Direct labor vs. indirect labor: what do these terms mean? And how much of each is happening in your shop?

When this subject comes up, general comments always end up saying that the techs must be hanging around doing nothing. Most who read the data only read the direct data and not the indirect data breakdown. And most shops do not pay attention to the indirect data, so therefore it is a good, appropriate question.

Let’s define what the two mean in the real world.

Direct labor means any labor charged to the vehicle for maintenance and repair. It’s pretty simple: you work on a vehicle, you charge the time to the vehicle. One must determine what they want charged directly to the piece of equipment and what is not. Which brings us to…

Indirect labor is labor that is not charged directly to the vehicle. Now this definition is determined by whoever is in charge of how the company wants to see its costs and how they want to manage them.

A few examples of indirect shop labor would be: cutting the grass, moving vehicles, general shop cleanup, tire work, changing light bulbs in the office, or even unclogging the toilet. I have seen techs (the labor pool) doing road tests, parts inventory, individual parts rebuilding like products blowers. They could be cleaning out trailers, washing equipment (if one wants that labor cost out of maintenance), doing general yard work, filling holes, grading the parking lot, or waxing the owner’s boat, or raising a dropped trailer in the yard, plowing snow in the cold weather, coding in VMRS, waiting for parts, or doing road call phone work.

This may not be productive vehicle work but it is fleet support from the labor pool, filling real-world needs that may not be seen from the outside.

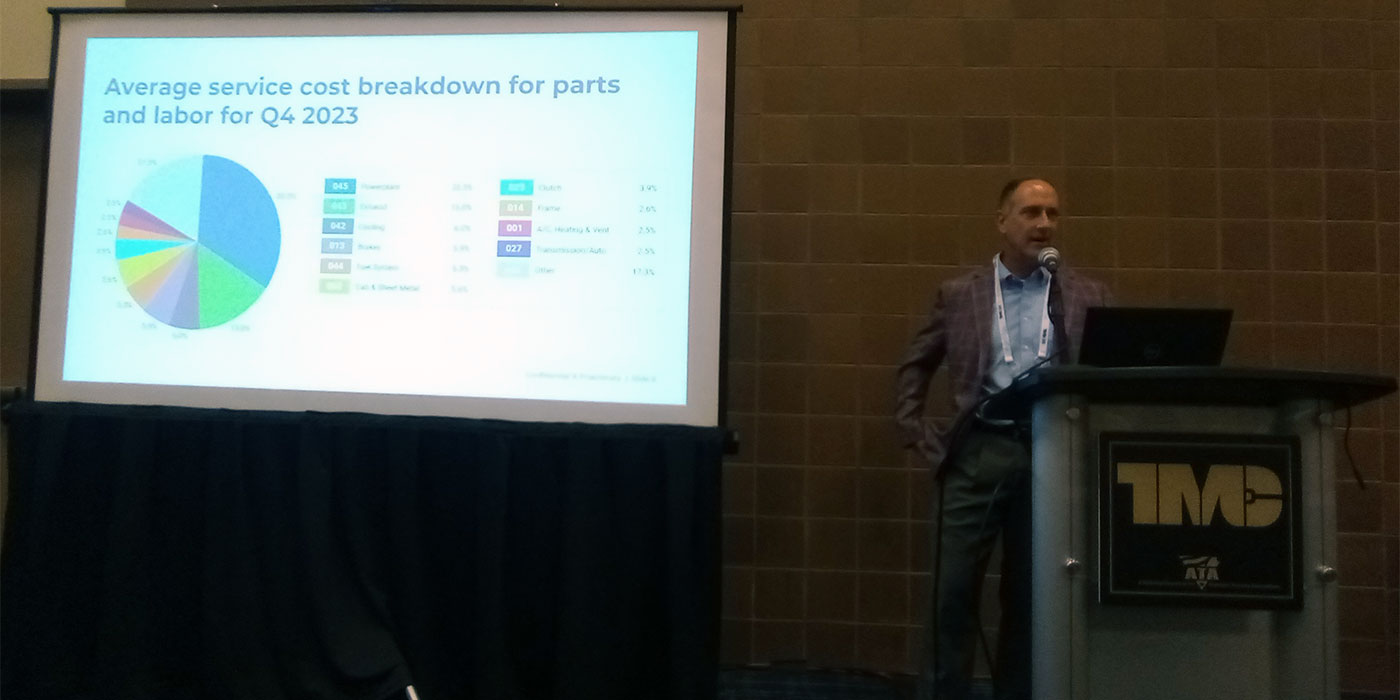

Calculating your labor costs

Labor requirement needs are determined by a simple formula: take the cost per mile—actual, historical, or predicted. Multiply that by the annual miles or hours, whichever is your preference. Take the total cost, divide that by two, (because parts and labor usually are a 50/50 split). Then take that and divide that by your internal cost per hour. That will give you the number of hours required for the predicted estimated repair hours per vehicle. Then multiply that by the number of vehicles. (The math is: =SUM(CPM/2)/Burden Rate=Hours x Vehicles=Labor Hours Required).

Now you must determine the hours and day coverage you want to be open.

Some operations departments want techs there when the trucks leave and when they return, some want the shop to be open on Saturday or even a second and/or third shift for repairs or, in most cases, just comfort.

In many cases the shop coverage is more than the repair hours required on the equipment. The balance of the shop open for Operational Support does not fit into the hours required. Anyone who runs vehicles and runs mean and lean knows that the cost to operate is much lower with a scare crow shop or no shop. It is just the way that it is.

All new vehicles do not necessarily reduce staff because you may need to have shop coverage. That where indirect labor comes into play—all those other things don’t go away, but maybe the indirect measures will force all to look at where it is going.

Indirect labor must be looked at not as technicians being unproductive or having too little work; if indirect labor is high then that needs to be looked at, digested, and maybe corrected. It may not be that you have too many mechanics, but too much BS work that the labor pool is doing; or, you may be a small shop that needs operational support. Bad coding could be another explanation. But be careful how you approach the coding by the techs, they can bury it in direct labor and you will never see it, then there is a real problem. The normal balance is approximately 75% direct, 25% indirect, and unless it is a captive charge, the back shop should be 95%.