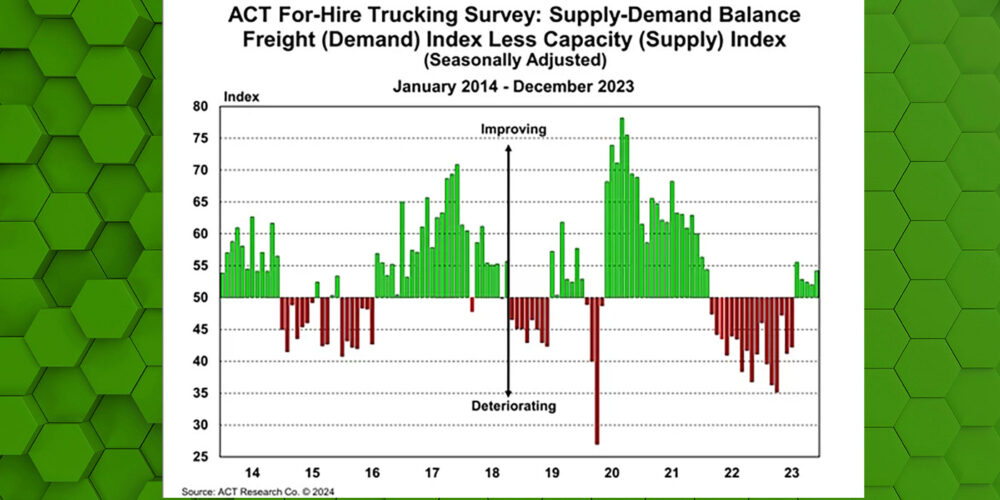

ACT Research’s latest For-Hire Trucking Index show the freight market gradually recovering, with December supply-demand balance (see chart above) tightening by 2.2 points to 54.2, but rising from 52.0 in November when adjusted for the season. The decrease in capacity was larger than the decline in volumes, ACT notes.

According to ACT Research, the main cause for the supply-demand balance improvement in the past five months has been capacity declines. ACT adds that this five-month positive string suggests a tighter market in 2024 after 17 months in a loose market balance, similar to the 2015-2016 downcycle, when the Supply-Demand Balance was loose for 16 of 19 months.

“With volumes stabilizing and capacity contracting, the for-hire Supply-Demand Balance has been signaling an impending increase in freight rates for a few months,” says Tim Denoyer, vice president and senior analyst at ACT Research. “Truckload spot rates are 12% above the seasonal pattern in January following the cold snap. While weather effects should revert in the coming months, freight is an outdoor sport, so the cycle will likely find a higher trajectory as the reversion happens amid tightening capacity and recovering demand.”

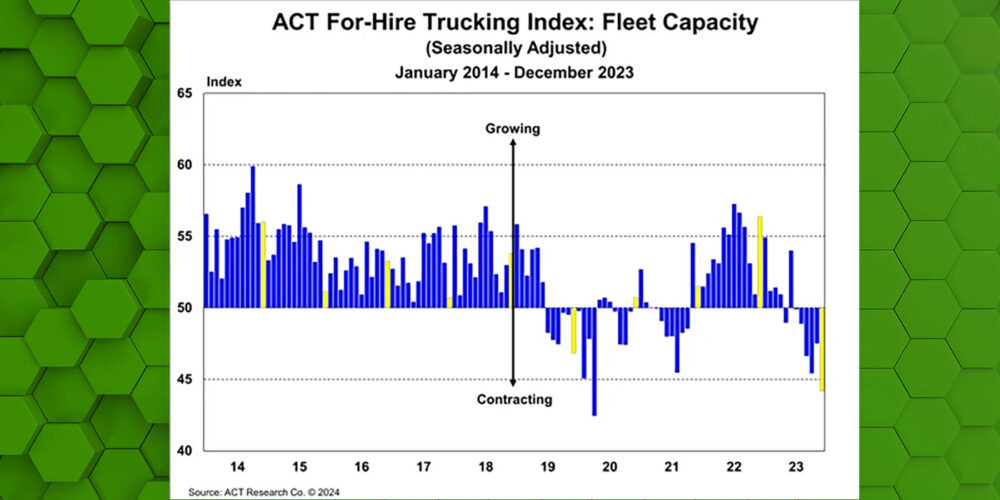

The fleet capacity Index decreased by 3.3 points m/m to 44.2 in December. ACT Research says for-hire capacity has contracted in seven of the past eight months, and decreased further as fleet purchase intentions cratered and driver availability fell further this month.

“Capacity is still being added industry-wide by private fleets, but declining U.S. Class 8 tractor sales indicate this phenomenon is starting to slow,” Denoyer added. “Unlike private fleets, for-hire capacity has been contracting, so as private fleet additions decline, tighter industry capacity should press rates up.”

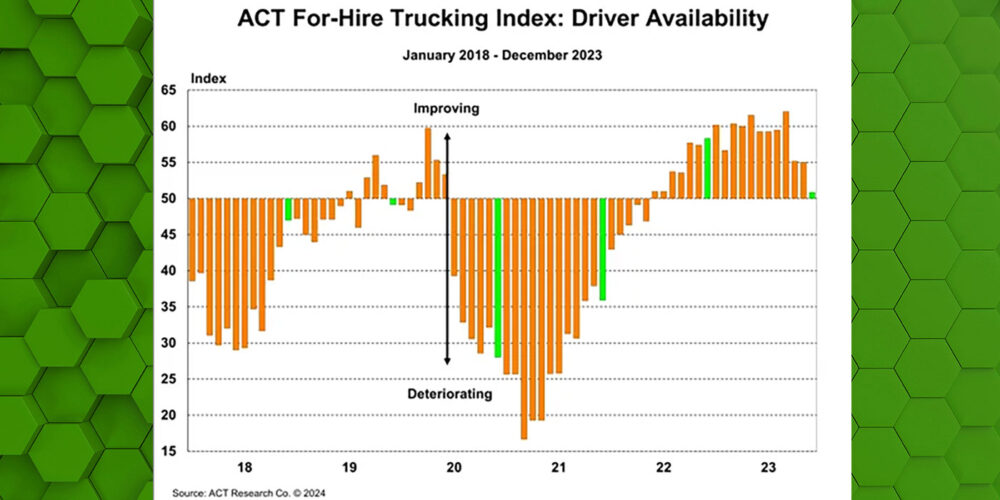

The driver availability Index dropped noticeably, down 4.1 points m/m to 50.9 in December. ACT Research says the Driver Availability index has fallen 11 points in the past three months and reversing course after a year of record availability, culminating in the all-time high reading of 62.0 in September ’23.

“The quality fleets in our survey have been safe havens for owner operators for the past couple years, but market dynamics seem to have finally caught up with the driver market. While bad news for the drivers, it’s key to tightening the freight market. While weather is the larger near-term factor, driver availability is a critical longer-term factor also starting to help press spot rates up,” Denoyer concluded.