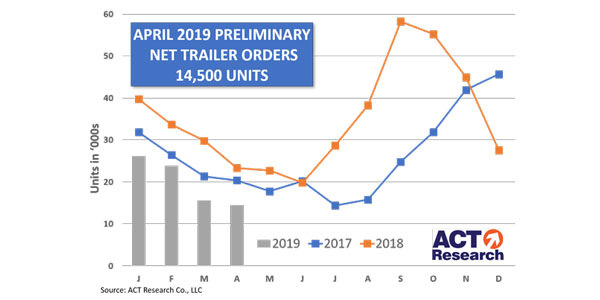

FTR reports preliminary trailer orders for April 2019 remained subdued for the second consecutive month coming in at 13,200 units, which is 40% below the same month in 2018. ACT Research‘s estimate for April 2019 net trailer orders is 14,500 units.

According to FTR, the low order level does not reflect a softening of demand, but rather that many large OEMs have filled their order boards for 2019. Backlogs remain hefty, with robust production levels, FTR reports. Trailers orders for the past 12 months now total 364,000 units.

“We expect the backlogs to remain very healthy, supporting continued high build rates,” Don Ake, FTR’s vice president of commercial vehicles, said. “Orders likely will stay at low volumes through the summer, or until OEMs open the 2020 order boards. OEMs have been cautious about taking longer-term orders due to uncertainty over future costs. Right now, the Chinese tariff situation is just adding to an already cloudy outlook.”

“Order volume was soft in April for the second straight month. Several factors appear to be in play,” Frank Maly, ACT’s Director of CV Transportation Analysis and Research, said. “OEMs continue to be reticent to fully open 2020 orderboards. This is evident in our measurement of the extent of the industry’s backlog, which has remained in the November or December timeframe throughout the first four months of 2019.”