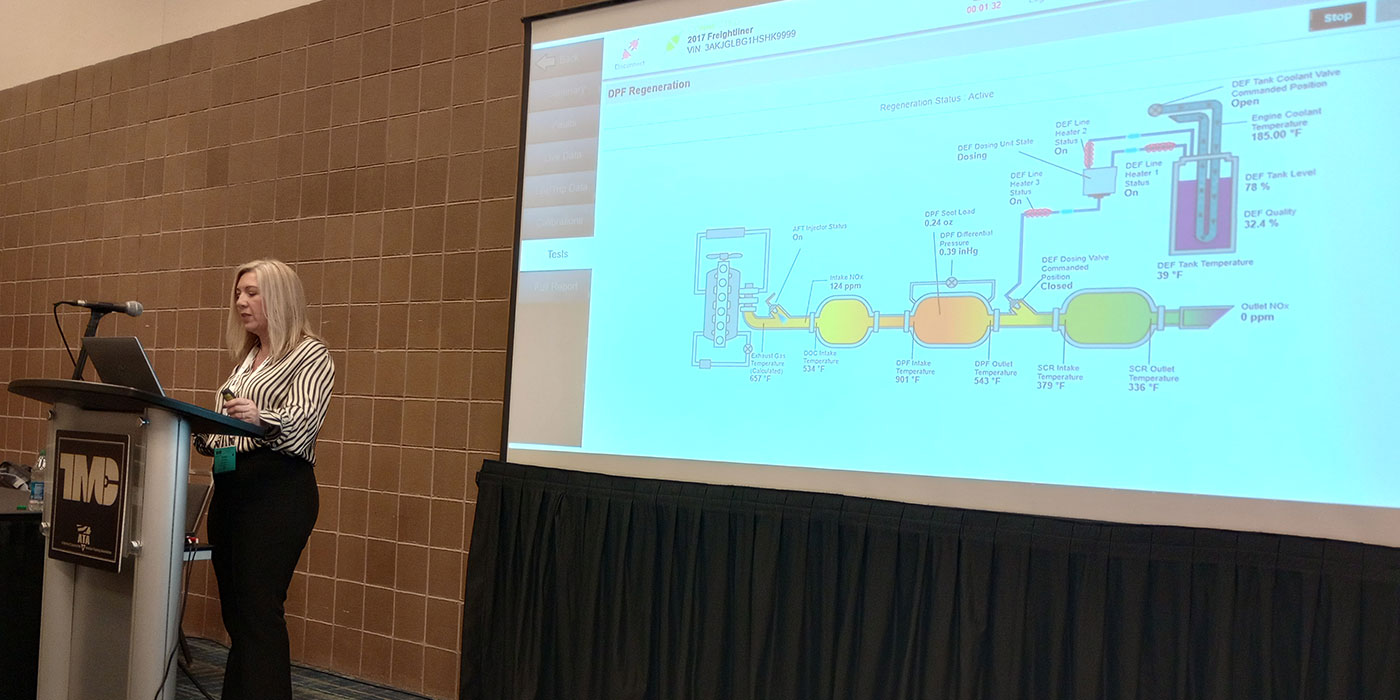

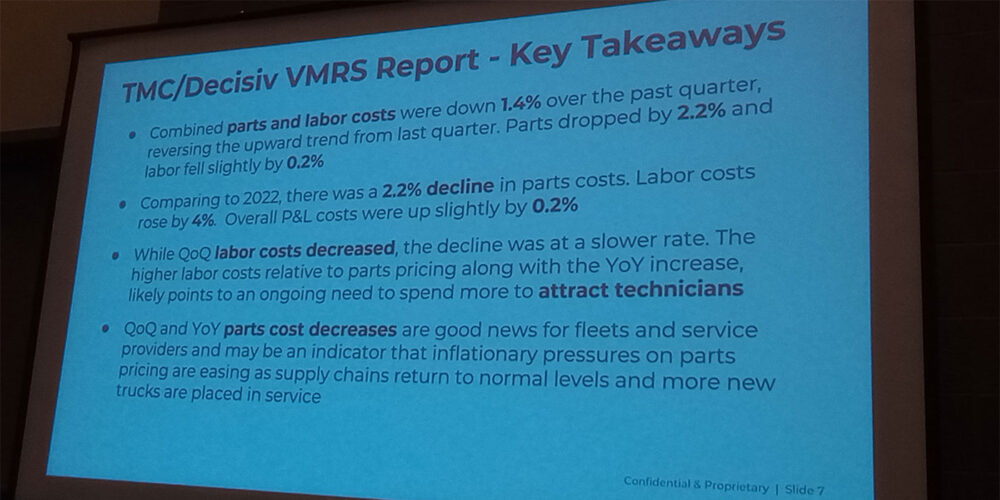

American Trucking Associations’ Technology & Maintenance Council and Decisiv Inc. said combined parts and labor expenses fell 1.4% during the fourth quarter of 2023. In the latest Decisiv/TMC North American Service Event Benchmark Report, TMC and Decisiv found that 25 key VMRS systems dipped in the final quarter of 2023, reversing a 2.1% increase the previous quarter.

“We are still facing an industry-wide challenge to find technicians, which is increasing labor costs for fleets and service providers. However, quarterly and annual parts cost decreases, driven by a reduction in pricing pressures and the influx of more new trucks, is bringing some welcome relief,” said Decisiv President and CEO Dick Hyatt. “With the Decisiv TMC Benchmark Report, TMC members have the parts and labor data they need to better analyze costs and continue implementing practices that will help them gain efficiency and become even more productive.”

The decrease was driven largely by parts costs, which dropped 2.2% in the fourth quarter of 2023 while labor costs fell 0.2%. While quarter-over-quarter parts and labor costs both declined in the last three months of the year, the parts-to-labor ratio held steady at about 1.5 for the past year.

On a year-over-year basis, combined parts and labor costs in final quarter of 2023 were 0.2% higher than the same quarter in 2022. However, in the annual comparison, a 2.2% drop in parts prices was offset by a 4.0% rise in labor costs.

With the most recent quarterly change, while labor costs decreased, the decline was at a slower rate. The higher labor costs relative to parts pricing and the year-over-year rise likely points to an ongoing need to spend more to attract technicians.

That industry wide challenge for fleets and service providers is expected to continue as Baby Boomers age and fewer workers enter vocational education programs. The U.S. Bureau of Labor Statistics reported that diesel service technician employment is projected to grow 4% from 2021 to 2031, creating about 28,500 openings for diesel service technicians each year, on average, over the decade. According to the TechForce Foundation’s Transportation Technician Supply & Demand Report, 177,000 new entrants in the diesel technician field are needed between 2022 and 2026.

Lower parts costs may reflect a decline in freight tonnage, leading to a decrease in mileage for trucking companies. The For-Hire Truck Tonnage Index from the American Trucking Associations for 2023 showed a 1.7% drop compared to the previous year. That figure, the largest decrease since 2020 and the only year since that tonnage contracted, represents a sizable drop for the trucking industry, which hauls more than 11 billion tons of freight annually.

“Lower parts and labor costs are welcome news to fleets, who have been weathering substantial increases for much of the last several years,” said TMC Executive Director Robert Braswell. “This important parts and labor cost analysis report is an excellent tool to help Council members compare how their operations are performing to industry trends and plan accordingly.”

The data that Decisiv collects and analyzes for the Decisiv/TMC North American Service Event Benchmark Reports on 25 Vehicle Maintenance Reporting Standard system level codes accounts for more than 97% of total parts and labor costs for more than seven million assets and over 300,000 monthly maintenance and repair events at more than 5,000 service locations.

ATA’s Technology & Maintenance Council issues the reports to its fleet members. The reports are organized based on the Council’s Vehicle Maintenance Reporting Standards sorted by VMRS-coded vehicle systems and geographic location.