What an interesting time for motor carriers. In the midst of the weakest economic recovery since the great depression, new or rising costs are happening all over their P&L. Trucks cost more, drivers are hard to get, new requirements for EOBRs, safety mandates, new toll roads and oh, fuel is likely to get even more expensive! Fuel traditionally was the second highest variable expense truckload carriers faced next to drivers. Since both driver cost and fuel cost are likely to rise, it is hard to say what the relationship will be in the future. In any case, fuel is going to draw more management attention, at least for those carriers that want to prosper in the future. This might be a good time to review the costs associated with fuel.

“Costs,” plural? Yes. The cost of the fuel burned in the engine is only on cost. Total costs are a combination of inventory, financing, acquisition (transaction) and the cost of fuel that is NOT burned in engines, or is burned while the tractor is not generating revenue. Inventory cost is pretty straightforward it’s the cost of the average inventory of fuel at a carrier’s terminals. With interest rates low, the cost is not currently super high, but it does cut into available liquidity. What about the inventory riding in a company’s trucks? If trucks are carrying 100 extra gallons routinely, then every 100 trucks are using something like $40,000 of working capital. Do those tanks really need to be full? If you have excess working capital, inventory cost is not really an issue—as long as interest rates stay low. Financing and acquisition costs for fuel purchased over-the-road are a little more complex and must be considered together because of the limitations of today’s payment systems. In some cases the cost of fuel includes TEN CENTS PER GALLON of financing and transaction costs, which might not be easily visible, but the arithmetic is easy. Some truck stops are paying 2.5% for the transaction. At $4.00 per gallon they have to pay for it somehow. If a carrier is buying based on price charged, as most do, this really isn’t an issue. However, it may mean leaving some opportunity on the table. Fuel costs from burning fuel while not generating revenue generally receive a lot of attention; idling, out-of-route, deadhead are all managed at some level by most carriers.

Which brings us to the sensitive discussion of fuel a fleet pays for that is not burned in engines. OK, call it what it is—fraud. One of the unfortunate consequences of higher fuel prices is the incentive for fuel fraud goes up dramatically. Five percent theft by a driver is difficult if not impossible to catch in most circumstances. That approaches $4,000/year in cost and perhaps $2-3,000 incremental disposable income for an unscrupulous driver. Fortunately, technology is being introduced to the market to help.

Before discussing the new technology, a refresher on how we got to where we are might help. A long time ago, buying fuel over-the-road involved a plastic card without a magnetic stripe. Yep, it was simply an identification card. On the bottom of the card it had the card’s purchase policy. The cashier was responsible for enforcing it, and at the end of the month when the carrier received the statement, if the policy had been violated the carrier simply rejected the invoice. There were conflicts. So billing companies started programs involving an “approval” issued by an operator in a call center. Can you say expensive? The answer was adding magnetic stripes and using terminals designed for consumer credit cards (debit cards weren’t invented yet). The cashier became a data entry clerk using devices not made for the purpose.

NATSO, the truck stop association called it the “point-of-sale dilemma.” It took months to properly train a fuel cashier. A company called Trendar came along with a “universal POS” that greatly simplified a cashier’s life by internally translating a diesel sale into one of the many codes that might be used by individual card companies. In that era, a gallon of diesel fuel might be sold for a dozen different prices—that is not an exaggeration; self, mini (remember that?) and full service, cash or credit, highway or non-highway. Trendar took over the truck stop market (25 years after its introduction there are still more Trendar POS units in truck stops than all the others combined). That technology enabled another change, however, making the driver a data entry clerk at the fuel pump.

Because of technology limitations the industry continued to use the consumer credit card model to perform commercial fuel transactions. This created several challenges. First the real customer, the carrier, was all but invisible to the truck stop. Second, unlike the consumer, the person wielding the card was a purchasing agent, not a principal in the transaction. But fuel was relatively cheap, fraud was not rampant, and there were other things to think about. During this time, a few truck stops created something called “direct bill,” which in effect acknowledged this as a commercial transaction. The supplier dealt directly with the customer and dealt with credit, collection and financing like other B2B suppliers. This is the state of the industry today. Magnetic stripe cards drive the great majority of transactions, some truck stops treat the sale of fuel as a commercial transaction and a significant number still attempt to treat it as a consumer transaction and allow the third party card systems to control their business.

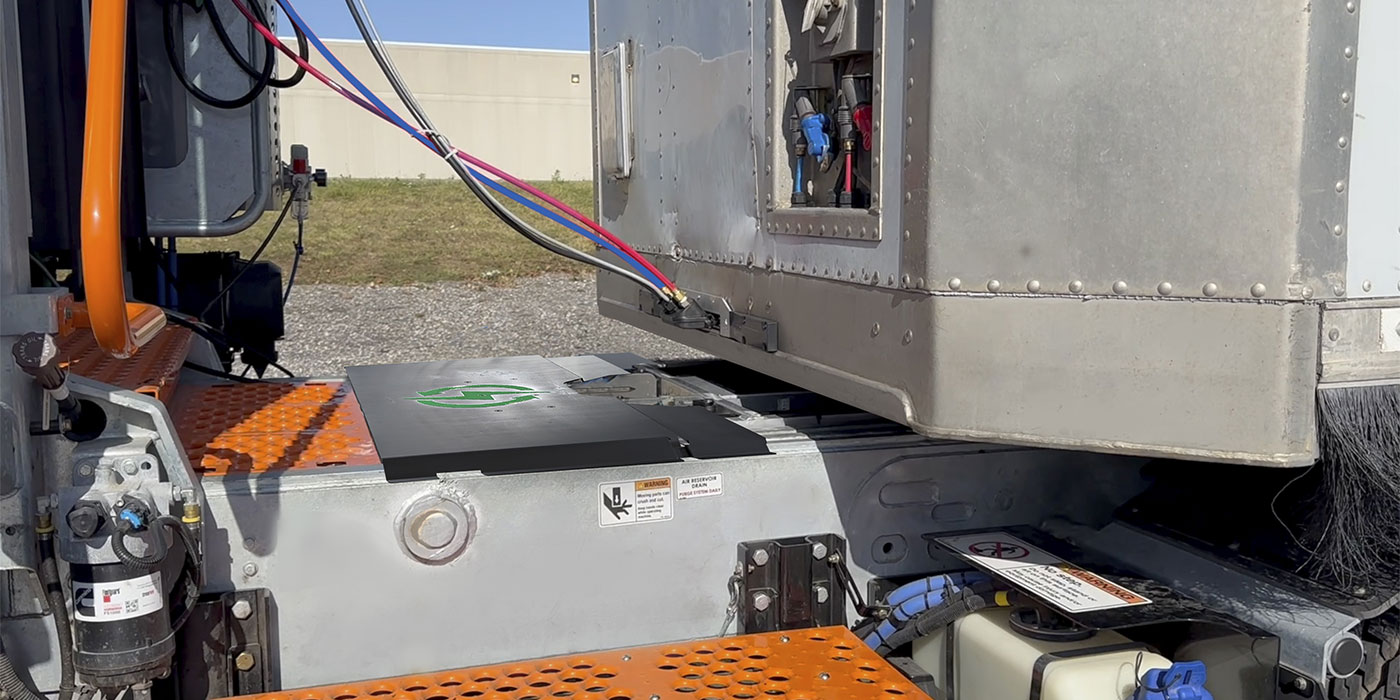

The Trendar POS introduced in the mid 80s was made possible by technology, specifically the IBM PC and its clones. Twenty-five years later there is enough new technology to allow for more change, and the catalyst that will enable the change is high fuel prices and the need to control expenses and specifically all fuel related costs. In the fuel lane itself, the key change will be the verification of the truck positioned in the lane. There are several ways to do this and at least two are installed in truck stops today. Fuel doesn’t flow until the right truck is in the lane, and if it leaves the fuel dispenser turns off. The technology in many ways is immaterial; the important thing is insuring that the carrier paying for the fuel has confidence that the truck being fueled is really their truck. The technology will require support from old-fashioned security items, like fences between lanes.

The “back-office” changes will be even more important. As part of the consumer model on which current fueling systems work, a separate database is maintained at the card processing center, just like in the days of the call centers. Synchronizing that database with a carriers information system is not fail safe or efficient. Furthermore, the “purchase policy” management systems are all tied to a card, because the separate database cannot keep up with the pace of changes in carrier information on a timely basis. A single purchase policy, based on a separate database maintained by a third party, is not a 21st Century solution to managing separate truck, trailer and driver needs. Basing a transaction on a daily fuel limit instead of the fuel consumed (or better yet the fuel that should have been consumed) since the last fueling is not a first class information technology solution. Marrying the decision-support systems in use by many carriers with the fuel approval system, and tuning them in real-time to the actual movement of freight will only happen when the fleet’s own information system is managing the fuel transaction. If a carrier saves 1% on fuel it is effectively reducing its price per gallon FOUR cents across the board.

Ernie Betancourt president of QuikQ, a provider of cardless direct fuel connection between truck stop point-of-sale systems and motor carrier enterprise systems.