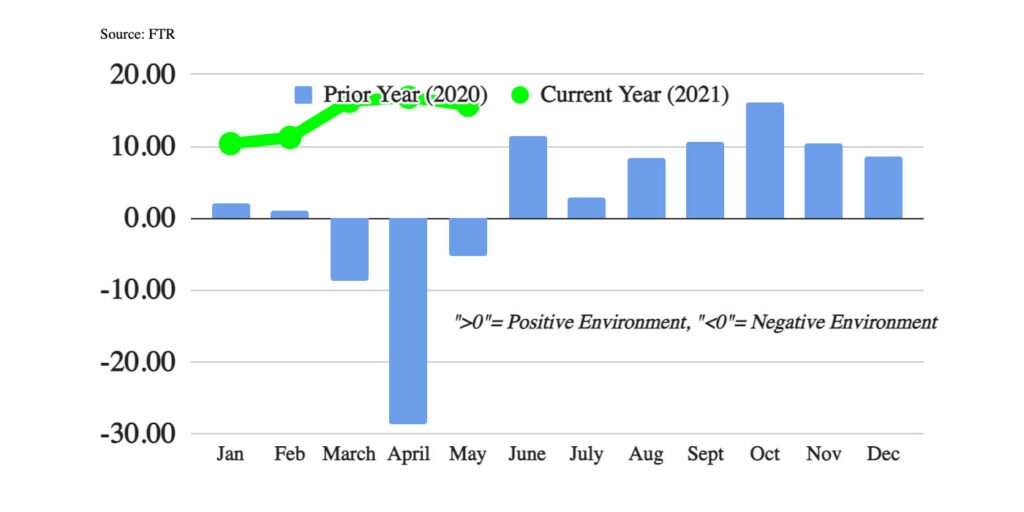

FTR’s Trucking Conditions Index (TCI) for May, as reported in the July issue of the Trucking Update, eased slightly from the April record reading (16.82) to a still-robust 15.72. The TCI tracks the changes representing five major conditions in the U.S. truck market: freight volumes, freight rates, fleet capacity, fuel price and financing.

Stronger freight rates would have pushed the index to a third straight record, but a swing in diesel prices from a slight positive in April to a negative in May, along with slightly weaker capacity utilization, offset those gains, FTR said. The TCI is forecast to remain at double-digit positive readings through 2021 and to remain positive through 2022. However, FTR said this outlook depends on only incremental improvement in driver capacity in the near-term.

“Market conditions in the flatbed segment appear to be stabilizing, but we do not have clear signs of the stress in the van markets easing,” said Avery Vise, FTR’s vice president of trucking. “The solid increase in for-hire trucking’s payroll employment during June might be a hint that the market is peaking, but we expect considerable friction to remain in the supply of drivers at least into next year. However, one of the market stresses has been the unprecedented surge in small new trucking operations, which has added to market disruptions. With high diesel prices and truck insurance costs, we would expect many of those drivers to return to the security of larger employers once spot rates start falling significantly. This possibility along with the end of generous unemployment benefits represent risks in the outlook.”

RELATED: Hear more market insights from FTR in our recent podcast interview with Don Ake.