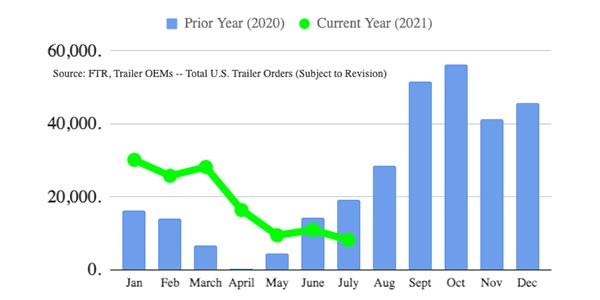

FTR reports that preliminary trailer orders continue to slide to the bottom of this cycle, registering only 8,200 units in July 32% below June and -58% year-over-year. Trailers orders for the past twelve months now total 354,000. Dry and refrigerated van orders remained paltry, FTR adds, as OEMs are booked full for 2021 and not entering orders yet for 2022. Vocational orders fell as well in July, as fleets have most of their orders in for this year.

“The orders are in for 2021 but the challenge remains to build the trailers,” said Don Ake, FTR vice president of commercial vehicles. “OEMs continue to struggle hiring factory workers. Suppliers are struggling to keep pace due to a shortage of manpower and imported parts and components. The supply chain is still experiencing disruptions and bottlenecks. Some improvement in production is expected this year, but there are indications some supplies will be restricted into next year.”

Preliminary reports from ACT Research, meanwhile, show that trailer OEMs posted 7,100 net orders in July, roughly two-thirds of June’s volume and 63% less than the same month last year.

Frank Maly, director of CV transportation analysis and research at ACT Research, commented further on production capacity and levels: “Initial reports indicate that OEMs were unable to increase daily production rates in July, as supply chain and staffing headwinds continue to challenge ramp-up efforts in response to their solid orderboards. While some announcements point to additional industry capacity coming online, those continuing component and staffing issues could make it challenging to fully utilize that potential in the near-term.”