A transition to sustainable transport could be cheaper in terms of investment into core transport infrastructure than continuing as is – if action is taken now. This is the main message of the ITF Transport Outlook 2023 report of the International Transport Forum at the OECD, presented on May 24 at the global summit of transport ministers in Leipzig, Germany.

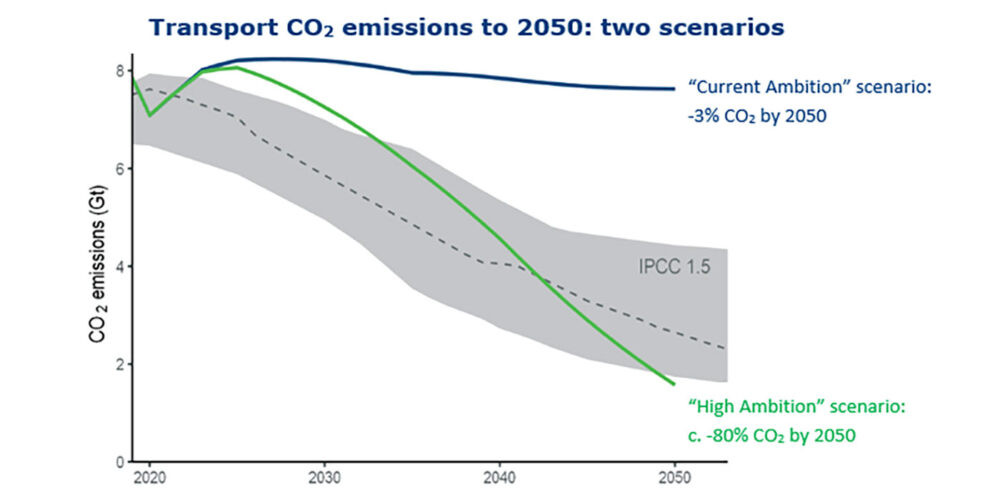

According to findings, if action to decarbonize transport is accelerated, the transport sector can still reduce its CO2 emissions by about 80% over the next 25 years (compared to 2019). This drop is said to put transport on the right path for limiting the global temperature increase to well below 2 degrees Celsius above pre-industrial levels, the goal of the Paris Climate Agreement.

Such an accelerated transition to low- and no-carbon transport requires significant investment. Providing the core infrastructure for the High Ambition scenario in the report, however, would require about 5% less investment than under current policies, according to the ITF’s projections.

“Freight transport will roughly double in the next 25 years if we stay on the current path, and passenger transport will grow by 79%. So we will also have to invest heavily under this scenario to accommodate this additional demand – and, from what we know, probably more so than if we invested in a low-carbon future,” said Orla McCarthy, project lead for ITF Transport Outlook 2023.

These projections consider investment needs for the core transport infrastructure – including rail lines, roads or ports – required to cater for future demand. Estimates for the extra investment needs for electric charging networks are also included in the report. This is the first edition of the ITF Transport Outlook to include estimates for infrastructure investment needs under both scenarios, to support policy decisions.

The report makes five recommendations for policy makers:

- Develop comprehensive strategies for future mobility and infrastructure.

Instead of providing infrastructure as a reaction to predicted demand, governments should take a “decide and provide” approach to investment, with a view to achieving certain public policy objectives. - Accelerate the transition to clean vehicle fleets.

Accelerating the transition towards clean vehicles and fuels requires targeted policy support with ambitious objectives and support measures. Enabling infrastructure requires additional investment. - Implement mode shift and demand-management policies where they are most effective.

Measures to reduce trips and travel distances, and encourage the use of more sustainable modes, work well in cities. For longer-distance travel, a transition to cleaner vehicles and fuels is the priority. - Consider the additional benefits for urban areas when evaluating policies.

Many policies designed to decarbonize urban transport can make mobility more affordable, improve access, reduce congestion, free up space, reduce crash risks and limit air pollutants. - Reform vehicle taxation to capture external costs of new vehicle fleets.

Falling fuel-tax revenues will hit revenues and make fuel taxes less effective as a policy lever as vehicles become emission-free. Road pricing and congestion charging can mitigate both.