According to ACT’s latest release of the North American Commercial Vehicle OUTLOOK, ACT lowered their GDP forecast, but continues to believe there is enough pent-up demand, and built-up purchasing power among consumers, albeit mitigated by inflation, to support growth in 2022. ACT’s analysts also believe tighter monetary policy will lead to GDP contraction in the first half of 2023, which will be offset by growth in the second half of next year, leading to a flat GDP forecast for the full year.

“We note that the modest economic rebound we are forecasting in the latter half of 2023 implies a pause in tightening by the Fed by the first half of the year,” said Kenny Vieth, ACT’s President and Senior Analyst. “As the economy laps tough inflation comparisons in early 2023, and with the economy sufficiently slowed by 2022’s justifiably aggressive rate hikes, we believe inflation is likely to come increasingly under control, allowing the Fed to pause and take stock. With no additional pressure being applied to the brakes, we envision the economy to resume expanding in the end of 2023.”

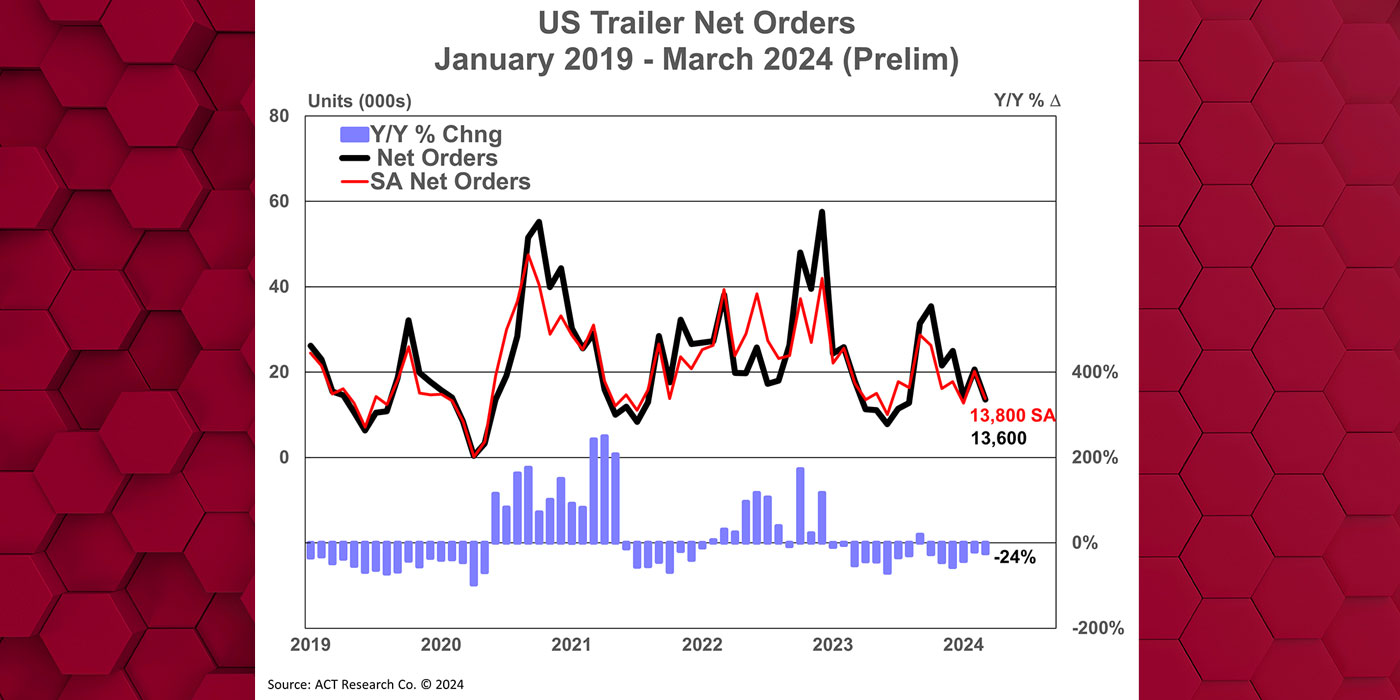

The N.A. CV OUTLOOK is a robust report that forecasts the future of the industry, looking at the next 1-5 years, with the objective of giving OEMs, Tier 1 and Tier 2 suppliers, and investment firms the information needed to plan accordingly for what is to come. The report provides a complete overview of the North American markets, as well as takes a deep dive into relevant, current market activity to highlight orders, production, and backlogs, shedding light on the forecast. Information included in this report covers forecasts and current market conditions for medium and heavy-duty trucks/tractors, and trailers, the macroeconomies of the US, Canada, and Mexico, publicly-traded carrier information, oil and fuel price impacts, freight and intermodal considerations, and regulatory environment impacts.

“We continue to see at least three factors mitigating a more severe downturn.” Vieth noted. “Carrier profitability is strong, with profits at all-time record levels in 2021, and full-year TL fleet profits are pegged at second-best ever levels in 2022. Vehicle demand remains healthy, if moderating from here, with pent-up demand expected to push into 2023. Finally, some pre-buy activity is anticipated prior to the implementation of CARB’s Clean Truck mandate, helping to support activity next year.”