The North American Council for Freight Efficiency (NACFE) has released a new Confidence Report, Natural Gas’ Role in Decarbonizing Trucking. The report focuses on natural gas as a fuel source and its potential to reduce greenhouse gas emissions, while also covering what NACFE calls significant advantages in reducing more immediate and local health effects caused by air pollutants like nitrogen oxides and particulate matter.

According to NACFE, a renewed interest in using natural gas in transportation, not only because it is a lower-carbon fuel than diesel fuel and is cleaner burning but also because of the Class 8 possibilities unlocked with the launch of the Cummins X15N 15L natural gas engine. NACFE says Renewable Natural Gas (RNG) in particular is being looked at because of its potential to have a negative carbon intensity when the feedstock is from animal waste.

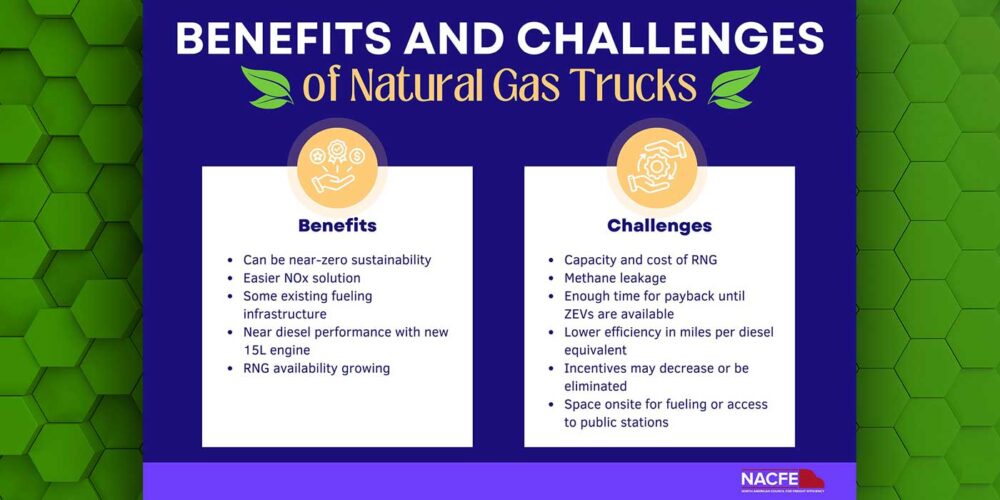

“CNG and RNG offer a lot of benefits as we decarbonize the transportation industry; however, there are challenges. Each fleet must assess all of these to be assured it is the right solution while in the messy middle,” says Jeff Seger, NACFE’s clean energy consultant.

The report provides an overview of the various types of natural gas and details fleets’ experience using natural gas fuel for their medium- and heavy-duty trucks. It also looks at available natural gas engines and truck makers that are offering a natural gas option in their product portfolios.

What is the ‘messy middle?’

During a press conference, NACFE explained this term (one they’ve used before to describe electrification) as a kind of bridge. Right now, the industry sits on one side of a gap, predominately using diesel and gas ICE vehicles. By roughly 2050, we will have made it to the other side where NACFE sees the industry operating vehicles on zero-emissions sources like hydrogen fuel cells or other clean EV tech. Alternative fuels like natural gas, current generation hydrogen and battery technology (along with related infrastructure challenges) between now and then make up the messy middle NACFE says we will cross.

“Natural gas engines need to be looked at as part of the ‘messy middle’ so fleets can decide if they want to invest in it considering other powertrain options,” says Mike Roeth, NACFE’s executive director. “It has it pluses and minuses, but it does produce less CO2 per unit of energy on a full-comparison basis compared to No. 2 diesel fuel.”

NACFE also delves into benefits and challenges for fleets when it comes to adopting natural gas as a power source for their trucks. Perhaps the biggest benefit, according to NACFE, is that natural gas vehicles can be a near-zero emission solution. On the challenge side, NACFE notes that natural gas vehicles are lower in efficiency in miles per diesel equivalent, and purchasing incentives may be changed or eventually end.

The NACFE Confidence Report ends with nine key findings about natural gas engine use in commercial vehicles.

- There appears to be a wide range in perception and results regarding the business case for natural gas;

- There are several positive environmental aspects of natural gas engines;

- There are environmental concerns with natural gas;

- Sustainability goals, regulations, and the California conundrum are considerations;

- The new 15-liter Cummins X15N engine seems promising;

- Aftertreatment is simple and more reliable;

- Natural gas is very abundant in the US;

- There is a question as to whether there will be an ample supply of RNG; and

- Because of economics and the environment, there are a few points to consider when comparing BEV and CNG.