Work Truck Solutions has released its Q1, 2023 Commercial Vehicle Market Analysis, showing that the slow but steady increase of inventory available from OEMs is affecting commercial vehicle sales in predictable ways. With Ford leading the charge among OEMs, new on-lot inventory per dealer continued to grow: +10.8% QoQ and +46.4% YoY, Work Truck Solutions says. With new inventory levels still only 46.3% of what they were in 2019, used vehicles continued to help fill the demand, as evidenced by the rise in used on-lot inventory per dealer, up 125.4% YoY, the company states.

Work Truck Solutions states that the average used vehicle prices continued to decline, down 1.7% QoQ and 4.3% YoY. Continuing the trend, the company says it has seen since Q2 2022, both new work trucks and vans still carry a significant price tag with prices increasing 2.4% QoQ and 4.1% YoY.

Within new vehicle averages, empty cargo vans by themselves showed no signs of stagnation with prices rising, the company notes: 5.0% QoQ and 5.8% YoY for light-duty work vans, and 1.6% QoQ and 7.8% YoY for medium-duty vans.

The prices of service trucks, according to Work Truck Solutions, also continued their upward trend, with light-duty up 1.9% QoQ, and 6.9% YoY, and medium-duty up 1.5% QoQ and 6.0% YoY.

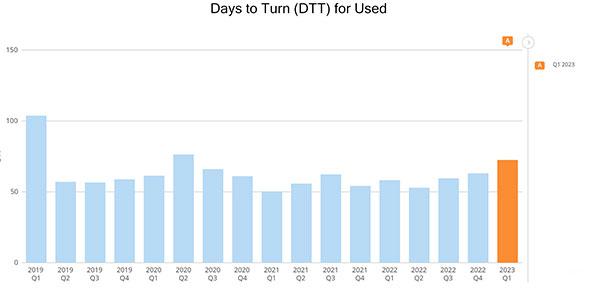

The median mileage of used work trucks and vans maintained its upward arc, with increases of 6.3% QoQ and 11.6% YoY. Although the combination of higher mileage and more available new vehicles is influencing the decrease in used-vehicle prices, unmet demand is slowing that decrease, and according to the company, there is a slight increase in days-to-turn that shows both new and used inventory staying on dealer lots longer, which the company says it will keep a close eye on in the coming months.

“An interesting note in this data is that even with higher new-vehicle prices, searches for new trucks and vans remained strong, demonstrating that customers are still dependent on replacing, and adding, vehicles for their businesses,” said Aaron Johnson, chief executive officer, Work Truck Solutions. “On the other side of the equation is an uncertain economy, inflation, and rising interest rates. Taking all of this information in aggregate means the commercial vehicle industry is likely moving into not only a more competitive phase, but a world where digital tools to help buyers with acquisition, like CV Showroom and EZ Order, are necessary for dealerships to thrive. Plus, savvy dealerships will need to utilize data-driven insights to position themselves as business partners rather than mere vendors.”