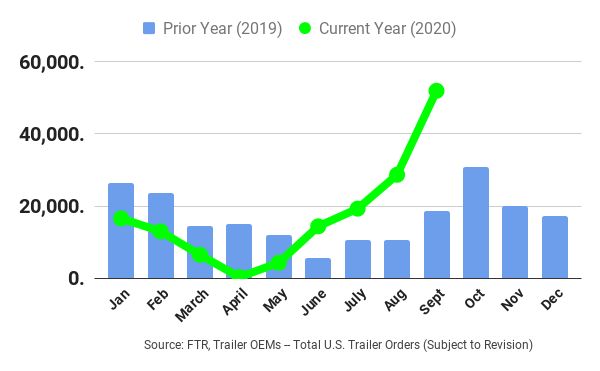

FTR reports that preliminary U.S. net trailer orders for September exploded to the third-highest month ever, at 52,000 units.

September’s orders were 23,500 units above August and 33,400 more than September 2019. With this latest activity, trailer orders for the last 12 months now equal 224,100 units, FTR says.

The great majority of the September orders were for dry vans. Refrigerated van orders were also comparatively robust, and flatbed orders are expected to continue their sluggish recovery, FTR says. Backlogs are predicted to jump back up to December 2019 levels. The strong order totals from the last two months should push production up to pre-pandemic levels in Q4, with more increases expected, starting early next year.

The Congressional stimulus package infused a tremendous amount of funds into the economy; this cash is being spent overwhelmingly in the consumer goods sector, as the service sector remains constrained during the pandemic, FTR says. This has boosted dry van freight, constraining capacity, and lifting freight rates. Fleets have responded by ordering dry vans in near-record quantities. Also, despite reduced restaurant sales, many consumers have more disposable income available to spend on food, which is helping reefer sales.

“There is expansion demand, replacement demand, dealer demand – just an enormous amount of demand for dry vans to keep consumer goods on the move,” Don Ake, FTR vice president of commercial vehicles, said. “Fleets are expecting the hot freight market to continue into 2021 and want to be prepared with adequate capacity. Reefer demand should also continue to be strong, and benefit from more restaurant activity as 2021 progresses.

“This appears to be a repeat of late-2018 when fleets ordered trailers in record numbers in September and October because of tight capacity and perceived limited build slots at the OEMs,” Ake added. “There could be some irrational exuberance behind orders this high. Fleets are expecting the current conditions to continue well into 2021, and this may not be the case. The trailer market has seen incredibly wide swings in 2020 and it is difficult to determine how long the current momentum can last. Orders may stay elevated if fleets compete to lock up future build slots as they did in 2018-2019.”