This year, costs are climbing. Noregon recently published their annual industry outlook whitepaper, which it describes as a comprehensive guide used by industry stakeholders to drive clarity in decision making and plan for the year ahead. In this study, Noregon noted that from 2012 to 2022, the cost per mile for long-haul trucking went from $1.63, to $2.25. Overall inflation does play a role, but Noregon highlights four main factors in the trucking industry that are also acting as drivers to increase costs:

- Rising complexity of servicing and maintaining new trucks featuring high degrees of sensors and distributed electronics;

- A severe shortage of skilled technicians;

- Greater wages for remaining industry technicians; and

- Continual rise in average age of Class 8 vehicles in operation (VIO).

Research from Noregon shows that the average age of Class 8 VIO is 12.3 years old, up from 12.1 years in 2023. While Noregon predicts 295,000 truck sales, and 265,000 trailer sales this year, only 11% of Class 8 VIO are between zero and three years old. Comparatively, at 38%, the largest group of fleet vehicles currently on the road is 15-plus years old. But the trucks themselves aren’t the only aging pieces of equipment.

Keeping up with the industry

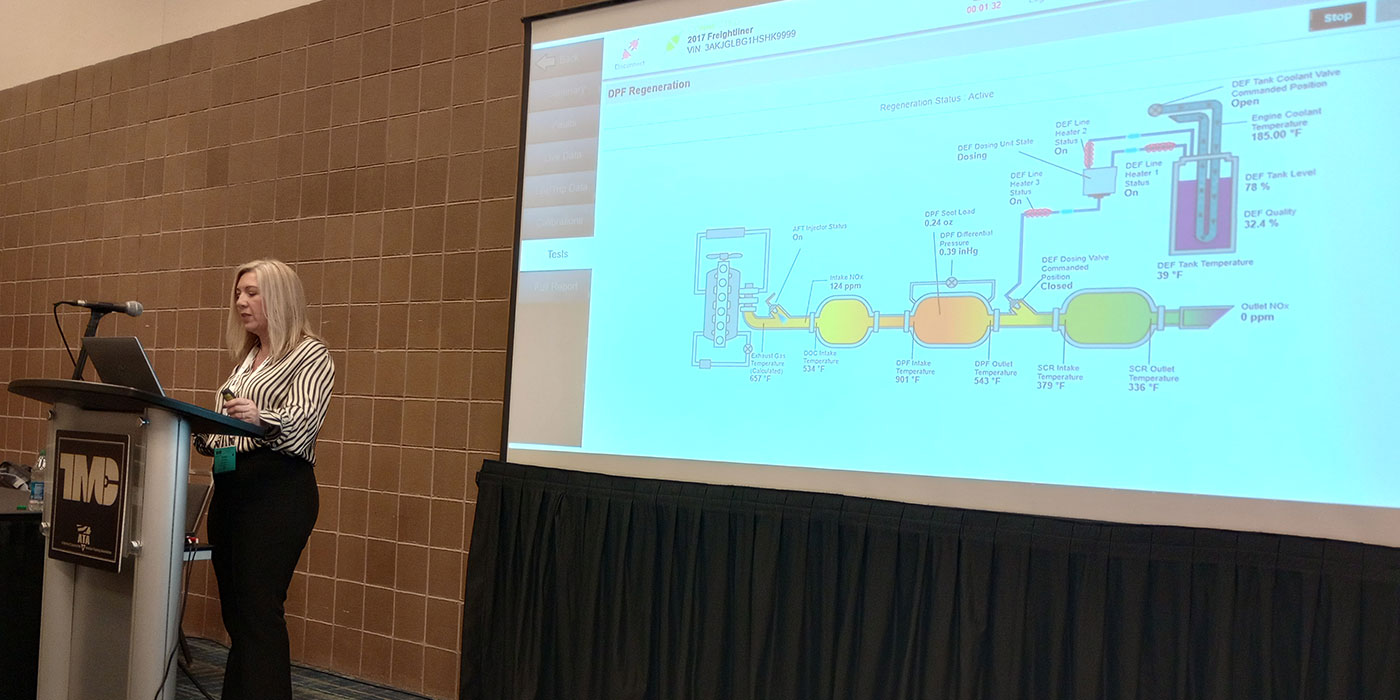

When surveyed, 35% of maintenance shop managers say they’re going to invest in new electronic diagnostic tools in 2024, to keep up with modern industry demands. Noregon says tools and solutions like JPRO, NextStep Repair, and Technician-as-a-Service (TaaS) can increase speed and accuracy of diagnostics. Ideally, those investments should pay off by getting more vehicles through the shop, faster. That matches with the three biggest challenges both independent repair shops and fleet maintenance shops say they faced in 2022 and 2023. In order of importance:

- Hiring skilled technicians;

- Accurate and effective troubleshooting; and

- Reducing the dwell time of vehicles waiting for service.

Economic and industry outlook

While the drive to increase business is a constant one, it also follows economic predictions, as more than 70% of shop owners Noregon surveyed believe the U.S. is either in a recession or approaching one. Noregon adds that recessionary phases and freight market slowdowns often lead to fewer Class 8 vehicles being purchased, and an increased need for repairs. This may be spurring a positive outlook by shop owners, despite the economic outlook. Sixty-six percent of independent shop owners report a positive, or very positive view for their businesses, while fleet shop owners are more split – with 53% of respondents expecting an upward trend, while 42% believe things will stay neutral. Neither group is very optimistic about the trucking industry, with 43% of independent shop owners, and only 23% of fleet shop owners sharing a positive opinion.

Growing trends

Noregon highlights a list of industry mega-trends and diagnostic tech trends that it expects to grow in the coming years or hold significant influence on the way shops do business.

Telematics and remote diagnostics, faster communication, just-in-time deliveries, and shifting to a products-as-a-service business model: These advancements share common goals, tied in with the topics we’ve discussed earlier. If you can know what’s wrong with a vehicle more quickly (or even before it rolls into the shop), and you’re prepared to repair it, that means less fleet downtime, and greater efficiency. Another hurdle many shops will have to navigate is not only servicing more automated and electronic components, but also becoming certified to service alternative fuel vehicles.

The next few years for shops are going to be interesting, and undoubtedly turbulent. Noregon can help by giving you insights into the upcoming technological shift we’re facing, and you can read more of their research here.