When looking for leading economic indicators in our industry, it’s best to ask fleets to report on their experiences. That’s what CK Marketing did in a recent survey in which the marketing group asked fleets to comment on several issues related to their freight capacity and equipment purchasing decisions.

When asked how fleet capacity (available equipment) compares to current freight demands, those survey responded that demand looks strong overall. A few fleets noted that they were experiencing a shortage of freight to haul. One fleet reported that the overall outlook for the next three months was also positive.

However, there are still some nagging issues. For instance, lack of good, dependable drivers remains a challenge. Fuel and insurance costs are continuing to increase—one fleet noted that those increases come faster than increases in revenue. Another fleet said that the quality of technicians was a concern.

In addition, the report found that the demand for new power units from the group that was surveyed had fallen off, which was reflected in softening build totals from the OEMs. One fleet manager commented, “There is no need to place orders far in advance because open build slots are available.” Another manager agreed, adding, that there was no reason to commit to a vehicle order until you are sure it is needed.

The survey also found that much of the severe equipment replacement demand has been fulfilled and for most of those fleets it was noted that there are not enough good drivers available to support adding more power units.

CK Marketing noted that the size of fleets planning orders has shifted a bit recently to smaller fleets—which is depressing the overall demand for units. The largest planned orders as calculated by total units came from a leasing company, a logistics company, a large LTL carrier and one significant TL carrier. One TL carrier mentioned it is buying only to replace units, not to meet increased freight demand.

More fleets (40% of those placing orders) are actually adding some capacity with their new orders now. The average percentage of planned orders designated for capacity increases is up as well. About half those adding significant percentages for more capacity are general freight-for-hire carriers.

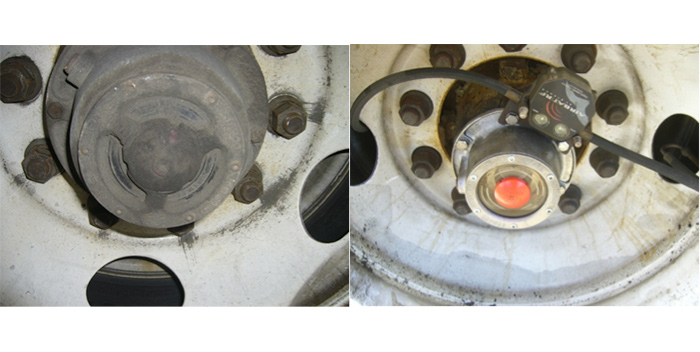

Timing for future orders (for those without current plans) is similar to last quarter. Freightliner and International remain the top two brands within the surveyed group with a number of fleet managers now planning to purchase Mack trucks. In addition, the survey found that more and more fleets are now the spec’ing of disc brakes.

When asked how they would rate overall the EPA 2010 engines, more than half those surveyed rated them as “excellent” or “better than expected.”

As for trailers, about 40% of fleets surveyed that are planning to place trailer orders intend to add some capacity with those. In addition, all of the fleets planning to order tankers are also intending to increase capacity of some of those units.