Trailer OEMs and major component suppliers continue to indicate strong demand and lingering supply-chain constraints. Despite OEMs expanding availability, 2023 is not yet fully open across the industry, partially because manufacturers continue to face volatile commodity costs, long lead times for some input components, and improved but still challenged labor considerations, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

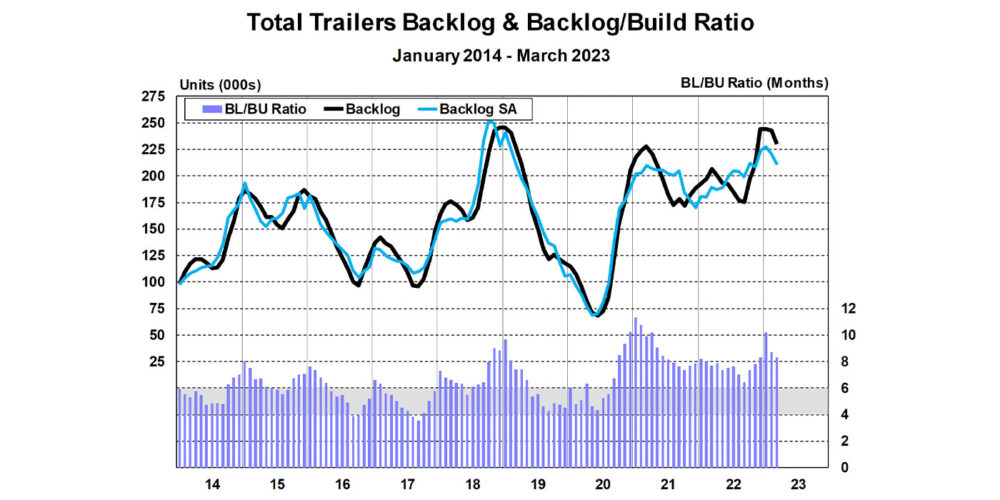

“Seasonally adjusted, the backlog-to-build ratio rose 100 basis points m/m, to 8.3 months, with weaker build in a seasonally strong month, from 7.3 months in February,” said Jennifer McNealy, director, CV Market Research & Publications, ACT Research. “Seasonal adjustment takes dry van BL/BU to 8.3 months and reefers to 10.7, so, either way one looks at it, with or without seasonal adjustment, this essentially commits the industry very deep into 2023.”

According to McNealy, March’s build per day declined 3% to 1,318 units per day, from February’s 1,359. However, overall build rose 14% M/M due to three more build days in March than February, a 14% increase. He notes that production growth, according to ACT Research findings, continues its upswing and projections point to a continuing trend.