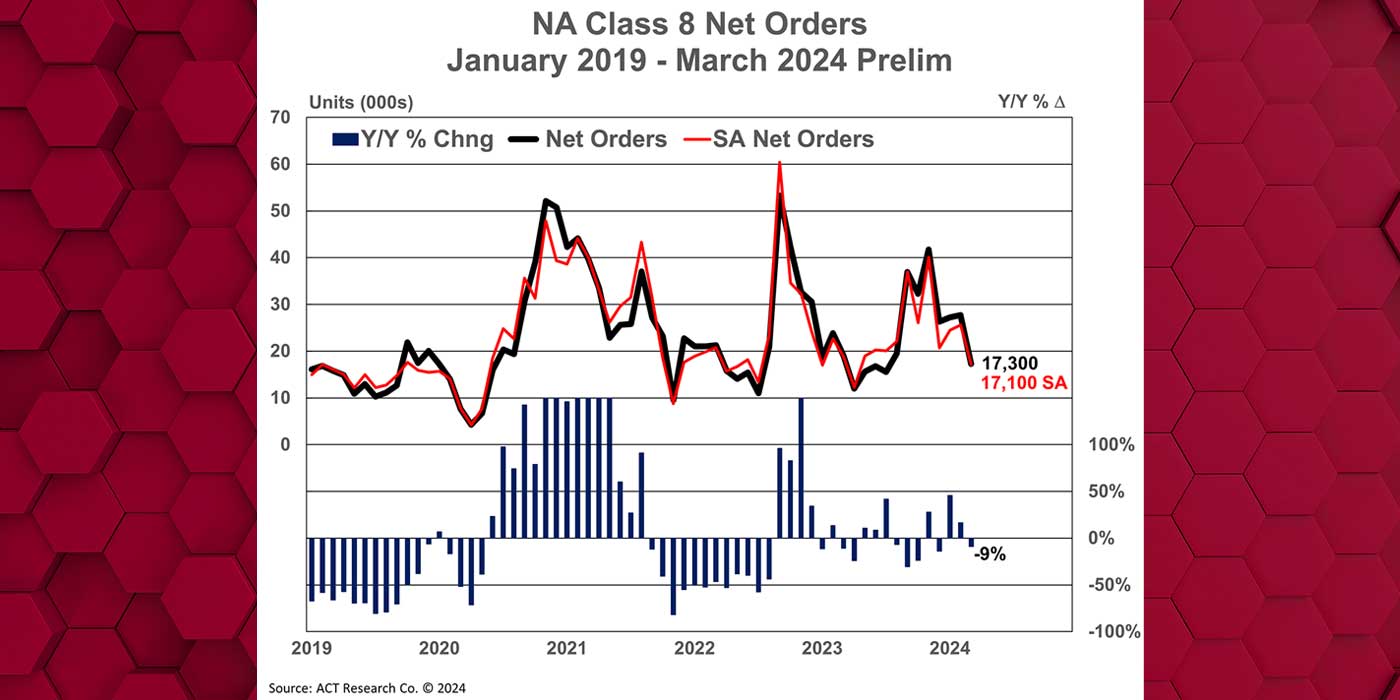

According to ACT Research’s (ACT) latest State of the Industry: Classes 5-8 Report, economic reports over the past month have more often risen above consensus than fallen below it, but it is premature to declare an end to freight market weakness, ACT Research says.

“Data points indicating increased economic activity represent the essential first steps in the process of increasing demand to rebalance the heavy freight markets. However, as in any commodity market, it is not just demand, but supply, and until the supply-side of the market is addressed, the disequilibrium story will continue to weigh on freight rates and by extension the heavy vehicle industry,” said Kenny Vieth, ACT Research’s president and senior analyst. “While the data are starting to suggest ‘less bad,’ reports suggesting recovery are premature, as key freight metrics continues to trend negative in the latest round of data releases.”

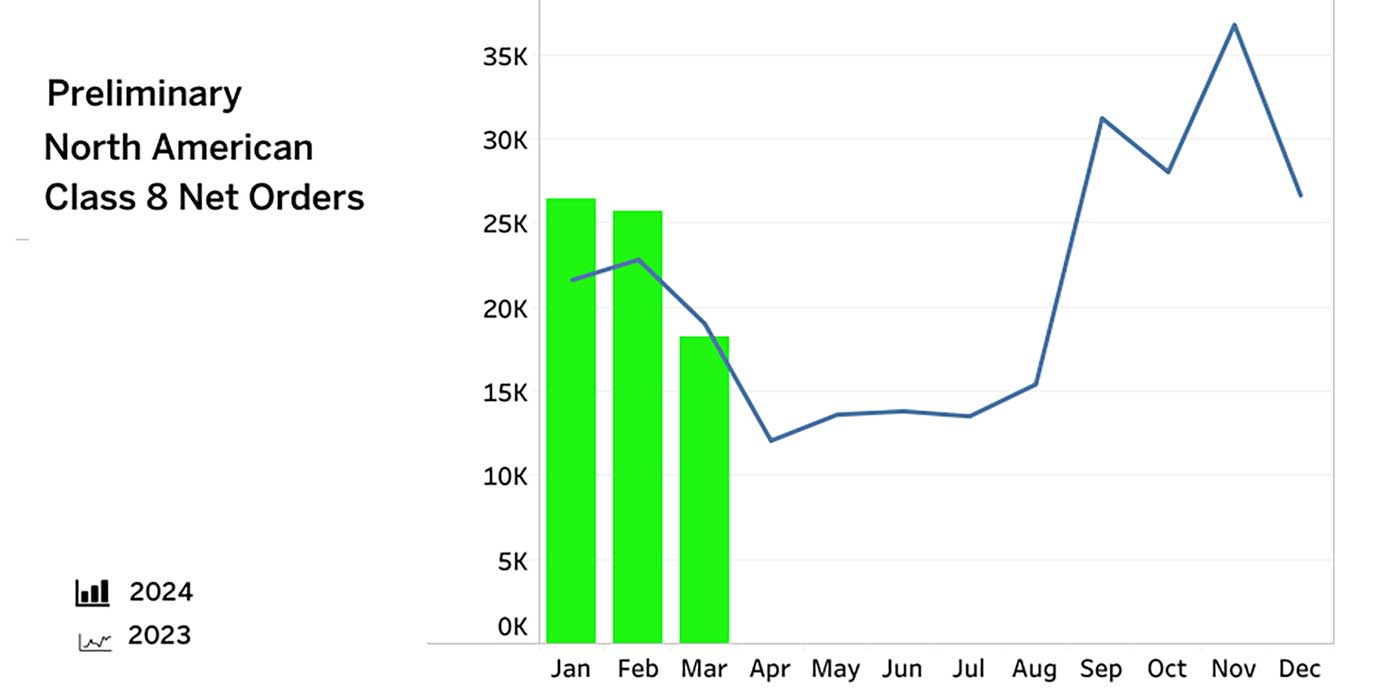

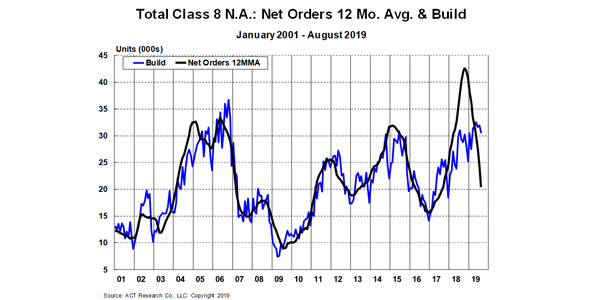

Speaking about the Class 8 market, Vieth said, “In concert with weak/deteriorating freight volumes and rates, forward-looking demand indicators continue to erode, even as mid and downstream data points remain robust. Ultimately, the current situation of weak orders and strong build is unsustainable.”

Regarding the medium-duty markets, he commented, “Medium-duty demand metrics remain in better balance, but there are signs of modest fraying on weak net orders, relative build strength and excessive inventories.”