Stepping into Hino Trucks’ new corporate office in Novi, Mich., feels more like walking through the doors of a slick Silicon Valley operation than a typical truck manufacturer.

Employees collaborate on curved couches and congregate around a long kitchen-like table near the espresso machine, which is no doubt fueling conversation. An open wooden slat staircase takes you upstairs where more employees are on the move. It all leads to Hino Trucks Insight Diagnostic Center, a room that tracks Hino trucks, identifies service needs, analyzes efficiencies and communicates that information to its customers.

“We’ve been in this new building for about three months,” says Glenn Ellis, senior vice president of customer experience for Hino Trucks, a Toyota Group company. “We’ve brought manufacturing, engineering and purchasing teams all under one roof. Toyota has its ‘One Toyota;’ this is our ‘One Hino.’”

Connectivity has long been a pillar of Hino Trucks’ market strategy thanks to its Verizon Connect-driven Hino Insight telematics platform that is built into every truck and comes as a standard solution with a one-year service plan with the option to extend it. The new diagnostic center takes connectivity to another level.

“Everyone from medium-sized fleets all the way down to the guy that owns one to five trucks are starting to utilize that telematics data,” Ellis says, standing in front of a giant screen that shows Hino trucks across the United States in various modes of operation: some are moving, some are stopped and others are idle. “When we first introduced telematics on our trucks in 2016 as a standard option, we saw about a 10% extension rate, meaning that we were providing one year of prepaid service to the customer at no charge and about 10% of our customers extended the service beyond the first year. Today, three years into it, the extension rate is up to about 25%.”

Hino Insight will be a key component of the OEM’s push into the Class 7 and 8 markets as its new XL Series comes rolling off its assembly line. By the time the ink for this story is dry, Hino Trucks will have delivered 100 demo units to customers and will be working to ramp up production in its new 1-million-sq.-ft. facility in Williamstown, W.V., with a series production of the 4×2 configuration ramping up in March and April, and the 6×4 configuration rolling down the line around June. And like all Hino Trucks, they’ll come with a full year of Hino Insight telematics service.

“Big fleets with mixed telematics systems are looking for a customized solution,” Ellis says. “They’re asking us to create APIs to send the raw data so they can then utilize that data in many different ways. From driver scorecards to fleet optimization and safety.

“Mid-sized to smaller fleets, I would say, are using Insight for routing optimization and driver performance, and I think they’re starting to realize that there’s additional benefit on the service side of it,” he continues. “We can now provide our customers with real-time maintenance reminders. Based on actual miles of the vehicle, we can tell them exactly when they’re due for oil service and other scheduled preventative maintenance. We’re also providing them with their diagnostic codes at three different severity levels to let the customer know, if they have a severe issue potentially with the truck that they need to get in, to schedule right away.”

Is regional-haul still a growing trend?

“Last mile delivery and the online consumer shopping trends are driving more and more business to that regional-haul need,” Ellis answers. “We are talking to several traditional Class 8, over-the-road fleets that are looking to purchase more regional-haul size trucks. From my understanding, it’s a shift a little bit in their strategy, and how they can utilize their drivers. Last mile delivery touches far more than Class 8 trucks.”

Driving trends

Hino’s decision to come into the Class 7 and 8 markets—which haven’t seen new players with serious manufacturing muscle in some time— with new products wasn’t made lightly. Ellis is confident that the XL Series will be another successful offering within Hino’s Class 4 to 8 lineup that has seen record year-over-year growth for the manufacturer seven years running.

“We set order intake records with our Class 6 and 7 trucks,” Ellis says. With the introduction of the XL Series and the opening of the aforementioned West Virginia plant, Ellis sees Hino’s manufacturing capabilities as an advantage in the market. “With our XL Series, our lead time is going to be relatively short compared to what other OEMs might have. Right now, the XL Series manufacturing lead times are in the 120-day range.”

The truck market continues to be hot, and you don’t see a lot of new trucks sitting on dealer lots. Hino is targeting dealer stock as a launch advantage to serve a market that needs rolling iron.

“We want every dealer to carry at least three to four XL Series trucks, based on the different configurations,” Ellis says. “But that’s in the smaller markets. As you get into bigger markets, we want dealers to carry more stock there.”

The XL-sized challenge facing Hino, however, is finding the right mix of standard and optional components that will meet fleet application needs. The XL7 and XL8 trucks are powered by Hino’s existing A09 engine, which has been in production for more than a decade. The A09 features a range of 300-360 HP and up to 1,150 lb.-ft. of torque. Several straight truck and tractor configurations will be offered, with GVWR ranging from 33,000 to 60,000 lbs., and GCWR up to 72,000 lbs. Transmission options include the standard Allison 3000 Series automatic transmission or an optional 10- or 13-speed Eaton manual transmission. And the XL Series will sport Dana axles, which diverges from Hino’s Class 6 and other Class 7 trucks.

“Those come standard with Meritor axles; that’s an example of where we are dual sourcing components,” Ellis explains. “That’s one of the challenges with a new product—there are a lot of applications that the XL Series trucks fit into, but we need to have the right wheel base, the right options given applications like front axle options or wheel combination with an axle. Those are some of the exciting challenges that we’re going to be working through.”

As Ellis looks across the truck market, he sees ample opportunity to tackle those challenges as the market remains strong.

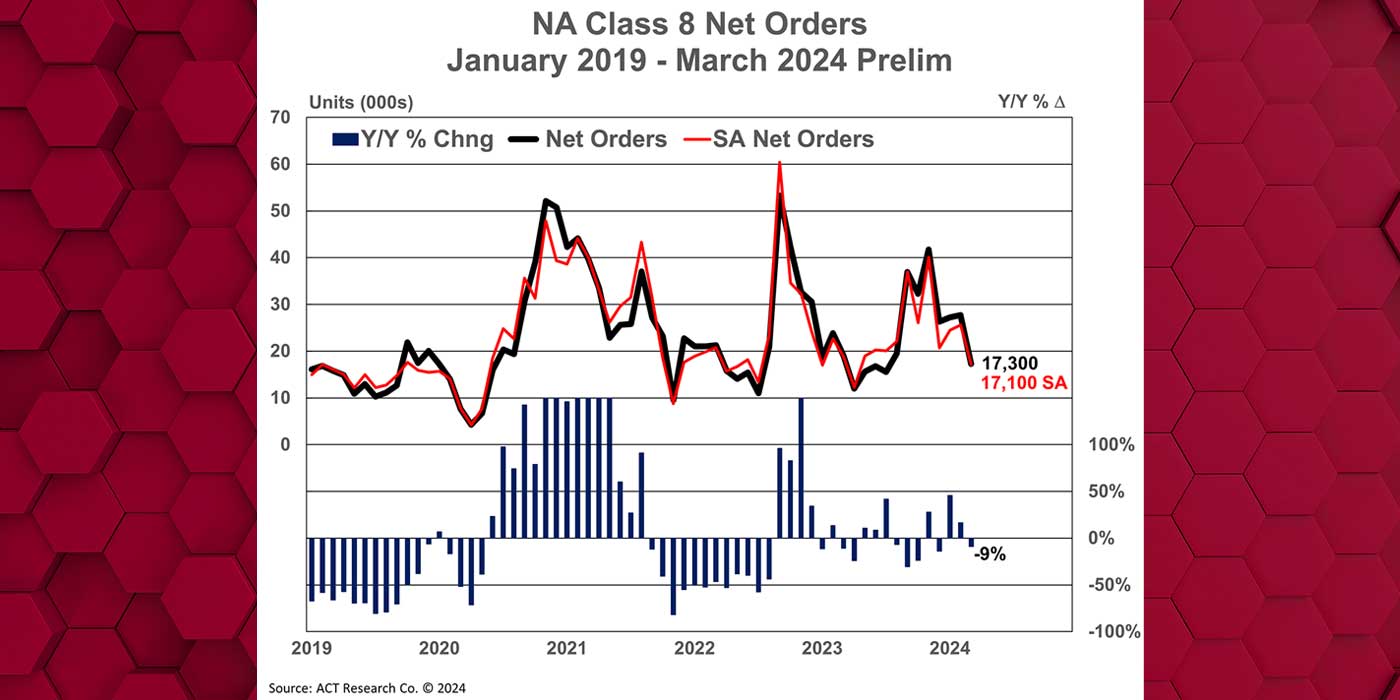

“Last year’s Class 8 truck orders were ridiculously high. So I think there probably will be more of a fall off in the Class 8 market,” he says. “But if you look at the Class 6 and 7 and even the Class 4 to 5 business, I think that will experience more of a softening of the growth rate. I still think there’s going to be year-over-year growth.”

Hino Trucks will measure the success of its XL Series against a competitive lineup of Class 8 trucks below 11-liter engine configurations.

“If you look at Class 7 and Class 8 in that below 11 liter range, it’s a pretty consistent market,” Ellis says. “We measured it at about 50,000 to 60,000 units a year.

“But right now, we’re focused on getting the XL Series demos out there so that people see the truck in the marketplace and have the opportunity to drive it. The feedback we got from our dealers when we did the training event, when they got to drive the XL Series versus the competitive trucks, is that they liked the ride, comfort and the visibility of the truck. The dealers are really excited. We completed the 12 different training events throughout the country, so our dealer staff is well trained, and they’re excited to start selling.”