The broader economy has rebounded quite well from the severe market turbulence of 2020—and seven countries, including the U.S. and China, have already reached their per capita GDPs return to pre-pandemic standing, according to the latest report from the Organization for Economic Co-operation and Development (OECD). According to the group, global economic output will rise by 5.8% in 2021, up significantly from 2020.

Key to this economic activity are companies with transportation fleets that provide the movement of goods across America. However, many of these firms must make strategic organizational decisions that impact their bottom lines when determining the right procurement strategies to upgrade hundreds of aging trucks in their fleets. The costs involved can be significant depending on the type of investment structure (lease versus purchase), and even as more companies shorten their equipment life cycles through leasing, many firms are realizing that not all lease agreements are equal.

There are many different lease programs., and it is crucial to understand the many variables and costs under a full-service leasing (FSL) program when compared to an unbundled lease (UBL) agreement. The most affected cost in an FSL lease structure is maintenance and repair (M&R).

How maintenance and repair costs impact the bottom line

M&R should be at the forefront of every company’s total cost of ownership (TCO) as it is the most volatile cost of a fleet operation. Improper preparation and management of M&R can drastically erode profits from the bottom line—and the older the truck, the costlier it gets. There are many areas fleets and carriers can focus on when it comes to increasing reliability and lowering maintenance costs, but preventive maintenance (PM) is crucial. The more money fleets spend on PM, the lower their overall maintenance costs will be.

However, determining M&R costs and helping to lower PM often comes down to how long you operate your truck, and how you structure your truck lease agreement, both of which can have a significant impact on what you end up spending for M&R. Fleet managers should collaborate with their finance teams and executives to take a closer look not only at the impact of M&R on the bottom line, but how their trucks’ lease structures impact profitability as well.

This issue will only grow in the coming years, as fleets look to either replace trucks or add to their mix to handle more demand for the economy’s continued re-opening activity. With the demand for shipping and transporting goods growing, and more trucks coming online, fleet managers and their executive teams have critical decisions to make.

How M&R costs differ depending on lease structure

One of the most apparent differences between a UBL and FSL is how fuel and M&R costs are calculated. Of course, fuel is the highest percentage of a fleet’s TCO.

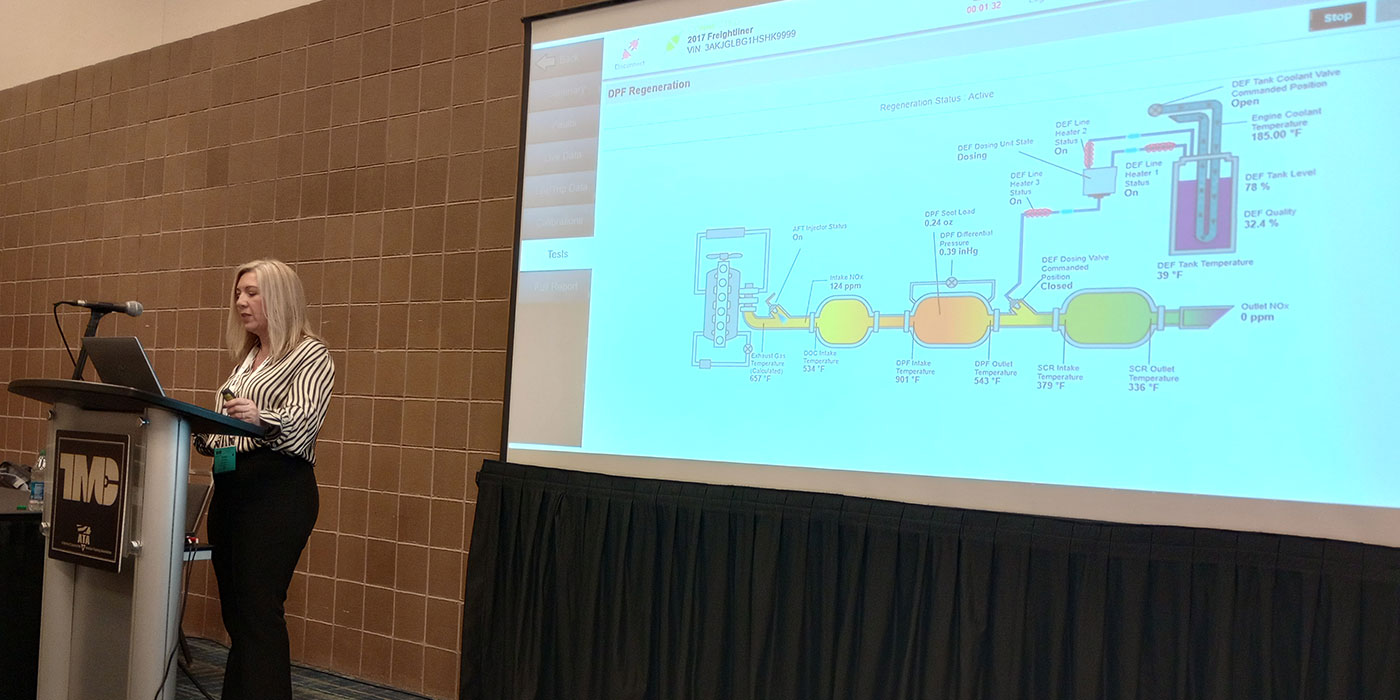

Aside from fuel expenditures, fleets must realize that in long-term lease or ownership of the vehicles, an organization is locked into a higher “fixed” cost for M&R. In contrast, a shorter lease life cycle of two trucks utilizing an Unbundled Lease agreement equates to a sliding scale of M&R costs. At about 48 months, the costs reset to newer truck CPMs. This means your M&R costs are much lower over time and can help improve margins toward the bottom line.

Furthermore, M&R is “front loaded” in an FSL agreement. As an example, companies will pay a minimum of .07 per mile in year one versus .02 per mile when unbundling (national average for year one). All trucks come with a bumper-to-bumper two-year warranty that can be extended to four years. Expenses for year one include wearable items (tires, brakes) plus preventive maintenance.

What are you paying for at 7 cents per mile? A shorter truck life cycle produces long-term savings beyond the first year. In a UBL, the CPM average equals 5.675 cents over five years. However, in an FSL, fleets pay up to 9 cents per mile.

Lower M&R costs that increase the potential to preserve margin can go a long way toward improving the bottom line, increasing competitiveness and protecting shareholder value.

Additionally, heavy-duty trucks must be well-maintained throughout the year and be prepared for all weather patterns in each region. It’s important to take every precaution necessary, particularly with M&R to ensure the safety of drivers operating the trucks and other motorists on the roads.

As such, it would be wise for fleets to pay particularly close attention to the way in which they structure their lease agreements so they not only preserve the bottom line, but also put themselves in position to effectively maintain each vehicle to reduce unwanted downtime and roadside breakdowns, which can jeopardize driver safety and further erode profits.

Katerina Jones is vice president of marketing and business development at Fleet Advantage, a provider of truck fleet business analytics, equipment financing and lifecycle cost management. For more information visit the Fleet Advantage website.