Not a day goes by, it seems, that there’s not news about new developments in electric vehicle chassis. Traditional truck OEMs and newcomers to the market alike are steadily announcing their latest plans and technologies, and fleets are taking notice.

Along with those developments, however, comes the need for fleet managers to address a number of EV specification and deployment challenges. Best approaches for addressing those issues are top of mind for suppliers, who shared their insights.

An exclusive EV manufacturer is addressing a range of needs

“Some fleets are already quite knowledgeable about EVs and others are in various stages of learning about them,” said Scott Zion, head of engineering at Xos, a manufacturer of Class 5 through Class 8 battery-electric vehicles and powertrains. “But regardless of their familiarity, across the board they are focused on the same thing they have addressed for all their vehicles, determining the ROI on their investment.

“A good place to start is to think about duty cycles,” Zion related. “Knowing how the vehicles will be operated, including the types of roads they’ll be using and daily mileages, is a first step in determining EV needs. We find that many fleets think they need more range than they actually do. The real question to ask about an EV’s range is how precise and repeatable the manufacturer’s algorithm is so you can confidently rely on it to know when recharging will be needed.”

A key challenge, Zion noted, is about charging infrastructure requirements. And while it is important to assess facility needs and work with electric utilities to expedite the process of commercial fleet electrification, other technologies are being made available as well.

For example, Xos is now building prototypes of its Hub mobile charging solution. Packaged in a standard trailer, the unit is capable of charging up to five vehicles at a time at facilities without a charging infrastructure. It can also be hauled to any location to extend the range of EV routes. Xos also recently introduced a line of five DC Fast Chargers for commercial EVs that range from 30 kW to 300 kW.

To address EV service considerations, Xos offers the Xosphere fleet management platform for tracking and reporting on maintenance activity. Connected via onboard telematics, the platform also provides real-time battery charge status.

Xos is also developing an ecosystem of service partners, including multi-brand truck dealers and independent providers. In August, the company announced a partnership with NationaLease to offer vehicles and service at its more than 900 locations in the U.S. and Canada. It also signed an agreement with Gabrielli Truck Sales to sell and service Xos vehicles for customers from 17 locations across New York, New Jersey, and Connecticut. Most recently, Xos named The W.W. Williams Company, a member of the WheelTime Network, as a pilot service provider in Arizona. W.W. Williams will also support Xos customers with service parts.

Xos Class 5-6 electric stepvans are currently in operation with a variety of companies including parcel delivery, textile, utility and repair, and armored transport operations. By the end of next year, it plans to begin producing its Class 6-7 MDXT electric truck for chassis-cab, box or reefer applications up to 33,000 lbs. GVWR. Additionally, it will roll out the HDXT Class 8 tractor for regional-haul operations featuring its proprietary battery systems and Allison e-axles.

A traditional OEM is leveraging its extensive experience

“Dealers are a valuable source of information for fleets about EVs,” said Greg Baker, product manager, commercial chassis at Freightliner Custom Chassis Corporation (FCCC). “They have full knowledge of factory-built vehicles and are experts at creating specs for your business needs. They are especially adept at addressing GVW, range, wheelbase and charging style questions, and in avoiding compatibility issues.”

For fleets looking to access expertise in electric medium- and heavy-duty trucks, Daimler Trucks North America (DTNA) launched Detroit eConsulting where they can work with a team of eMobility experts dedicated to supporting them as they navigate electric truck conversion. The service is offered in three packages, including Baseline, which is included with the purchase of Freightliner electric trucks and features best practices and dealership-level consultation.

With Powerline and Megaline packages from Detroit eConsulting, which are available for a fee to buyers of any EV, customers receive assistance about charging infrastructure planning, solar panel and stationary energy storage projects, and support when working with local utilities. Additional services include a cost-benefit and route analysis, and assistance with capital and operating expenditure optimization.

Florian Salah, manager, ZEV Consulting and Training at DTNA, said fleets discussing EVs with Detroit eConsulting have included operations that know what they want, others that are thinking about it, and companies that require early education. “We strive to understand their operations, typical routes and maximum range needs, and their long-term goals,” he said. “With that information and our knowledge from pilot projects, we can go deeper into an assessment of the pros and cons of different choices.”

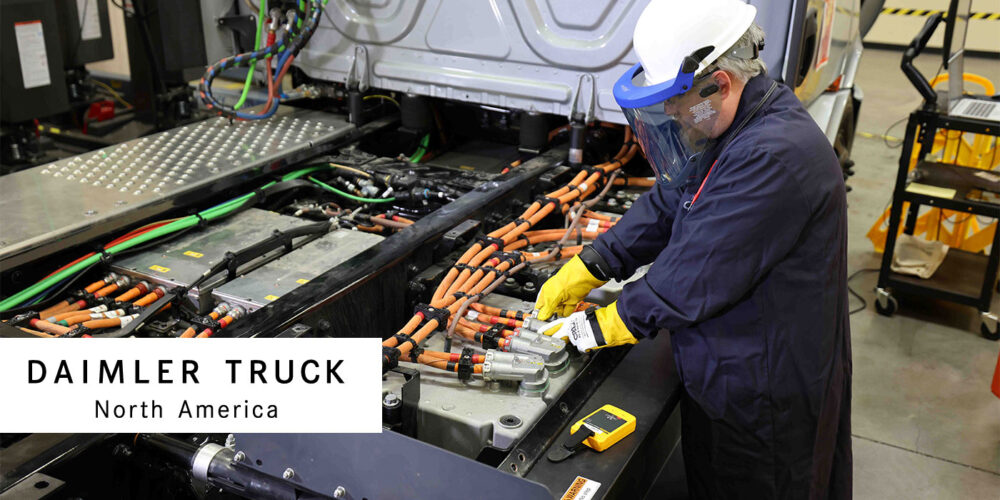

Part of that analysis is about EV maintenance and repair needs, Salah noted. “We’re already leveraging our dealership and service network to speed response time and meet service expectations for commercial customers. Coinciding with the rollout of EVs is technician training for high voltage systems, and dedicated bays and tools. Additionally, if fleets express an interest in developing in-house EV service capabilities we will support those efforts.”

For Greg Baker, one of the biggest considerations for fleets is the charging infrastructure. “As growth in EV chassis deployment continues it’s become a chicken and egg question,” he said. “While we’re in production with electric walk-in vans and school buses, and Freightliner will be soon for eM2 medium-duty and Class 8 eCascadia models, getting the charging infrastructure and charge management system in place for multiple vehicles is essential.”

DTNA is working with utilities and charging infrastructure provider partners, Florian Salah reported. In addition, it has introduced the Detroit eFill line of electric commercial vehicle chargers in an array of options for customers. Developed in partnership with Power Electronics, eFill charging stations are designed to integrate with the Detroit ePowertrain found in eCascadia and eM2 trucks, as well as other brands of EVs.

The initial Detroit eFill systems are DC fast chargers carrying the CCS-1 standard with power ratings from 30 kW to 400 kW. The power range allows for scalability for fleets with one or two trucks to truck stops with charger islands.

DTNA, in partnership with Portland General Electric (PGE), has also opened Electric Island, a public site with eight vehicle charging stations for electric cars, buses, box vans and semi-trucks. The site will also allow PGE and DTNA to study energy management, charger use and performance, and the charging performance of FCCC and Freightliner EVs.

“We have other plans with different partners to build charging corridors and facilities designed to handle larger commercial vehicles,” Salah said. “We’re actively learning where, when and how customers will charge their EVs because we recognize that increased demand is coming.”

An established integrator is serving as a central resource

EV technology, especially high voltage battery technology, is maturing rapidly, noted Dave Brosky, vice president of sales and business development for Fontaine Modification Work & EV Solutions. At the same time, existing OEMs are integrating more advanced electric powertrains into their chassis and new vehicle manufacturers are introducing a range of purpose-built EVs.

“As fleets identify the EVs that will fit best with their operations, they should consider OEM chassis as well as alternative solutions,” Brosky said. “Across the board, EVs are available to address almost any Class 4-8 use case. The focus today has shifted from technology to determining a charging strategy relative to the number of vehicles they plan to deploy and the power infrastructure in their facilities.

“From day one, fleets also need to be in a position to address EV maintenance and service,” Brosky continued. “They know that certain systems on EVs will require less service, but maintenance will still be needed. It’s important to establish whether you want to do your own service, and if so, what training will be required, or have a designated service provider. There are numerous choices to consider, including OEM dealers, component manufacturer service networks, and third-party providers.”

Leveraging its extensive expertise and existing relationships as a post-production vehicle modification service provider, Fontaine is serving as an integrator for Class 4-8 EVs in several of its facilities. The company offers up front engineering work and coordinates with chassis manufacturers and electric powertrain partners, as well as body builders and truck equipment suppliers.

“We’re gaining experience with production of multiple systems to support fleet mechanical installation and system integration needs,” Brosky said. “As an intermediate and final stage manufacturer, we are in a position to serve as a central resource as EV makers seek higher volumes and enter more specialty vehicle and niche markets.

“Electric commercial vehicles are one of the fastest growing segments in the U.S.,” Brosky added, “and many innovative companies are working hard to meet deployment needs and solve challenges. For fleets, there is a lot of value in bringing in partners who know trucks and their applications early on and in taking advantage of their experience.”