Shippers and logistics providers are currently attempting to make sense of conflicting signals related to sluggish economic growth. The International Monetary Fund predicted 3.5% worldwide growth in 2017. However, in the first quarter of this year the U.S. GDP rose only 1.2%. While this is ahead of last year’s 0.8% growth, it is only the fourth-fastest first quarter in the last six years.

Conflicting signals

According to Supply Chain Management Professionals (CSCMP), “The conflicting signals leave shippers and logistics providers with little clarity on economic fundamentals for the remainder of 2017. Further complicating the outlook are variables such as currency exchange levels, interest rates and political trends. Against that uncertain backdrop, executives must make vital decisions about capacity, pricing, technology deployment and strategy.”

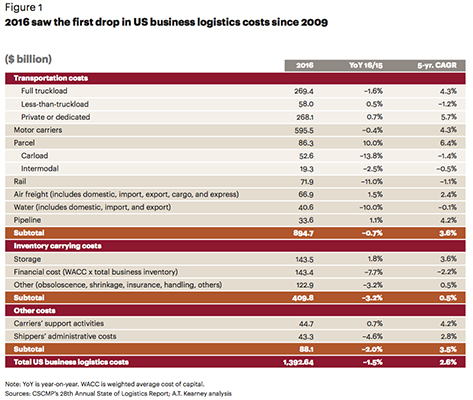

Energy costs no longer dictate logistics spending

Overall spending on logistics dropped despite a rise in energy prices. This marks the second straight year in which the two have moved in opposite directions, indicating that energy prices are no longer the primary factor in logistics costs. Last year, CSCMP suggested that consumers have become the driving force behind logistics spending, and this year’s results confirm the powerful impact on rising consumer demand for e-commerce deliveries. While overall transportation costs fell 0.7% last year, spending on package delivery services jumped 10%. Parcel and express delivery has surpassed railroads as the second-largest logistics sector behind motor freight. Meanwhile, energy-sensitive pipelines and railroads saw rates and volumes stall or drop as oil prices remained at historically low levels despite the upturn in 2016.

Crosscurrents also affected inventory-carrying costs last year. Storage expenditures rose 1.8% and are now as important as the financial carry cost of inventory. Until last year, storage costs grew at a compound annual rate of 4.7%. Nevertheless, a 54-basus-point drop in weighted average cost of capital pulled down overall inventory carry costs by 3.17%, CSCMP reported.

In addition, CSCMP reported experiencing the first decline in United States business logistics costs (USBLC) since 2009, even as a surging e-commerce sector propelled demand for parcel delivery services. Other sectors, including motor carrier and rail, were challenged by overcapacity, rate pressure and sluggish demand. When coupled with nominal GDP growth of 2.93%, USBLC, as a percentage of GDP, declined to 7.50%. Now, at the mid-point of the year, CSCMP is seeing a mix of signals from decision-makers, who see consumer confidence rise while GDP growth disappoints.

The logistics industry appears destined for a prolonged bout of cognitive dissonance, coupling frustration over subpar growth with the optimism reflected in rising stock market values, technology investments and consumer confidence data. Yet uncertainty hasn’t slowed the pace of change; on the contrary, industries are churning with disruption as newcomers and incumbents view for market share, and innovation undermines old business models. However, CSCMP says, one thing is certain: “business as usual” won’t return.