Mild recession scenario considered in commercial vehicle market forecasting

According to ACT’s latest release of the North American Commercial Vehicle OUTLOOK, while ACT Research still believes a soft landing is the US economy’s most likely path, the potential for a mild recession is becoming an increasingly compelling alternative. “We find ourselves in a turbulent environment, where still significant positive and increasingly negative economic forces are crashing

May preliminary data show new truck order activity aligned with macro trend

Preliminary North American Class 8 net orders in May were 14,000 units, while Classes 5-7 net orders moderated to 17,000 units. Complete industry data for May, including final order numbers, will be published by ACT Research in mid-June. “We are coming to that time of year when orders tend to be seasonally weak, as OEMs

Dry van orders responsible for U.S. trailer net orders decline in April

April net U.S. trailer orders of 19,614 units decreased more than 48% from the previous month, but were 23% higher compared to April of 2021, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report. “Order placement remained choppy in April, and dry vans, with a 64% month-over-month slide in

U.S. used truck retail sales close 2021 with 6% increase

Preliminary used Class 8 retail volumes (same dealer sales) grew 4% month-over-month and ended 2021 with a 6% YTD increase, despite dropping 30% y/y in December, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. Other data released in ACT’s preliminary report included

Used truck retail sales close 2021 with 6% increase

Preliminary used Class 8 retail volumes (same dealer sales) grew 4% month-over-month and ended 2021 with a 6% ytd increase, despite dropping 30% y/y in December, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. Other data released in ACT’s preliminary report included

The continued impact of supply-chain constrained production

Preliminary NA Class 8 net orders in December were 22,800 units, while NA Classes 5-7 net orders dropped to 18,100 units, a significant sequential uptick for Class 8 but lower m/m and y/y readings for the medium-duty market. Complete industry data for December, including final order numbers, will be published by ACT Research in mid-January. “For Class 8,

The challenges facing strong Class 8 demand

They are numerous. According to ACT Research’s recently released Transportation Digest, supply-chain difficulties, COVID, inflation, high energy prices, robust freight and rates, and public policy continue to be the dominant issues shaping the heavy-duty outlook. “Class 8 demand remains strong, but the ability of manufacturers to respond to that demand continues to be constrained,” said

Five truck trend takeaways from December

Welcome to 2022! It’s a weird number to say. Sounds like the future, but I’m not sure this is the future we were promised. Or is it? The best way to find out is to take stock of the biggest trucking headlines that hit our site last month and get an idea of what’s ahead.

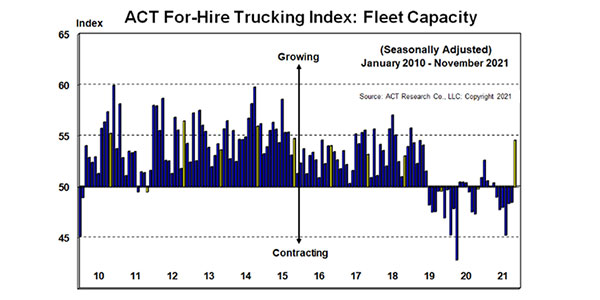

ACT Research For-Hire Trucking Index shows capacity recovering

The latest release of ACT Research’s For-Hire Trucking Index, with November data, showed across-the-board increases. The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. ACT Research converts responses into diffusion indexes, where the neutral or flat activity level is 50. “Led by better driver availability, the Capacity Index increased 6.1

U.S. trailer orders about lower YTD compared to first 11 months of 2020

November net U.S. trailer orders of 32,103 units increased more than 84% from the previous month, but were nearly 20% lower compared to November of 2020. Before accounting for cancellations, new orders of 33.9k units were up more than 73% versus October, but 18% lower than the previous November, according to this month’s issue of

The biggest truck technology stories of 2021

If it’s difficult getting microchips here in the States, I can’t imagine the supply chain nightmare it must be for elves in the North Pole. The jolly old elf and his crew may not be immune to the strains plaguing the transportation industry, but the show must go on. And just as truckers keep on

Pressure continues for new commercial vehicle order activity

Preliminary NA Class 8 net orders in November were 9,800 units, while NA Classes 5-7 net orders dropped to 21,500 units, both representing lower sequential and year-over-year readings. Complete industry data for November, including final order numbers, will be published by ACT Research in mid-December. “Long backlog lead times resulting from ongoing supply-side constraints continue