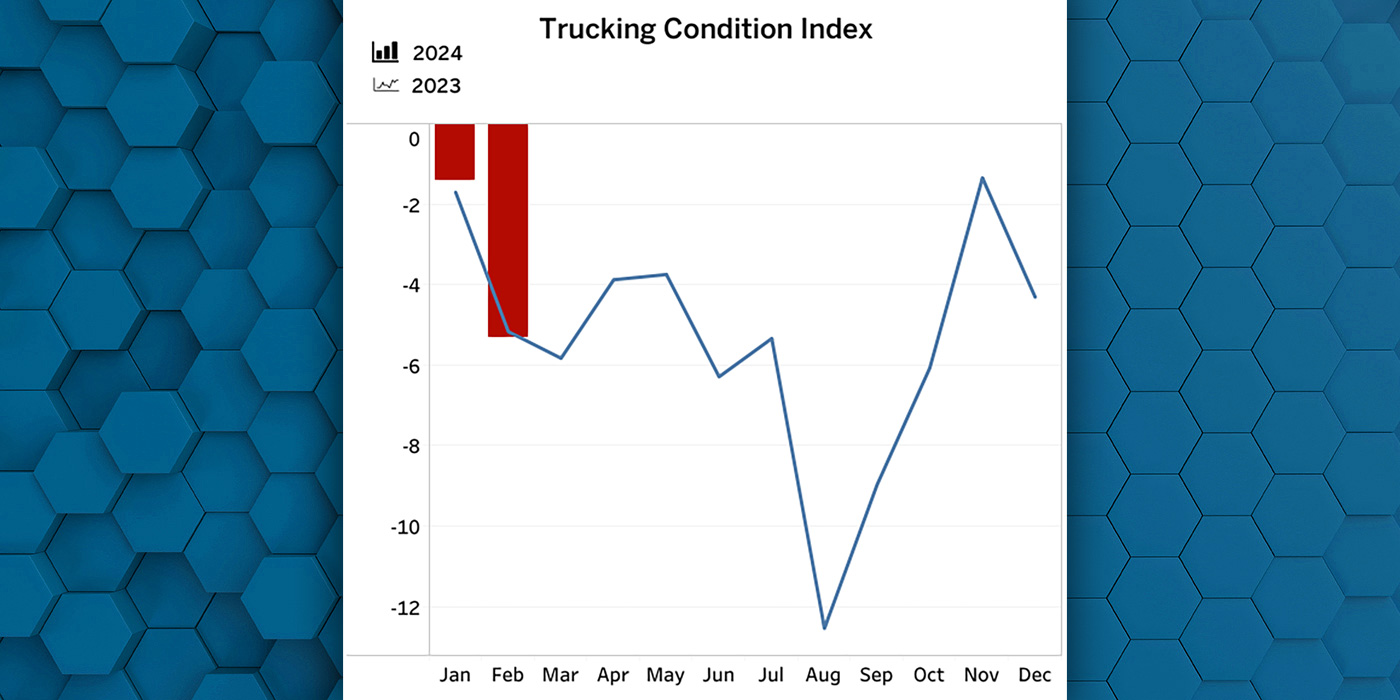

ACT Research Co. released its State of the Industry report on US Class 8 truck sales and prices and found that volumes fell in May but were up over the year, while prices have remained flat. ACT, one of the foremost sources for new and used commercial vehicle (CV) industry data, market analysis and forecasting services for the North American market, publishes the report regularly.

While total reported volumes of used Class 8 trucks fell to 2,496 units in May, an 11% month-over-month decrease, the overall numbers were up 3% year-over-year, according to ACT‘s State of the Industry: U.S. Classes 3-8 Used Trucks.

Keeping with the flattening trend seen in age and mileage, average price also experienced a leveling off compared to April. YTD prices were up 8% from last year, with gains in line for ACT’s expectations of 5-10% growth in 2015.

“Volume softening can be seen in the retail and wholesale markets, with m/m declines of 12% and 14%, respectively. Auction transactions saw a 9% increase m/m, 8% above volumes from May 2014,”said Steve Tam, the Vice President-Commercial Vehicle Sector for ACT. “Our guidance for full year 2015 sales remains unchanged.”

The full report from ACT provides data on the average selling price, miles, and age based on a sample of industry data; it also includes the average selling price for top-selling Class 8 models for each of the major truck OEMs – Freightliner (owned by Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo). Those who wish to subscribe to the full report should visit http://www.actresearch.net.

For the latest industry and market data, be sure to head over to our Market Data news hub by clicking here.