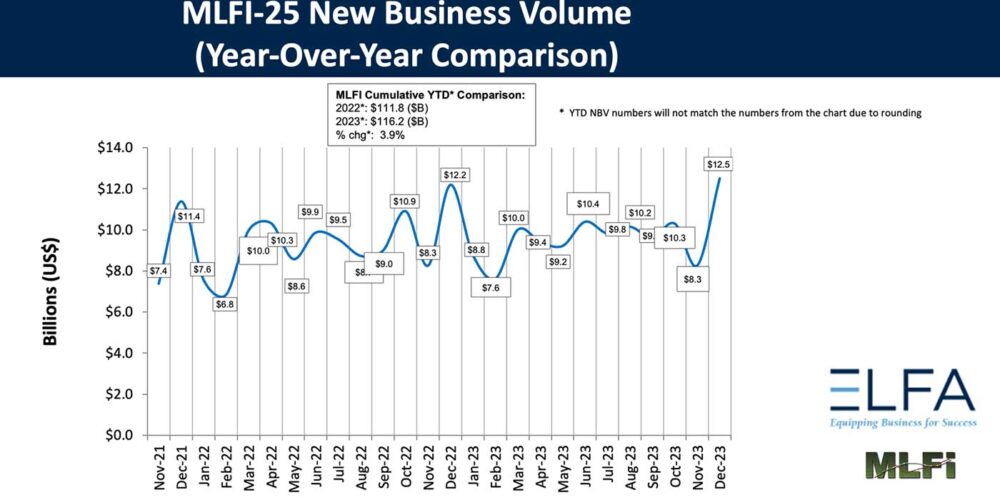

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for December was $12.5 billion, up 2% year-over-year from new business volume in December 2022. Month-to-month data showed volume was up 51% from $8.3 billion in November in what ELFA notes was a typical end-of-quarter, end-of-year spike. Cumulative new business volume for 2023 was up 3.9% compared to 2022.

Receivables over 30 days were 2.3%, up from 2.0% the previous month, and up from 1.8% in the same period in 2022. Charge-offs were 0.4%, unchanged from the previous month and up from 0.3% in the year-earlier period.

Credit approvals totaled 75%, down from 76% in November. Total headcount for equipment finance companies was up 1.2% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in January is 48.6, an increase from the December index of 42.5.

“The MLFI closes out 2023 with a strong finish despite ongoing concerns of a recession and the higher interest rate environment throughout the year,” said Leigh Lytle, president and chief executive officer of ELFA. “Positive year-end new business volume shows that U.S. businesses continue to rely on equipment financing to operate and grow. Delinquencies and losses, while historically elevated, have remained within consistent ranges since last summer. These metrics, combined with improved industry confidence, bode well for an optimistic start to 2024.”

“DLL finished the year strong with a good December as new applications were up, both in dollar amount and overall count,” said Neal Garnett, chief commercial officer of DLL. “This contributed to DLL closing out 2023 above plan. Based on the positive closing of 2023, I believe the industry can move into 2024 with confidence. Activity across industry verticals is robust with expectations that tech device sales and, by extension, leasing volumes will recover in 2024. I also anticipate a focus on retail finance programs from hard asset manufacturers, pulling inventory from their dealer channels.”