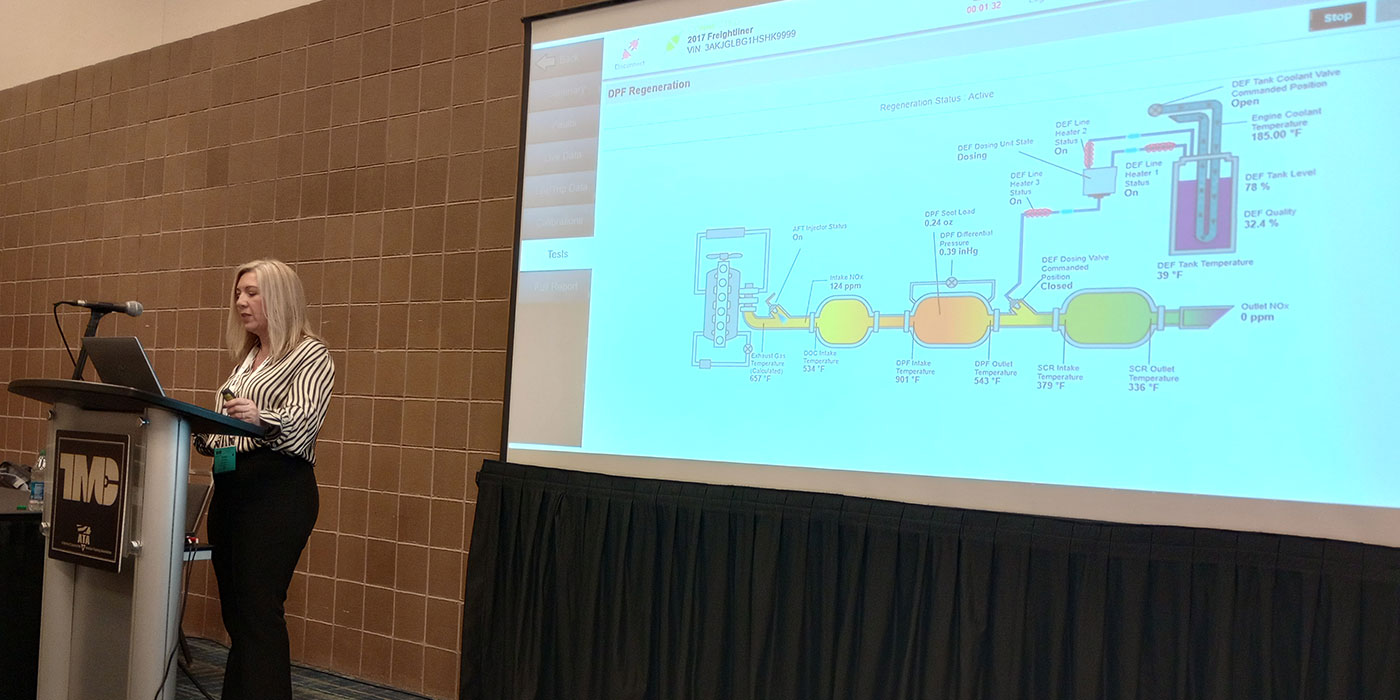

The 2021 heavy-duty aftermarket is just beginning to gain positive momentum and should continue to rebound from 2020’s recession brought on due to COVID-19 as vaccines take effect, according to John Blodgett, vice president of sales and marketing for MacKay & Co. Blodgett led a session detailing an overview and outlook of the economy for the heavy-duty aftermarket during this year’s Heavy Duty Aftermarket Week (HDAW).

“That’s really part of the theme for today: There are a lot of positive signs going forward,” Blodgett said. “We’re not out of it yet, but we’re headed in the right direction.”

Regarding aftermarket demand in the U.S. for Class 6-8 trucks, trailers and container chassis, Blodgett said the market was down 9.2% in 2020.

“The change, down 9.2%, actually isn’t as bad as we where we were in the middle of the year. We were forecasting the market being down as much as 19% for the year,” Blodgett said. “So while we don’t like 9.2% down for the year, it is better than where we were. We actually had a good second half of 2020, which helped keep that market up.”

Following a full-on recession in Q2 of 2020, Blodgett said the economy today is starting to turn for the positive as consumers are starting to spend more money.

Blodgett said the total truckable economic activity in 2021 is expected to continue to rebound, however whether it turns into a recovery will depend on how the pandemic is resolved. He said consumers will continue to lead the rebound; as they gain the ability to spend more money, they will buy more products and more trucks will be moving goods.

“If we get people vaccinated and that herd immunity kicks in, in turn we can start opening up businesses that have been slightly shut or completely shut,” he said. “The pace of that will … be an influence on how quickly the economy bounces back.”

While investment activity was weak in January 2021 due to domestic and international supply chain disruptions adversely affecting production and inventory management, Blodgett said there “is too much money on the line for that not to be addressed.” He added residential construction has been strong so far this year, and commercial real estate also “has not been terrible.”

Supply chain and tariff issues are still plaguing exports and imports, Blodgett said, adding he expects the government sector to be “buried for quite a while.”

“Governments have been really impacted by the loss of tax revenue because of the pandemic, and that impacts what local, state and county governments can spend,” he said.

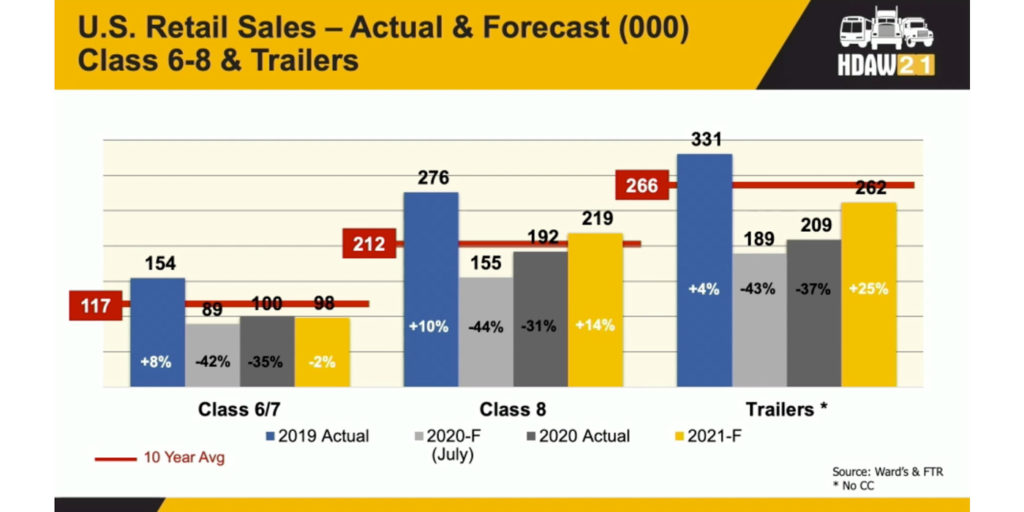

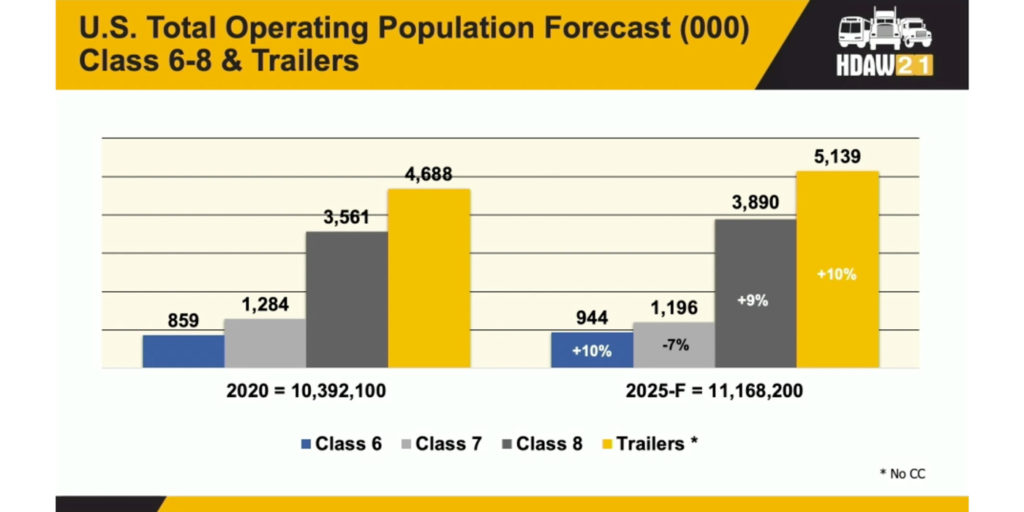

Regarding U.S. retail sales, 2020 numbers for Class 6, 7 and 8 as well as trailers all came in higher than what was forecasted in July of 2020, although each of these category sales came in much lower than in 2019. Looking out to 2021, Blodgett said medium-duty vehicles are expected to sell about 98,000 units (the 10-year average is 117,000), heavy-duty vehicles are expected to sell about 219,000 units (the 10-year average is 212,000) and trailers are expected to sell about 262,000 units (the 10-year average is 266,000). Blodgett said the total operating population of Class 6-8 vehicles and trailers stands at 10,392,100, and that number is expected to grow by about 7.5% by 2025.

Blodgett forecasted the first quarter of 2021 will experience much slower economic growth than the following three this year, but says he believes Q2 may be as much as 35% higher than Q1.

“It may take a while into the second quarter of the year before we see that, but then we have the balance of the year being pretty strong,” he said.

Technology outlook

Blodgett said he is seeing more and more vehicles being sold each year with higher degrees of advanced technologies, including cameras and telematics hardware.

In a survey MacKay & Co. presented to fleets about the alternative power technology they’re using in 2020, only 1% of the power units in fleets surveyed were using electric. Those fleets forecasted said they expect about 12% of their power units will be a combination of electric and hydrogen, Blodgett said.

“It’s not a huge increase, but it’s a big chunk,” he said. “I think the most important thing to keep in mind as distributors of parts is what’s going on in your marketplace and your customers. I think how the technology is going to be deployed is going to be different depending on what part of the country you’re in. If you’re in California it’s likely going to be different than how it is in Kansas. Watch the national trends, but keep a close eye on your customers and your market.”

Blodgett also discussed e-commerce’s growing importance – especially regarding parts – moving forward. He said 12% of all parts orders are being made through an online source, and e-commerce parts ordering is expected to grow to 15% in three years.

“E-commerce is an important option for you to have for your customers,” Blodgett said. “This tends to be [more important] for the small/mid-size fleets. The large fleets have systems in place that will automatically take care of stocking and getting parts, but the smaller and mid-size fleets don’t have that and they’re looking for ways to be more efficient and buy parts after-hours. And, I think this last year has really accelerated their need and opened their eyes more to the opportunities related to e-commerce. Don’t miss out on this.”

For more on the future of the heavy-duty aftermarket, click here to read HDAW ’21’s Heavy Duty Aftermarket Dialogue.