While the language might be different and the truck offerings are specific to Mexican applications, the challenges fleets face south of the boarder are surprisingly familiar: the fight for greater fuel efficiency; a growing driver shortage; and looming regulations that will change the equipment landscape.

“There are big challenges in Mexico. We have new regulations, we need to accept the use of more efficient fuels, and there is a lot of disruption coming like autonomous systems and electrification,” said Fernando Paez, president and chief executive officer of Olympic Transport, which runs cross-boarder operations into the U.S. and Canada, representing 95% of its business.

Paez sat beside Daimler Commercial Vehicles Mexico President and Chief Executive Officer Flavio Rivera during a recent press event held in Jalisco, Mexico, an area that is second only to Mexico City in terms of population and as an economic indicator. Rivera reported that Mexico GDP growth will hold steady at 1.5% to 2% in 2018 with the transportation industry playing a large role in its growth.

Rivera pointed to a 2017 statistic from the National Institute of Statistics and Geography that reported that the Mexico transportation industry made up 5.5% of the GDP. The Mexican transportation industry is serviced by 145,000 companies that transport 86% of the domestic load and represents 76% of the freight value between Mexico and the U.S. For both Rivera and Paez, the continued evolution of equipment efficiency and technology will support the industry.

“The total number of units in Mexico’s public and private sectors, Class 4 to 8, is 530,000, and 69% of them do not comply with the EPA ’04 emission standards that Mexico is currently using, “ Rivera said. “And the average age of a truck in a fleet is 17 years old.”

While that is a far cry from the average age of a U.S. fleet’s truck at three to five years, the differences give way to the similarities when you take a closer look at the Mexican market. Granted, there is a good chunk of the market that is driven by the acquisition price of the truck, but the majority of the market—66%–falls into a segment Rivera called the “Performance Seekers.” These are fleets interested in new equipment technologies and focus on fuel efficiency with trucks that are, on average, 9.6 years old. Further, 17% of the market is made up progressive fleets like Paez’s Olympic Transport, which aims for a four-year truck lifecycle and is focused on the new technologies that will improve efficiency and offer solutions to challenges like the driver shortage.

“The cost of the vehicles is increasing because the regulations are more strict,” Paez said, offering a refrain to which all fleets can relate. “Before, engines were simpler; now they’re more complex with more components, [aftertreatment systems], etc. At the same time, we now have more efficient trucks—with better performance than we had in the past—so these engines are giving us more kilometers per meter.”

In terms of fuel efficiency, Rivera reported that diesel costs makes up 57% of Mexican fleets’ cost of truck operation. Daimler Commercial Vehicles Mexico’s strategy for offering increased value within the truck as a business tool is driven by the same four pillars that’s driving Daimler Trucks North America as a whole: Connectivity; Automated technology; Shared Services; and Electrification.

“The first step in making new technologies available is the introduction of the Freightliner new Cascadia. With the Freightliner new Cascadia, we can show that our focus is the customer,” Rivera said. “Daimler Trucks is a company that is always looking to implement new technologies, and it’s not something we only do with the creation of new models for the industry, but more importantly through communications channels with customers that allow us to bring new solutions to the market and adapt.”

“We have been using some of the telematics technology to help us remotely diagnose units, and it’s a good start,” Paez said. “There are different challenges, different technologies, and we what we need is support with those technologies so that we do not lag behind in terms of autonomous and electric vehicles. We need to change, but when should we start adopting new technologies? That’s where our relationship with Daimler Trucks supports us.”

It would come as no surprise that equipment has played an increasingly important role in the battle to attract and retain drivers within Mexico.

“We’re facing a driver shortage, and I think that autonomous technology could help us,” Paez said, stressing the importance of having the best trucks on the road to keep drivers in his seats, as well as meeting the equipment requirements necessary to operate in Mexico, the U.S. and Canada. “If you have a good truck in which drivers can work comfortably and be more efficient, then you’re going to see an advantage. We’re trying to be competitive in terms of price and increasing the drivers’ salaries parallel to the market, but it’s not always about money. It’s about how you treat the driver and the value you place on them. We are offering experiences—something different for the drivers. We take them out of their routine to somewhere that they can be entertained, but also train them and motivate them with speeches, and they can feel identified with the company.”

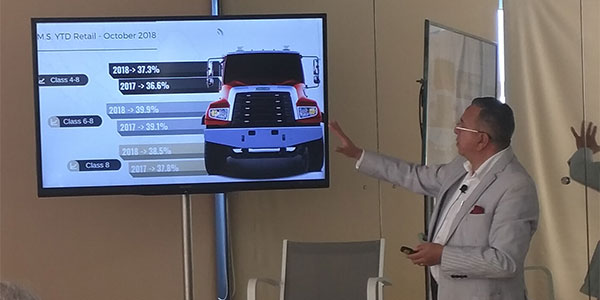

For both Olympic Transport and Daimler Commercial Vehicles Mexico, focusing on the customers—both external and internal—is a key component to their success. Success that can be seen Freightliner’s increased market share in the Mexican market, making up 40% of the Class 6 to 8 market. Rivera said that he is focused on growing Daimler’s leadership position.

“The new products we bring to market will move safety, efficiency and productivity forward,” Rivera said. “We are acting on the direction given to us by Roger Nielsen [Daimler Trucks North America’s president and chief executive officer], and our focus—above all—is on the needs of our customers.”