The transportation fleet sector continues to face numerous industry, economic and environmental challenges that are certain to create operational turbulence. Everything from fuel and equipment prices due to interest rates, ongoing driver and technician shortages, and a possible economic recession have many in the industry on edge as they navigate through the early parts of 2023.

However, similar to years past, the industry remains resilient, and demand for goods has held up steadily despite higher interest rates and the threat of an economic slowdown. In 2022, transporters were responsible for roughly 12.5 billion tons of freight with an estimated value of more than $13.1 trillion. Simply put, truck transportation is the backbone of the American economy and will continue to serve in this capacity for many years.

That being said, there are a handful of critical areas the industry must continue to navigate through to remain prosperous during the current and ongoing economic turbulence.

Interest rates will continue to rise

First and foremost is the continued rise of interest rates and CPI. The Federal Reserve raised its benchmark interest rate in early February by a quarter percentage point, bringing the target range to 4.5% to 4.75%. At the time, the Fed gave no indication to ending its rate increase campaign in 2023.

With operational costs rising, along with the cost of financing, it’s imperative that companies with transportation fleets and their leadership teams have a strategic plan to lower their total cost of ownership (TCO).

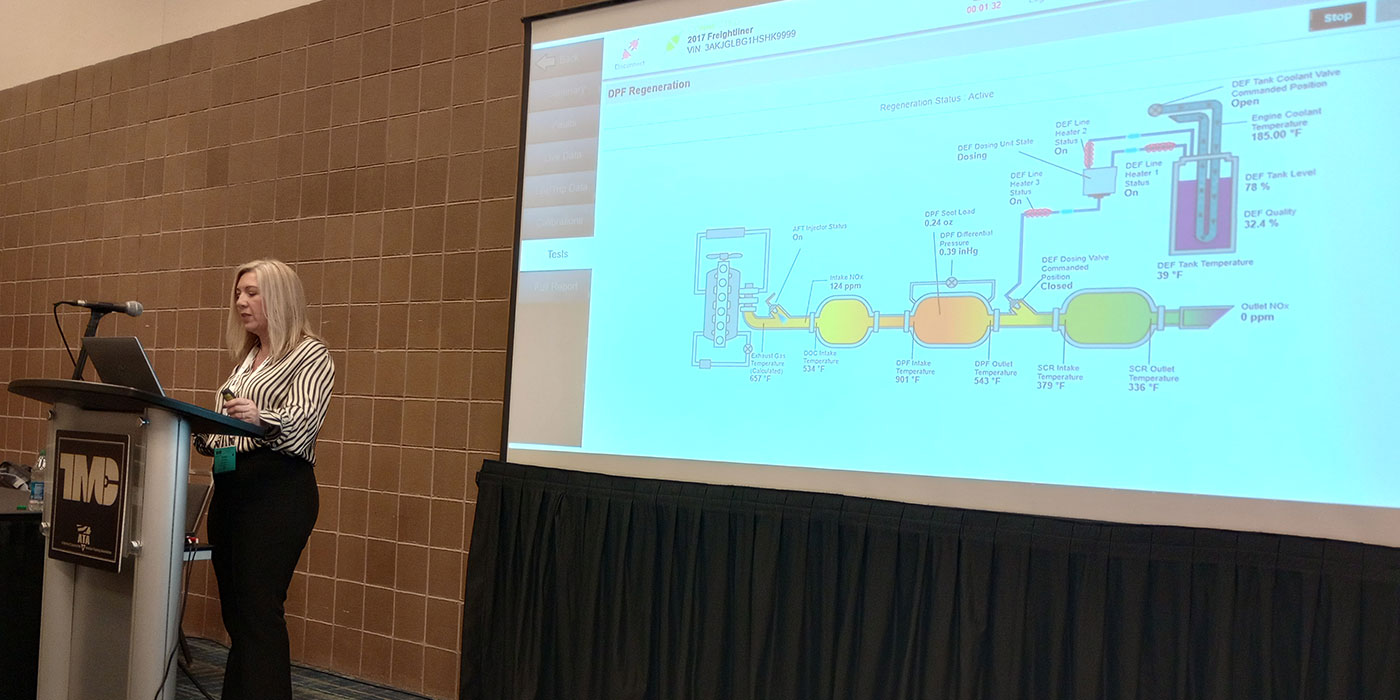

Organizations are battling the current challenging environment for their fleets with a strategy that leans on utilizing advanced data analytics and Fleet Modernization studies to help them inject more flexibility and business agility. These strategies are helping them pay closer attention to their truck’s life cycles to understand where they can save money by optimizing and shortening replacement cycles. Rather than keeping their trucks in operation for several years, companies are leveraging fleet studies that scrutinize performance data and economic factors to determine an optimum procurement strategy. However, we have seen the need this past year to extend life cycles, especially on young vintage models, due to the shortage of equipment.

Strategies to preserve operational cash flow

Companies are also taking a closer look at leasing their trucks, which has proven to improve cash flow, optimize asset utilization, and to provide maximum flexibility. Lease versus purchase analysis is extremely beneficial in helping fleets understand and pinpoint where and how they will preserve cash flow when they move to a lease structure. A recent industry benchmarking survey showed that nearly half of respondents (42%) are leasing trucks today, up from 31% a year ago. Furthermore, despite the government’s slight 20% reduction to bonus depreciation beginning in 2023, leasing remains the most favorable option for fleets planning new equipment acquisitions. Sale-Leaseback programs are also a great example of how companies today can monetize the dormant equity that they had in their fleets to allow them additional flexibility.

While it’s easy to think about a pivot to used trucks, the prices of these units have also remained high. Many fleets are redeploying off-lease equipment that allows them to fill in some gaps that they might ordinarily have. While prices have eased off their highs, the increasing seasonality costs coupled with new California Air Resources Board (CARB) requirements will keep prices elevated. Investing in new equipment is key, and while original equipment manufacturers’ (OEM) backlogs on orders remain, these pressures are beginning to abate a little.

Having a strategic plan in place

These new regulations will add another layer of complexity to an already difficult market. Therefore, it is essential to start planning ahead. Instead of looking at planning cycles for immediate needs, fleets need to review procurement requirements for the next several years, developing a strategic plan based on data to maximize their utilization while reducing their life cycle. Furthermore, as you think about managing a life cycle, you also can’t base your procurement cycle one year out. Therefore, you must have a multi-year approach and one-, three-, and five-year plan for equipment replacement.

This will also help fleets bridge to alternate fuel trucks when appropriate for their specific operation. Whether it’s electric vehicle trucks, hydrogen, or other alternative fuels, we’re looking at helping our clients take a measured approach so they can introduce these newer technologies and become familiar in a more realistic manner.

Keeping an eye on reducing emissions

Entering 2023, reducing the carbon footprint is no longer viewed as a challenge, but more so an opportunity. The best approach to realistically bridge today’s clean-diesel technology into tomorrow’s alternate fuel options is by leading with the appropriate ESG roadmap supported by strategic asset management partners to determine truck procurement strategies with optimal life cycle management. This will maximize environmental considerations and organically progress toward alternate fuel technology. In doing so, fleets will achieve critical ESG goals and continuously operate the most appropriate equipment for their operation. Be sure to find a partner that can help certify your greenhouse gas emissions (GHG) output, as recently mandated under a proposed rule issued by the Securities and Exchange Commission (SEC).

This year will most likely offer many operational and economic challenges, similar to years past. With the right plan in place and the right asset management partner, you’ll find better flexibility to make agile business decisions that benefit your employees, customers, and the environment.

Brian Holland is CPA, CTP, CGMA, president and chief executive officer of Fleet Advantage.