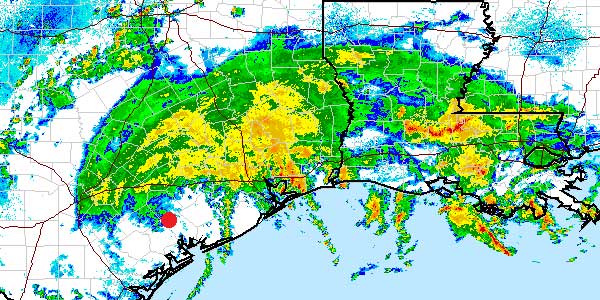

Beyond its devastating impact to the city of Houston and the surrounding areas, the aftermath of Hurricane Harvey will impact a wide variety of commerce and business segments, and trucking is no exception. FTR has quantified preliminary numbers, gauging the impact in the overall trucking market. Hurricane Harvey’s broad swath across Texas will strongly affect over 7% of U.S. trucking over the next month and beyond.

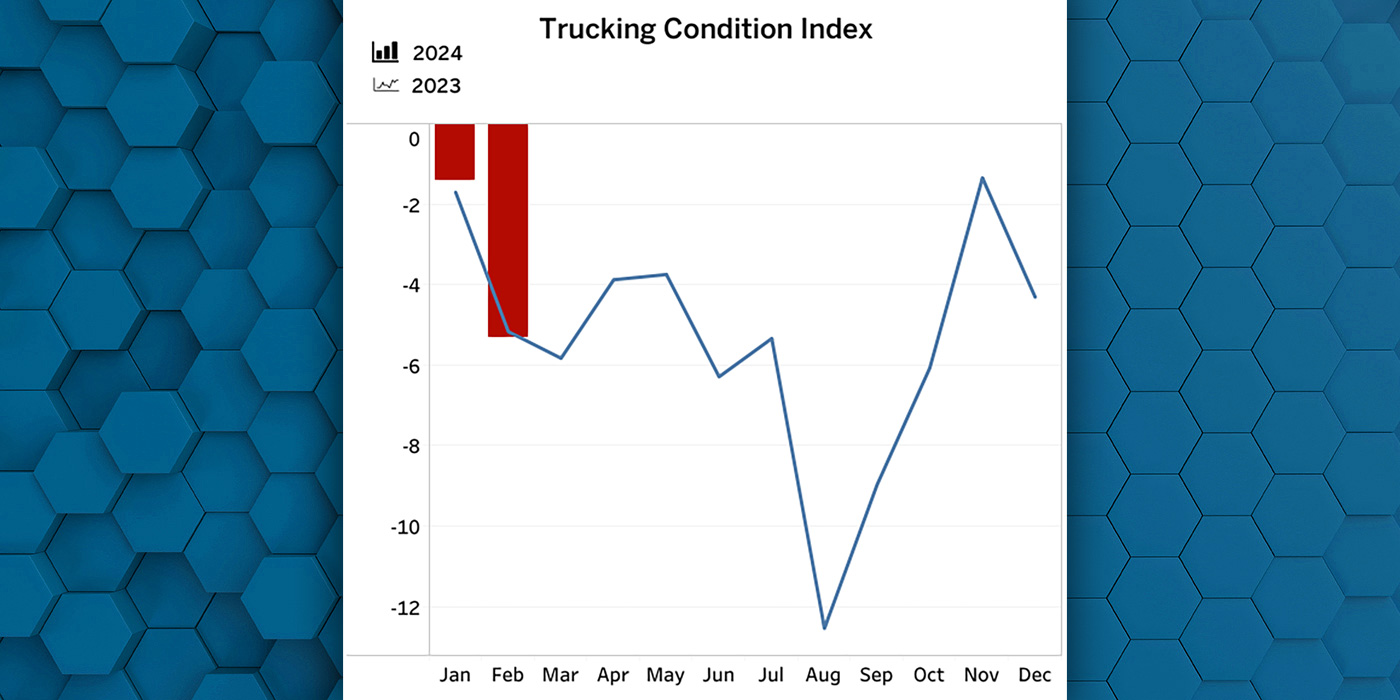

FTR has studied several major weather events, starting with Hurricane Katrina in New Orleans. These weather events show significant pricing effects, including seven extra percentage points of annualized pricing for the five months following Katrina in 2005 and a peak of 22% year-over-year spot price increases following the monster winter of 2014.

“Look for spot prices to jump over the next several weeks with very strong effects in Texas and the South Central region,” predicted Noël Perry, a partner at FTR. “Spot pricing was already up strong, in double-digit territory. Market participants could easily add five percentage points to those numbers.”

The largest effects of the storm will be regionalized, FTR said, but transportation managers across the entire U.S. will be scrambling.

Additional Impacts

Texas provides 30% of U.S. refinery capacity, a production base that has been hit hard by this storm. Regional diesel supplies will be strongly affected, with national prices jumping as well. “With companies such as Exxon Mobil and Phillips 66 closing down their refineries, we are talking about impacts to fuel and energy,” said Larry Gross, a partner at FTR. “In addition, Houston is a big interchange point for rail and intermodal, so it’s not just trucking which will be disrupted. Freight transportation is an integrated system, and this becomes more obvious during major weather events when disruptions occur.”

There is also the question of contract rates between shippers and trucking companies. “There is always a lag between spot rate increases and contract rates,” said Perry. “Analysts have been wondering when trucking contract rates will begin following spot rates up. The combination of regional and fuel effects from Harvey, coupled with the Electronic Logging Device (ELD) mandate in December, could be the catalyst to a pricing spiral.”