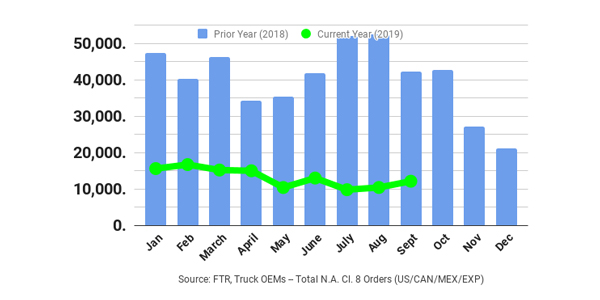

According to the numbers from both FTR and ACT Research Co., Class 8 orders in September rose month-over-month but fell year-over-year, while medium-duty orders were down in the month.

FTR has preliminary North American Class 8 orders for September at 12,100 units, up 13% month-over-month but down 72% year-over-year.

Class 8 orders continue to track in the 10,000-13,000-unit range for the fifth month in a row, FTR says. Fleets are moving around or canceling orders previously placed, but are not ordering many new trucks for Q4 delivery. Carriers have not begun ordering for 2020 requirements yet, due to the tariffs and the economic uncertainty. Class 8 orders for the past 12 months have totaled 214,000 units.

“Class 8 orders have been remarkedly consistent; unfortunately, they are stuck at the bottom of the cycle. It’s basically the same story as the last several months, all the orders needed for 2019 were placed months ago and fleets are now adjusting delivery dates and finalizing requirements,” said Don Ake, FTR’s vice president of commercial vehicles. “Fleets are nervous. Freight growth continues to ease back. The latest manufacturing and construction numbers are concerning. The trade issue with China looms. In this environment, fleets see no reason to begin ordering for 2020 until Q4. However, we are returning to normal industry ordering trends after a tumultuous period, and orders should rise in October.”

According to ACT Research’s preliminary numbers, the industry booked 12,600 units in September, up 13% from August, while Classes 5-7 orders fell 9.4% month-over-month.

“Little has changed since August with respect to the freight market and freight rates, while uncertainties surrounding trade and tariffs continue to weigh on truck buyers’ psyches,” said Steve Tam, ACT’s vice president. “Fleet overcapacitization has led to reduced utilization, with all the foregoing considerations conspiring to undermine demand.

“The medium-duty market, “Tam went on, “marked a sixth consecutive month of below-trend net order activity in September, which is more a recognition of the outsized strength of the market in the not-too-distant past than a comment on its current state. Nonetheless, demand is slowing, setting up expectations for a small decline next year.”