Trailer orders for August remain in low holding pattern

FTR reports that final trailer orders for August remain in a low holding pattern at 10,400 units, up 1% month-over-month.

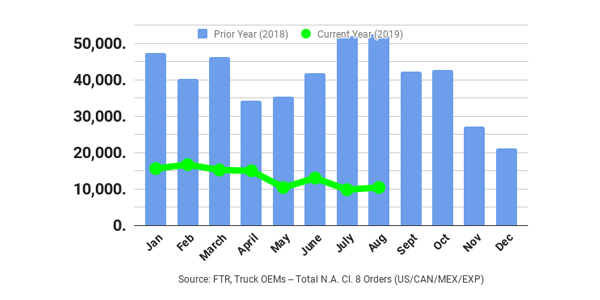

North American Class 8 orders for August up modestly from July

According to ACT Research’s preliminary North America Class 8 net order data, the industry booked 10,900 units in August, up nearly 6% from July, but 79% below last August’s best-ever order month, while FTR reports preliminary North American Class 8 orders for August at 10,400 units, up 4% m/m but down 80% y/y.

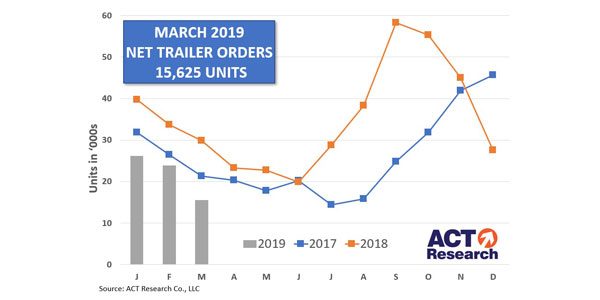

Trailer orders continue to drop in March

According to the latest reports from both ACT Research and FTR, trailer orders continued to fall in the month of March.

Trailer orders set all-time high monthly record

September trailer orders remained at record levels in September, according to ACT Research and FTR. September trailers orders were 56,000 units, which exceeded the previous monthly record by 10,000 trailers, according to FTR. ACT estimates September orders to be 58,200 units, and that annual orders are up by about 50% compared to 2017. “Fleets reached a

‘From first mile to last mile’: is it time to expand into new applications?

The trucking industry is experiencing a boom with no end in short-term sight. The latest report from FTR’s Trucking Conditions Index—which tracks changes in U.S. truck market conditions, including freight volumes, freight rates, fleet capacity, fuel price and financing—is that the y/y Index remains more than triple the 2017 reading of 2.97. The current

Preliminary numbers show Class 8 orders up year-over-year

According to preliminary numbers from FTR, Class 8 net orders for March came in at 22,800 units, slightly above FTR’s expectations and much higher than a year ago for the third consecutive month. March orders were basically flat month-over-month and up 41% year-over-year. Backlogs are now close to where they were a year ago, and production

Truck sales strong in February, preliminary data says

February 2017 was yet another strong month for truck sales, according to preliminary numbers from both FTR and ACT Research. ACT’s preliminary numbers had February Class 8 orders hitting a 14-month high at 23,200 units, a second consecutive month of orders rising above both trend and ACT’s expectations. “Orders rose 28% versus year-ago February. That

November preliminary truck orders rise

According to FTR’s preliminary Class 8 net order numbers for November, orders came in at 19,300 units, up 41% month-over-month. This was right in line with the FTR forecast, and represents the market making a return to tracking normal cycles. Class 8 backlogs are expected to increase for the first time in ten months. Including November, Class

July trailer orders come in below expectations

FTR reports that final July trailer orders were below expectations at 9,500 units, which is 20% below June and -55% year-over-year. Dry van orders were particularly weak, with other trailer segments experiencing noticeable order declines as well. Orders have totaled 260,000 units over the past twelve months. Backlogs fell another 9% and are now 21%

Once again, truck sales drop

Across the truck industry, sales numbers have been dropping. Preliminary numbers are in for April, and according to both FTR and ACT Research Co., heavy-duty sales are down for the month. ACT’s preliminary numbers show 33,800 new orders from Classes 5-8 (13,700 from Class 8 and 20,100 from Classes 5-7). That’s a 16% drop from March and a