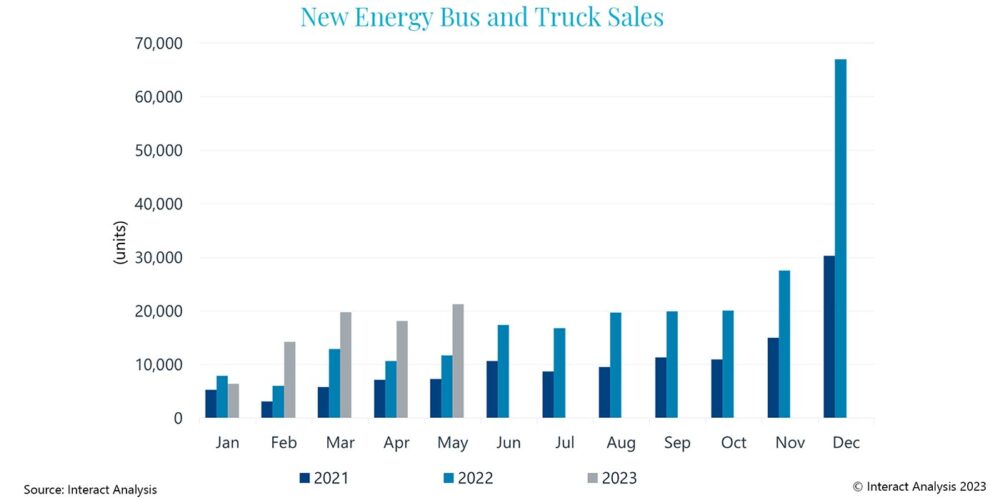

According to data gathered by Interact Analysis, in May, total registration of new energy commercial vehicles in China reached 21,308 units, an increase of 82% compared with the same period last year and 17% higher than the previous month, reaching a new high for the year. According to Interact’s China New Energy Bus and Truck Market Tracker, this was the third-highest monthly sales volume in recent years. The penetration rate of new energy commercial vehicles also continues to rise, reaching 8.9% in May from 5.3% for the same month last year.

New energy light-duty commercial vehicles led the market. In May, total sales of new energy light commercial vehicles exceeded 17,000 units, a year-on-year increase of 133%, accounting for 82% of overall sales of new energy commercial vehicles. Meanwhile, sales of new energy heavy-duty commercial vehicles reached over 2,537 units, down by 22% year-on-year. This decline was mainly attributable to a drop in sales of large buses (down 55% year-on-year), while the growth rate of new energy heavy-duty trucks also slowed down.

Fuel cell commercial vehicles had the fastest growth rate. Registration sales of fuel cell commercial vehicles reached 517 units in May, a year-on-year increase of over 8 times and a month-on-month increase of 19%, reaching a new high for the year. Battery electric vehicles had sales of 20,518 units in May, an 81% year-over-year increase accounting for approximately 96% of the total. Sales of hybrid vehicles reached 273 units last month, falling by 10% year-on-year.

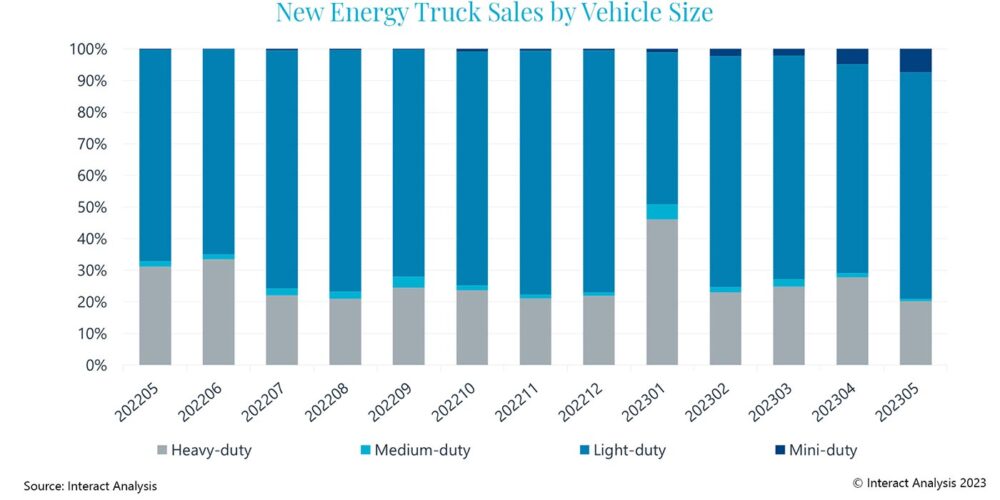

Medium and heavy-duty trucks new energy slowed down, while light-duty new energy trucks continued to gain momentum. In May, registration sales of new energy trucks reached 9,392 units, up by 60% year-on-year and by 14% month-on-month, with the penetration rate rising to 4.5%.

While sales of medium-sized trucks fell, the other three vehicle types all experienced year-over-year sales growth. Due to the small base in the same period last year, the new energy mini trucks segment showed the fastest year-over-year growth in May 2023, reaching 688 units primarily concentrated in the below 1.5-ton range.

Sales of new energy light-duty trucks reached 6,733 units over the month with a year-on-year growth rate of 72%, accounting for 72% of the new energy truck market and mainly consisting of battery electric logistics vehicles.

However, the growth rate in the medium and heavy-duty truck market has slowed down. Sales of new energy heavy-duty trucks increased slightly by 4% from last year to 1,899 units, accounting for 20% of the new energy truck market, with towing vehicles accounting for about 50%. In May, the majority of new energy heavy-duty trucks were sold to Hebei province, accounting for 26%, while the sales in other provinces accounted for less than 10%. Sales of medium-duty trucks reached 72 units, down by 32% year-on-year, marking the lowest monthly sales volume since March 2022.

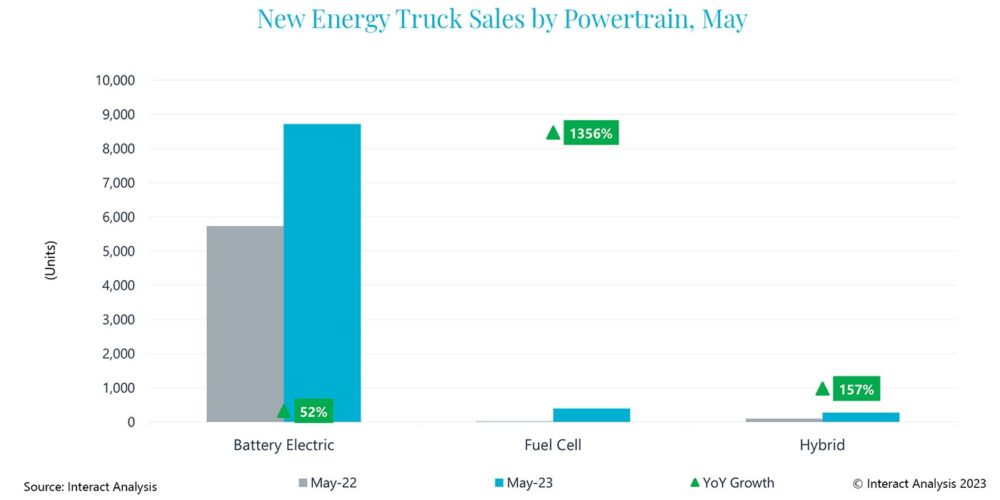

Sales of all three new energy powertrains increased, with fuel cell vehicles growing fastest. In May, the terminal sales of fuel cell trucks increased by over 13 times from the same period last year, reaching 393 units and accounting for 76% of the overall fuel cell commercial vehicles. Heavy-duty trucks have been a dominant vehicle type for the promotion and implementation of fuel cell technology. In May, registration sales of fuel cell heavy-duty trucks reached 235 units, with a year-on-year increase of over 8 times. Sales of battery electric trucks reached 8,727 units, up by 52% year-on-year, with light-duty trucks accounting for 72% of the total. Sales of hybrid electric trucks increased by 157% to 272 units.

Sales of battery electric and fuel cell powertrain buses have increased year-over-year. In May, the sales of pure electric buses exceeded 10,000 units, an increase of 111% compared with the previous year, accounting for 99% of total sales. A total of 124 fuel cell powered vehicles were sold, up by 313% year-over-year, all of which were large- and medium-sized buses.

You can read more of this data on the Interact Analysis website.