FTR Shippers Conditions Index remains in low territory

FTR’s Shippers Conditions Index (SCI) for May remained basically unchanged from the previous month at a current reading of -7.5 reflecting a continuing tight capacity situation with utilization rates holding between 98% and 99%. Increases in labor costs and purchased transportation will drive shippers’ cost upwards throughout the remainder of the year. Spot rates for

FTR: Shippers Condition Index reflects mild pullback from critical capacity

FTR’s Shippers Conditions Index (SCI) for April rose one point to a reading of -7.7, reflecting a mild pullback from a critical capacity possibility reflected in the previous month’s reading. However, this one month change does not signal any real improvement in trucking capacity that remains extremely tight. The index remains in low territory reflecting the

FTR Shippers Conditions Index continues to reflect tight capacity

FTR’s Shippers Conditions Index (SCI) for March was basically unchanged from February at a reading of -8.7. The negative level of the SCI reflects extremely tight capacity available to haul goods. FTR currently expects the tight environment for shippers to moderate slightly in the coming months unless freight growth picks up as a result of

FTR shippers conditions index deteriorates in February

FTR’s Shippers Conditions Index (SCI) for February, at a reading of -8.8, reflects an earlier than normal tightening of capacity created by the debilitating effects of winter storms in early 2014. Conditions are expected to improve from this low point if a slowing of freight growth persists; however, shippers are advised to acquire sufficient capacity

FTR Shippers Condition Index remains in neutral territory entering 2011

FTR Associates’ Shippers Condition Index was hovering near the neutral reading of zero at the end of 2010, reflecting the continuing effects of the earlier pause in the economic recovery. FTR projects that the SCI, which sums up all market influences that affect shippers, will soon significantly worsen due to tightening carrier capacity as the economy re-accelerates and new Federal trucking regulations take hold.

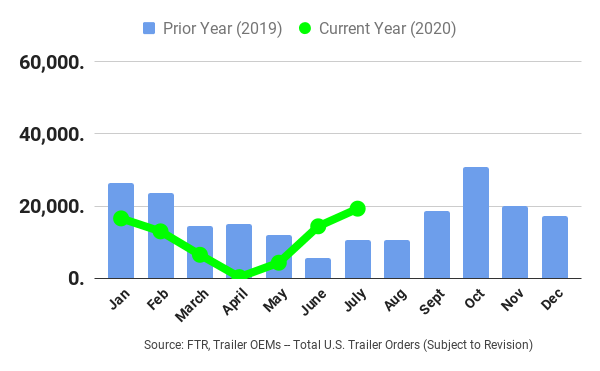

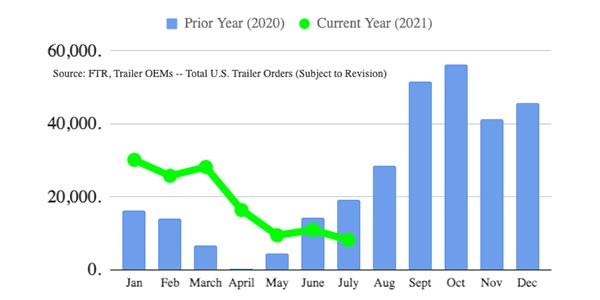

Trailer orders continue to slide in July

FTR reports that preliminary trailer orders continue to slide to the bottom of this cycle, registering only 8,200 units in July 32% below June and -58% year-over-year. Trailers orders for the past twelve months now total 354,000. Dry and refrigerated van orders remained paltry, FTR adds, as OEMs are booked full for 2021 and not

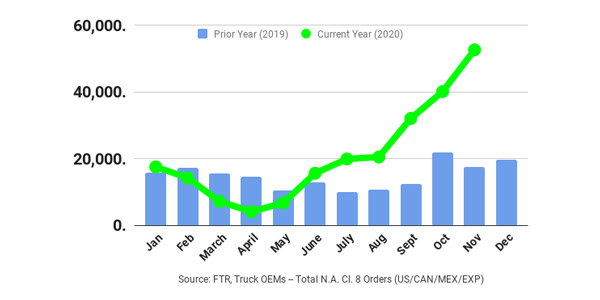

Class 8 orders hit third-highest ever total in November

According to preliminary reports from both FTR and ACT Research, North American Class 8 net orders exploded in November to the third-highest total ever. FTR has the preliminary number at 52,600 units, the best performance since August 2018. Orders were +31% month-over-month and almost three times the level of November 2019. Class 8 orders for

Fleets have ‘renewed confidence’ as truck orders improve in September

According to the latest numbers from FTR and ACT Research, Class 8 net orders surged in September to the highest total since October 2018, hitting 32,000 units according to FTR (ACT Research reports 31,100 units). September order activity was up 55% month-over-month and 160% year-over-year, FTR says. “As orders rebounded to relatively healthy levels early

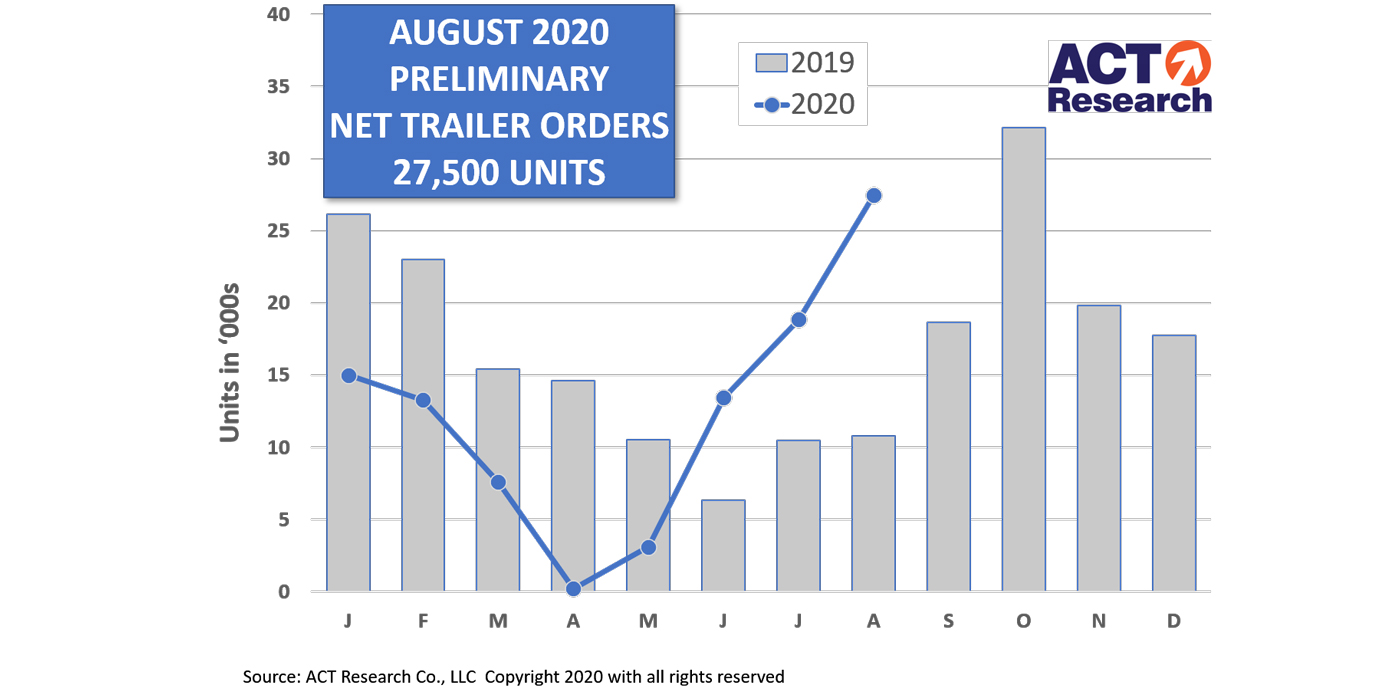

“A welcome surprise:” Trailer orders strong in August

Trailer order numbers from August show continued positive momentum, according to the latest preliminary numbers from both FTR and ACT Research. FTR reports that preliminary U.S. net trailer orders for August jumped 49% month-over-month to 28,700 units, the strongest activity since last October. August orders were 174% above the same month during the previous year,

Final July net trailer orders climb to highest level in 2020

FTR reports final net trailer orders continued to climb in July, reaching 19,300 units, the highest level for the year. ACT Research reports July net U.S. trailer orders of 18,851 units. July order activity was up 33% from June and +84% y/y, FTR says. Trailer orders now total 173,000 for the past twelve months. Dry