Increasing engine emissions regulations, aggressive sustainability targets and the path toward zero emissions that is being blazed by California all contribute to what Ann Wilson, senior vice president, government affairs, MEMA, dubbed the “Year of Fuel Efficiency” from a regulations and legislations standpoint, during her Heavy Duty Aftermarket Dialogue presentation.

“Fuel efficiency [regulation] is going to come at us like a hot knife through butter,” she said. “They have to finalize those regulations before mid-point next year or else a new congress or president can overturn it.”

Wilson delved into what’s driving increased emissions regulations at the D.C. level, and what she thinks this Congress and president can actually get done. So here’s Wilson’s take on…

California, emissions regulations and the rest of the country.

“The California Air Resources Board has proposed new regulations for heavy vehicles; they want to see zero emissions by 2040 from fleets operating in the state,” she said. “If you go back to what the president said, he wants California and the EPA to work together. Now, we’re all in favor of that because we don’t want one set of regulations for 49 states and one set of regulations for California.

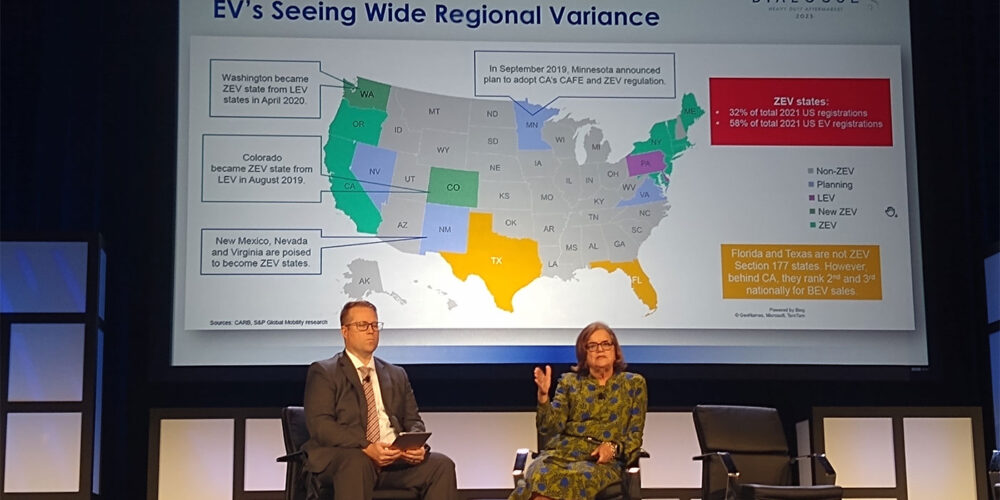

“Now look at how the California rules are spreading.” [Editor’s note: Lead image at the top of the story]

“One thing I would point out,” she continued, “is that there seem to be two different camps: Those states that are following what California is doing on light vehicles and those who are willing to follow it for commercial vehicles.

According to Wilson, she sees these regulations transforming the commercial vehicle industry “worldwide.”

“Not just in the United States; not just in California; not just in Virginia–worldwide. Some of you are going to be able to make it; some of you may not be able to make it. This is where the MEMA staff could be helpful if we understand your commercial pressures, and you work with us on what you need to see happen.”

Is there a chance of a unified fuel efficiency standard for commercial vehicles?

“If there’s ever a chance, it’s going to be now,” Wilson said. “The Biden administration is committed to it. But understand: the first thing that will come out is a light-duty vehicle standard, and then there will be phase two and phase three of the heavy-duty vehicle rule together.”

ESG reporting and its business impact.

Environmental, social, and governance (ESG) investments and subsequent reporting is growing. Whenever there are large amounts of money being thrown around, the Security and Exchange Commissions (SEC) is there, and it has turned its sights on ESG trends. But there’s a fight brewing.

“We have a very active Supreme Court, and what we saw at the end of 2021 and the beginning of 2022 had to do with the EPA in the state of West Virginia, and this has to do with emissions. The Supreme Court said that the EPA had gone beyond its authority,” Wilson said and then explained how that ruling is the basis for a move against the SEC’s power related to ESG. “Now there are many in Washington, who are arguing that the SEC does not have the authority to require companies to provide [greenhouse gas emissions and related ESG] information.”

Again, Wilson requested information from suppliers and manufactures as to what their customers are already requiring in ESG reports in order to do business–because that will still drive the need for ESG reporting and investments regardless of what Washington decides–to allow MEMA to act in the industry’s interests.

Lightning round! Wilson’s takeaways that go beyond fuel efficiency.

What can Washington really get done this Congress: “I do think it will become much more difficult, if not almost impossible, to pass large pieces of legislation. With a split Congress, a split country, and a Democrat in the White House, it’s always going to be difficult.”

Right to Repair for the heavy-duty industry: “Passing a Repair Act is MEMA aftermarket’s No. 1 legislative priority in this conference. They are going to change. And the independent ability to maintain and repair vehicles–whether they are light vehicles or heavy vehicles–is going to be critical.”

CHIPS Bill: “$52 billion–it’s not chump change, but it’s not going to make the United States completely independent on CHIPS. The $52 billion is appropriated to provide access to the research and development of semiconductors from in this country. I think what has been concerning is that some chip manufacturers, now coming to many of you, are saying: “If you want the mature technology chips that you’ve been counting on, you need to tell us right now and then that’s it.’ In other words, ‘We’re not making anymore of these chips so put your order in now.’

“If you’re experiencing that, let us know because we need to be telling the Secretary of Commerce that this isn’t working, and that they have to put more pressure on the chip manufacturers to make sure that the vehicle manufacturers, of both heavy-duty and light-duty vehicles, are going to be served, at least in part, from the money in the CHIPS Act.”

China: “Tariffs still exist. We are telling representatives that we need to end the tariffs because they’re actually just a tax on manufacturers. And even if they can’t do that, as a bridge, they need to put in an exclusion process that makes sense for everybody.”