Over the last several months there have been indications that our industry is finally improving. For starters, vehicle OEMs are reporting profits and an increase in production.

Mark Lampert, senior vice president, sales and marketing for Daimler Trucks of North America (DTNA), recently reported that in 2011 DTNA had 104,000 Class 8 truck orders, adding that the truck maker expects a strong first quarter this year. Reflecting on the recovery, Lampert stated, “We feel like we’ve turned the corner and are back to normal production.” He cited the need for fleets to replace aging vehicles as one of the drivers in the turn-around, noting that older vehicles are now too costly to operate, especially since newer models are realizing better fuel economy.

Other OEMS are also reporting financial up-ticks. Volvo Trucks, stated that in 2011 it recorded it a company record market share of 12.1% of the combined U.S. and Canadian retail market, and reached record penetration levels for its proprietary engines and I-Shift automated manual transmission.

Likewise, PACCAR reported strong revenues and net income for the fourth quarter of 2011 and achieved its 73rd consecutive year of net profit. Its fourth quarter revenues of $4.85 billion were the highest quarterly revenues in company history, said Mark Pigott, chairman and chief executive officer.

PACCAR’s Peterbilt and Kenworth trucks have faired well recently. Peterbilt posted a December 2011 sales increase of 93.2%. Kenworth sales for the same period jumped 105.3%.

Mack Trucks, a part of the Volvo Group, reported that December 2011 sales were up 10.3% from the previous year.

On the trailer build side, “Following some mid-year sponginess, the trailer industry ended 2011 on a particularly strong note,” said Kenny Vieth, president and senior analyst at ACT. Orders in December were a virtual duplication of November’s five-year high, backlogs rose to their highest level this cycle, and cancellations were virtually non-existent. Rising backlogs and low levels of cancellation activity speaks to the strength of demand at the start of 2012.

This information is substantiated by a recent survey (conducted by CK Commercial Vehicle Research) of representatives from small, medium and large for-hire, private and government fleets, who operate a total of 101,000 Class 8 and 70,000 medium-duty power units). Those surveyed indicated that they intend to purchase new equipment in 2012, which would be an average order size of 16% of their current fleet population for both Class 8 and medium-duty orders. In addition, of those surveyed, one in four fleets said it planned to add some capacity with new equipment.

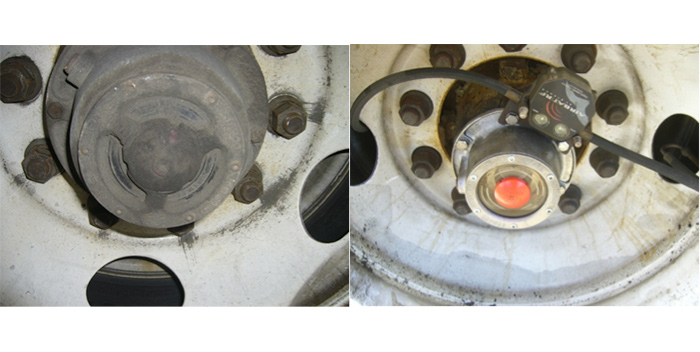

As we move through 2012 and beyond, fleet vehicle purchases may be predicated on the acceptance of new technologies. Frost & Sullivan lists these as: powertrains (automatic/automated transmission); selective catalytic reduction (SCR); tire pressure monitoring systems; air disc and larger drum brakes; remote diagnostics/prognostics; and critical event/safety system intervention alert. While these technologies cost more upfront, most have already proven that they can reduce overall operating costs.