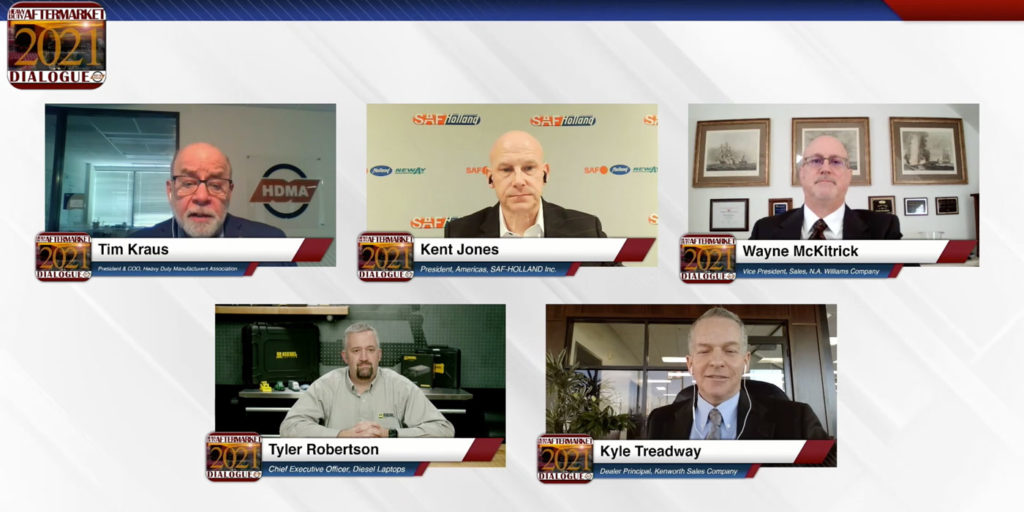

The annual Heavy Duty Aftermarket Week (HDAW) is proceeding virtually this year, and as always, it was preceded by Heavy Duty Aftermarket Dialogue, in which executives from OEMs, suppliers and organizations shared their thoughts on the future of heavy-duty service and the aftermarket. Here are some of the biggest takeaways.

Panel guests over the course of the day included:

- Friedrich Baumann – president of sales, marketing and aftersales, Navistar

- Al Dragone – chief executive officer, FleetPride

- Kent Jones – president, Americas, SAF-Holland Inc.

- Wayne McKitrick – vice president, sales, N.A. Williams Co.

- Tyler Robertson – chief executive officer, Diesel Laptops

- Kyle Treadway – dealer principal, Kenworth Sales Co.

On the progress toward electrification

Baumann: It’s coming at us faster than we would have anticipated two or three years ago. I can tell you there is a lot of momentum right now in the marketplace, a lot of customer interest; however, once they understand in which phase we are and what the cost is for a vehicle of that type right now, there is a lot of sticker shock. But, that is not surprising at this point because it is pretty much in the piloting and demonstrator phase. The big question is: what will be the adoption rate?

I can see with government grants that there will be a quite high adoption rate on the school bus side of the business. I think last mile delivery will be another area where we see adoption of that technology rather sooner than later. And with the current range limitations, medium-duty is another application where we will see, especially on the delivery side, a high [adoption] rate. I would not be surprised that seven to 10 years from now we have 30% adoption in the medium-duty bus environment.

Dragone: Hydrogen will play a role in the go-forward strategy for a lot of OEs. From an aftermarket standpoint, we think that there are going to be significant changes in the future. But this is probably not something that is going to impact our business in the next ten years.

RELATED: Listen to our recent podcast series on electrification here.

On how electrification will affect service

Baumann: One thing is clear: there will be a lot less moving parts in that segment… there’s a lot of training and certification required for the techs.

We for sure have parts distribution and supply issues, because today in our PDCs [Parts Distribution Centers] we are not yet set up to really handle battery or [fuel] cell technology. We need to invest in infrastructure to even handle that type of material within our PDC environment. And there is a lot of training and certification required for the techs.

On the growth of digital platforms for service

Dragone: I would say that our biggest investment in 2020 was building out our digital platform. But we’re not doing this because the demand is there right now… we’re anticipating where it’s going to be, not where it is today. But as we all lived through 2020 we saw what other industries were doing, what other companies were doing, and how much growth was out there in the e-commerce platforms. You can’t ignore that.

On how business has changed during the pandemic

Jones: We had invested quite a bit in online ordering, self-help information around inventory, and service information that’s online and available for customers. Over 25% of our commerce now is running through those online channels and previously it was 5-7%.

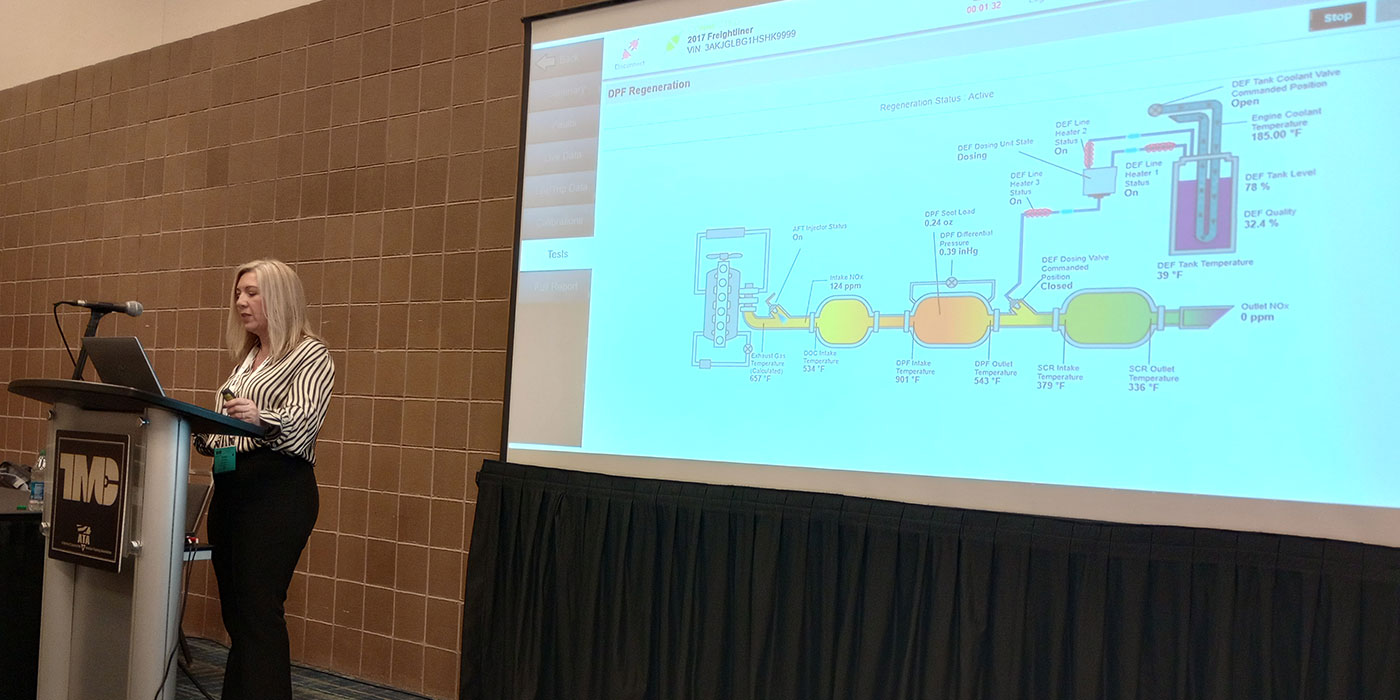

On the effects of advancing aftermarket technology

Treadway: The lack of in-person training has been very limiting and debilitating for our team. As our equipment gets more and more technical—they’re basically computers on wheels now—the skill level that we require of our technicians is so critical. With advanced driver assistance systems, it’s going to be even more the case. Truck owners and operators are not technicians, and they’re going to be relying on us to help them service, repair and maintain these technologies.

Robertson: The old way was ‘my truck has a check engine light, I pull into a shop, now we diagnose, now we repair, now we order parts,’ and that’s almost getting reversed now with remote diagnostics. OEMs are starting to put all that stuff together. It should be as simple as ‘I have this fault code, I follow this tree, here’s the part number I need to buy, I click a button and the part shows up.’ We’re a long ways from that, but not as far as people think, and that’s really where I see the industry going.

McKitrick: A lot of heavy-duty distributors are starting to look at more of a management-type system for their parts. At one point, we’re going to be able to ensure that the parts are available when it’s needed and not have to wait an hour, a day, three days.