Samsara recently released its 2023 State of Connected Operations Report, offering a new look into how the organizations within industries that drive more than 40% of the global GDP are reinventing their operations. With perspectives from more than 1,500 physical operations leaders across nine countries, the report, according to Samsara, uncovers the investment strategies leaders are pursuing to build new revenue streams, leverage emerging technologies, and rise above economic and geopolitical uncertainty. The research found that Connected Operations Leaders—those who reported the highest level of digital maturity—were six times more likely to exceed their financial goals by 25% or more.

According to the company, physical operations leaders experienced a variety of challenges that drove headlines and boardroom discussions this past year. With elevated fuel costs and inflation, labor and equipment shortages, and supply chain constraints, they overcame these challenges by turning to technology and doing more with less. Below is a glimpse of the report’s findings.

Reworking supply chains and technology budgets to build resiliency

The importance of operational visibility is growing and driving investments. Supply chain delays and shortages, volatile fuel prices, and cross-border travel and trade are the top three concerns of leaders. To increase supply chain predictability and efficiency, 59% plan to move operations back to their country of origin, known as onshoring, this year. Real-time operations data is a competitive advantage and critical for decision-making for 90% of leaders. As such, 67% are increasing their technology budgets this year.

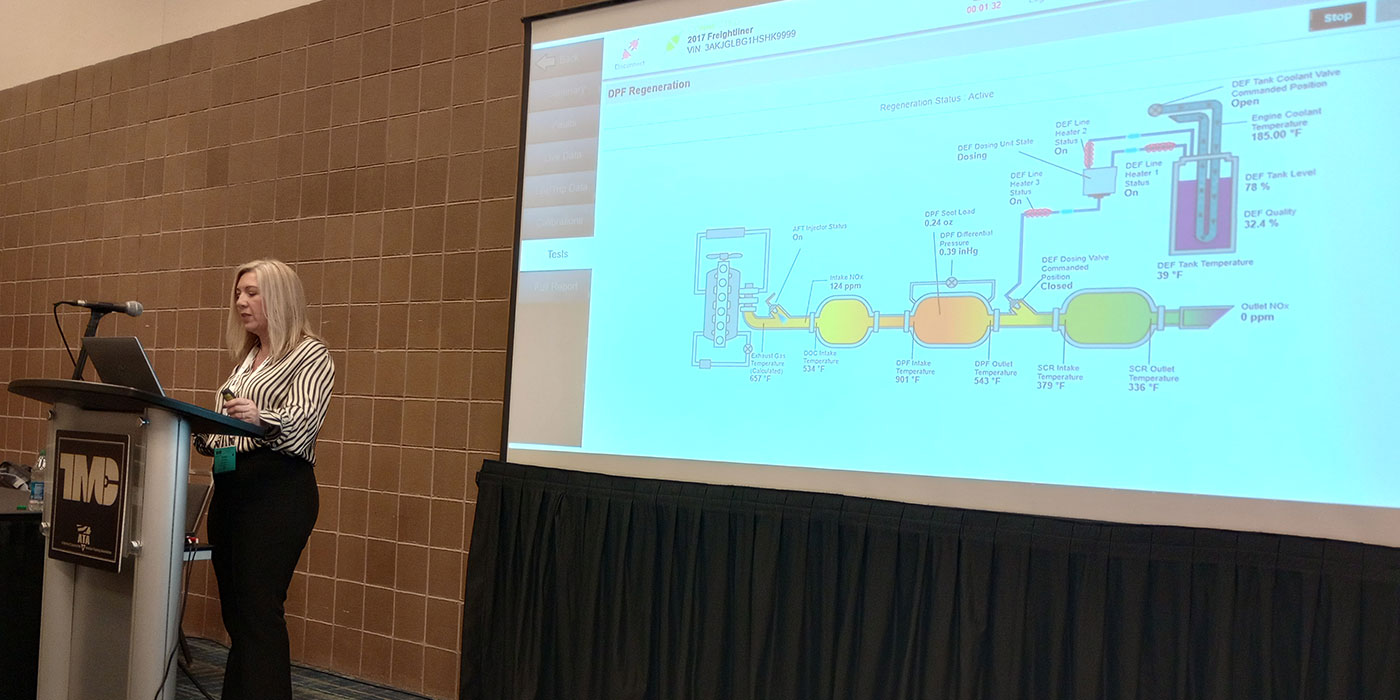

Out with the old—in with AI, automation, and digital workflows

With boosting efficiency top of mind, leaders are leaning into generative artificial intelligence (AI) and automation. By 2024, 84% of leaders plan to use generative AI and 91% automation to modernize their operations. Further, 51% are already using or plan to use autonomous vehicles and/or equipment this year. Leaders are also scrapping pen-and-paper processes for digital workflows, and by 2025 they predict 55% of their employees in the field will rely on digital workflows to perform day-to-day tasks.

Investing in workforce development

The future of work is rapidly changing as technology transforms legacy ways of getting work done. Consider that in just two years, leaders predict that one in six employees will be doing jobs that don’t exist today. This helps illustrate why more than half (52%) report teaching employees how to use new technologies is a top priority this year. An estimated $7 billion will be spent on training, upskilling, and reskilling employees in 2023 across the organizations surveyed.

Using sustainability as fuel for new revenue streams

Investments in sustainability are leading to the invention of new operating models. Last year, Samsara’s research found that 49% of leaders were planning to accelerate their electric vehicle (EV) adoption to combat rising fuel costs. Now, they are looking beyond adoption and will monetize EVs through pay-per-use or subscription charging stations (62%) and sell energy back to the grid (58%) by 2025. At this time, leaders predict 53% of their organizations’ fleet vehicles will be electric or hybrid.

“The bottom-line benefits of digitization are clear, but it’s the positive impact on lives and the environment that will be the most incredible to see,” Hausman added. “These leaders are shaping what we’ll remember as a transformative decade in physical operations.”

To view all insights from the 2023 State of Connected Operations Report—and discover the strategies Connected Operations Leaders are using to reinvent their operations—visit the Samsara website.